In Phoenix, Arizona, an indemnification agreement for a trust is a legally binding document that provides protection and reimbursement to trustees or other individuals involved in trust administration in the event of any losses, claims, liabilities, or expenses incurred during their role. This agreement safeguards trustees from personal financial liability while promoting trust administration efficiency and ensuring beneficiaries' interests are protected. The Phoenix Arizona Indemnification Agreement for a Trust is designed to mitigate risks associated with the management, investment, distribution, and other affairs related to the trust. It aims to shield trustees from potential litigation, legal disputes, and unexpected financial consequences that may arise during the course of their duties. There are various types of Phoenix Arizona Indemnification Agreements for a Trust, each suited for different circumstances and levels of risk mitigation. Some of these may include: 1. Standard Indemnification Agreement: This agreement provides basic protection to trustees, indemnifying them against claims or losses incurred while performing their duties in good faith and within the scope of their authority. 2. Limited Liability Indemnification Agreement: This type of agreement establishes parameters and limitations on trustees' liability, particularly in cases of negligence or wrongful acts. It defines specific situations where trustees can be indemnified and others where their liability remains intact. 3. Exculpatory Indemnification Agreement: This agreement includes more extensive provisions that relieve trustees from liability, except in cases of willful misconduct or gross negligence. It offers a higher level of protection for trustees, encouraging them to confidently execute their fiduciary responsibilities. 4. Judicial/ Court Approval Indemnification Agreement: In some instances, trustees may need to seek court approval for indemnification due to specific circumstances outlined in the trust document or when facing potential conflicts of interest. This agreement ensures that trustees obtain court permission before being indemnified. Regardless of the specific type of Phoenix Arizona Indemnification Agreement for a Trust, it is crucial to consult with experienced legal professionals to draft and review the document accurately. They can provide customized guidance based on the trust's unique requirements, state laws, and legal precedents to ensure that trustees are adequately protected and beneficiaries' interests are upheld.

Phoenix Arizona Indemnification Agreement for a Trust

Description

How to fill out Phoenix Arizona Indemnification Agreement For A Trust?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Phoenix Indemnification Agreement for a Trust meeting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Aside from the Phoenix Indemnification Agreement for a Trust, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Experts verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can pick the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Phoenix Indemnification Agreement for a Trust:

- Examine the content of the page you’re on.

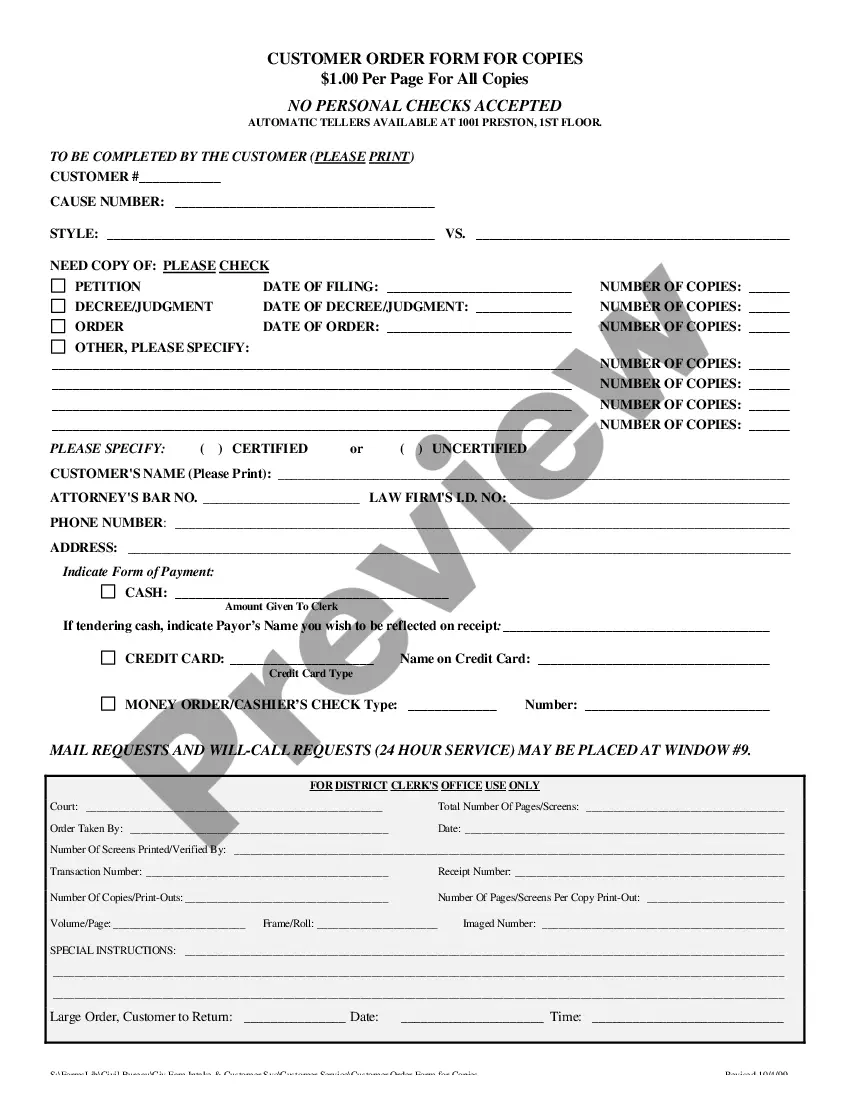

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Phoenix Indemnification Agreement for a Trust.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!