A Maricopa Arizona Indemnification Agreement for a Trust is a legal document that outlines the responsibilities and liabilities associated with acting as a trustee. In a trust, the trustee is entrusted with managing and administering the assets and interests of the trust beneficiaries. However, this position can come with certain risks, as trustees may be subject to legal actions or claims against them. The purpose of an Indemnification Agreement is to provide protection and assurance to trustees by outlining the terms under which they can seek indemnification from the trust's assets. This agreement safeguards trustees from personal financial loss resulting from legal actions taken against them during the course of their duties. This legal document typically includes specific provisions and clauses that define the circumstances under which indemnification is granted. It outlines situations in which trustees are eligible for indemnification, such as claims related to breach of fiduciary duty, negligence, or acts committed in good faith. The agreement may also specify the limits of indemnification, ensuring trustees are protected within reasonable boundaries. Different types of Maricopa Arizona Indemnification Agreements for a Trust may include: 1. General Indemnification Agreement: This type of agreement provides comprehensive protection to trustees, covering a wide range of potential claims or legal actions. 2. Limited Indemnification Agreement: This agreement may have certain restrictions or exclusions, such as limiting indemnification to claims resulting from negligence but excluding intentional misconduct. 3. Trust-Specific Indemnification Agreement: Some trusts may have unique requirements or considerations that necessitate a tailored indemnification agreement, addressing specific risks or circumstances relevant to that trust. It is important to note that the terms and conditions within Maricopa Arizona Indemnification Agreements for a Trust can vary depending on individual circumstances, the specific trust involved, and applicable state laws. Consulting with an attorney who specializes in estate planning and trust administration is crucial to ensure compliance and accuracy in drafting these agreements.

Maricopa Arizona Indemnification Agreement for a Trust

Description

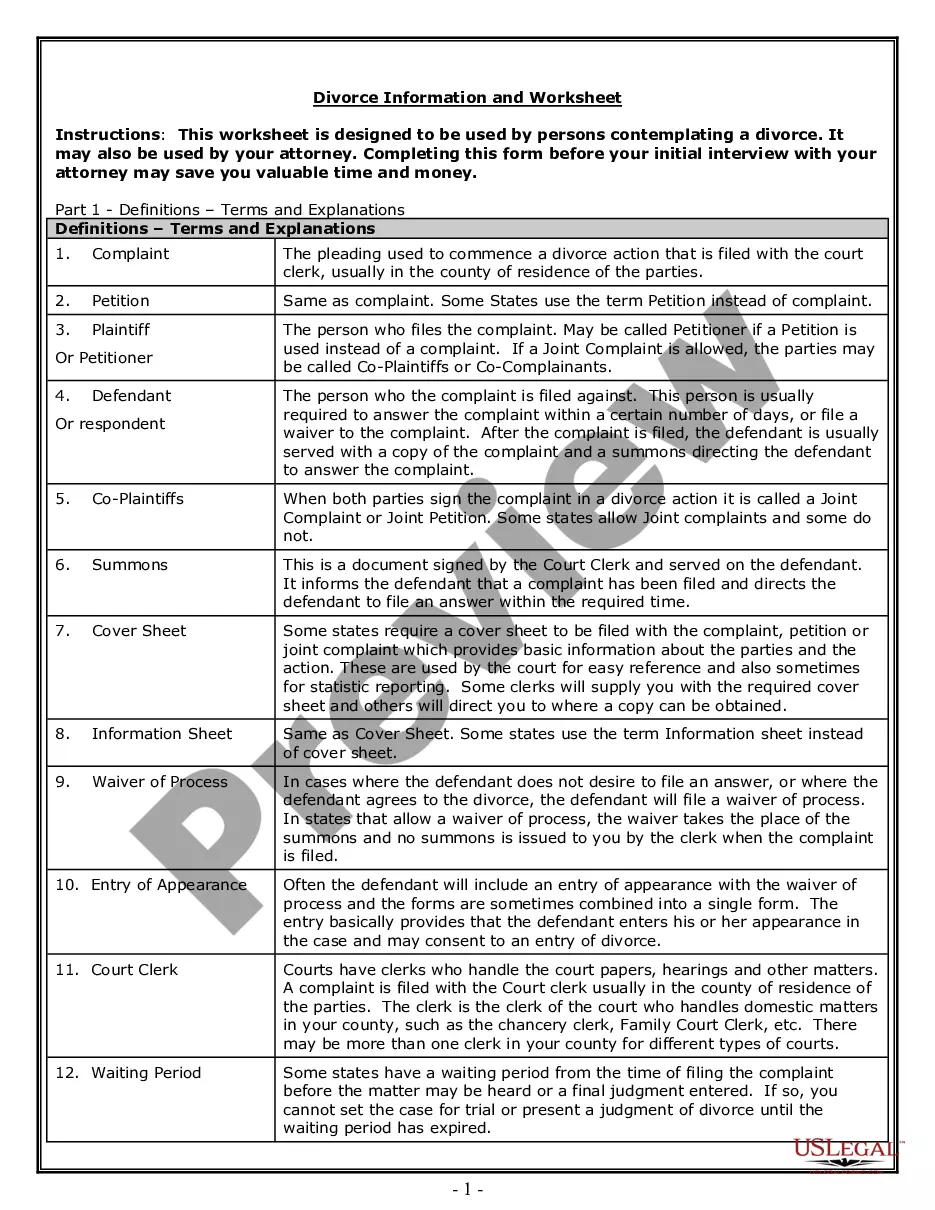

How to fill out Maricopa Arizona Indemnification Agreement For A Trust?

Whether you plan to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Maricopa Indemnification Agreement for a Trust is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to obtain the Maricopa Indemnification Agreement for a Trust. Follow the guidelines below:

- Make certain the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Indemnification Agreement for a Trust in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

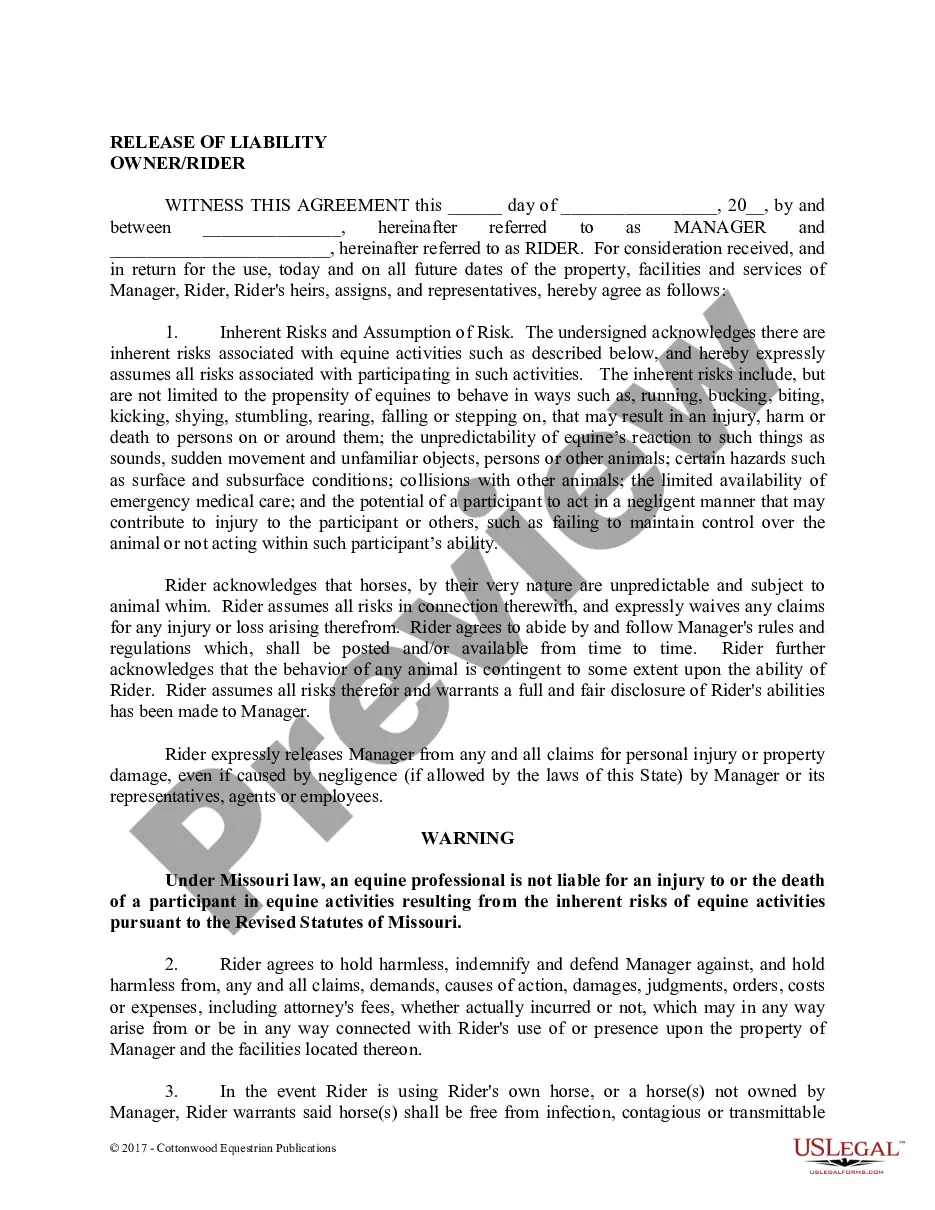

An indemnity agreement is a contract that protects one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.?

Indemnity is a contractual agreement between two parties. In this arrangement, one party agrees to pay for potential losses or damages caused by another party.

?To indemnify? means to compensate someone for his/her harm or loss. In most contracts, an indemnification clause serves to compensate a party for harm or loss arising in connection with the other party's actions or failure to act.

A common example of indemnification happens with reagrd to insurance transactions. This often happens when an insurance company, as part of an individual's insurance policy, agrees to indemnify the insured person for losses that the insured person incurred as the result of accident or property damage.

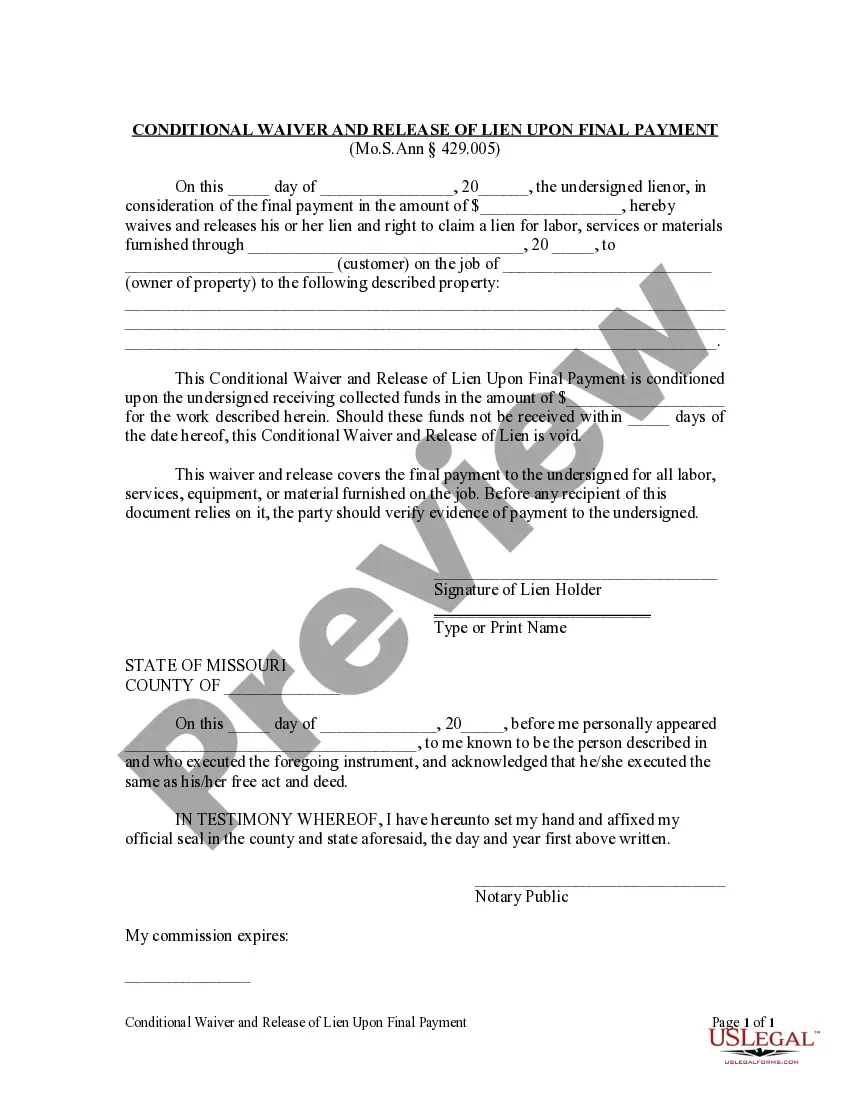

The sole purpose of the Trust is to provide assurance to the Beneficiaries of the availability of amounts to which the Beneficiaries would be entitled according to the Grantor's Indemnification Obligations to the Beneficiaries.

Who Signs and Witnesses a Letter of Indemnity. The two parties should sign the document, of course.

A waiver or release of liability is a contract releasing a party from liability for injuries resulting from their ordinary negligence. An indemnification agreement is a contract agreeing to reimburse the party for any monetary loss incurred as a result of a participant's engagement in an activity.

Indemnification in real estate defines the buyer taking full responsibility for what should be the seller's fault otherwise. For example, you agree to purchase a property with minor flaws caused by the seller. The previous owner might have felled a tree which crashed into the roof.

The two parties of the contract will sign the indemnification agreement. This means the indemnitee, or the person/business/company providing the good/service, will sign the document. The indemnifier, or the person/business/company receiving the good/service, will sign the document as well.

The most important part of an indemnification clause is that it protects the indemnified party from lawsuits filed by third parties. This protection is important because damaged parties are still able to pursue compensation for their losses even if this clause isn't in the contract.