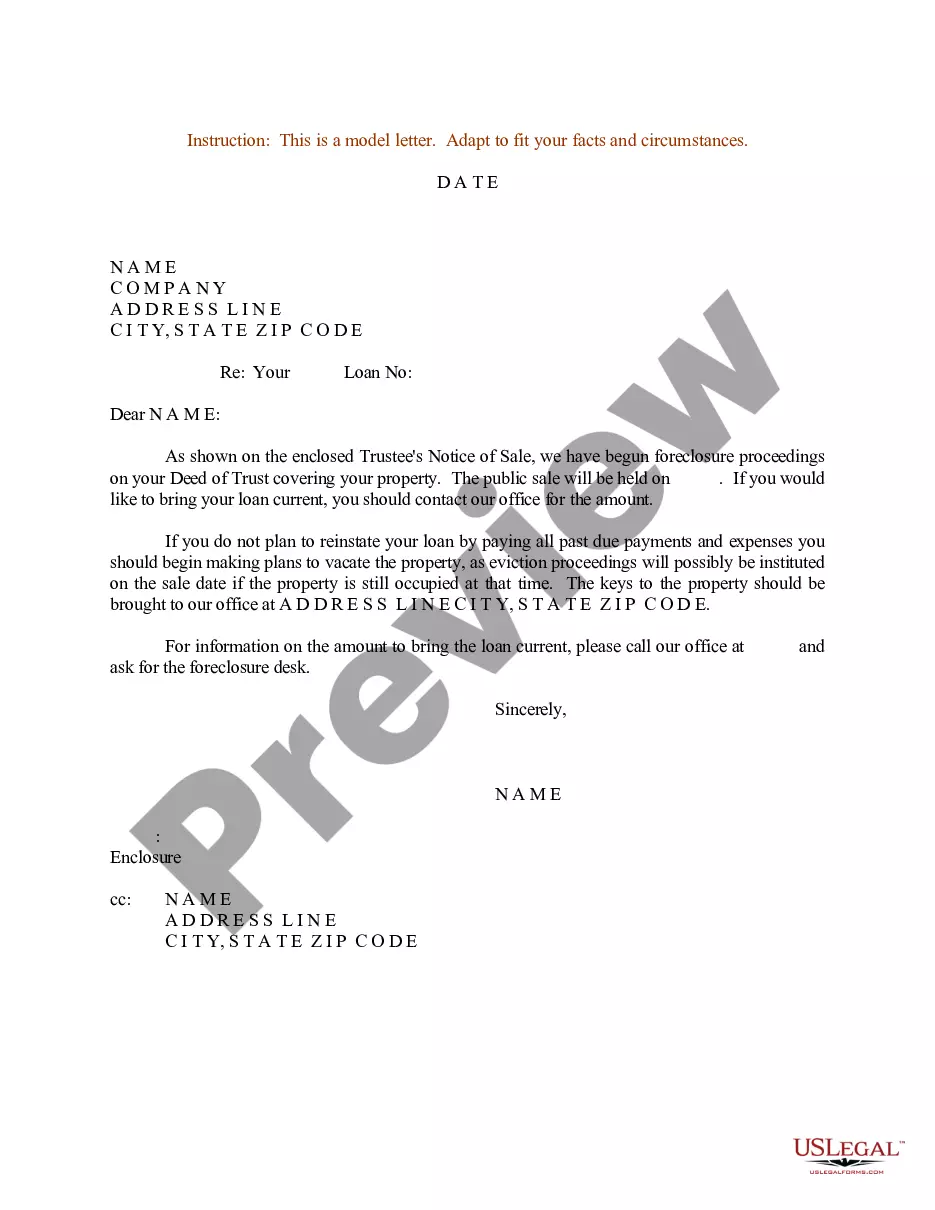

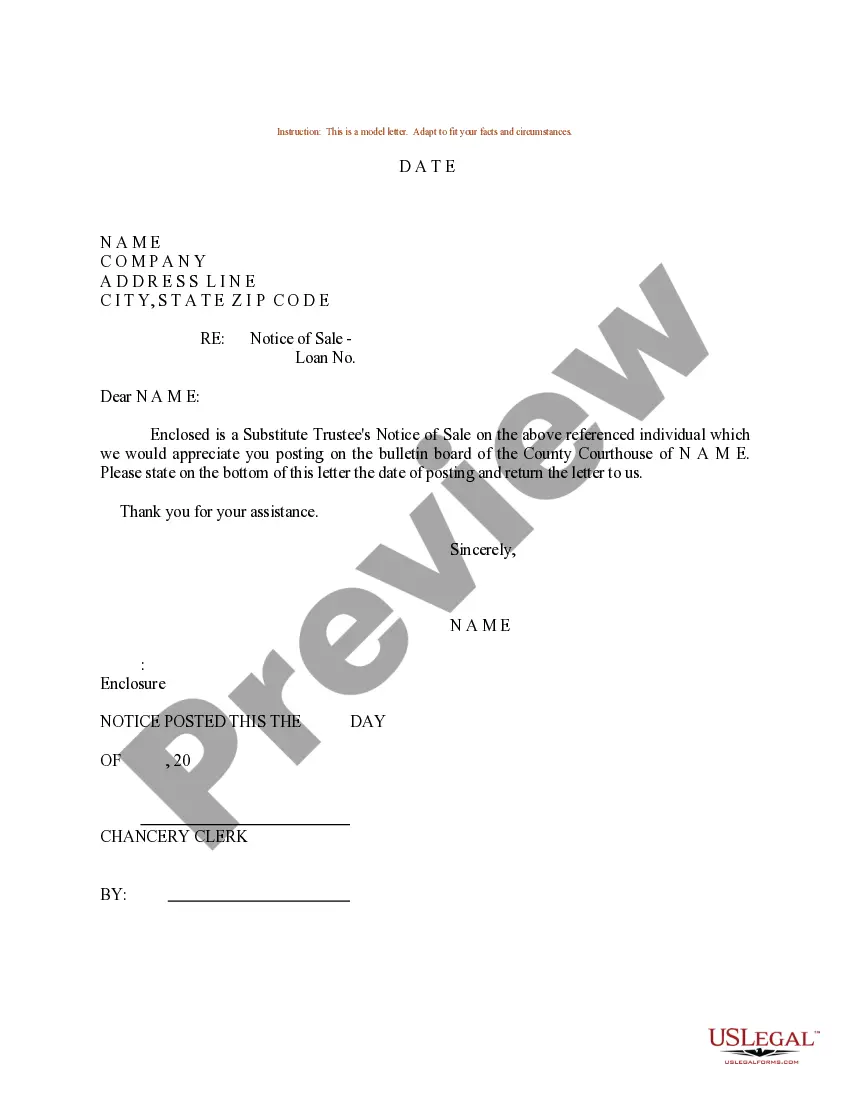

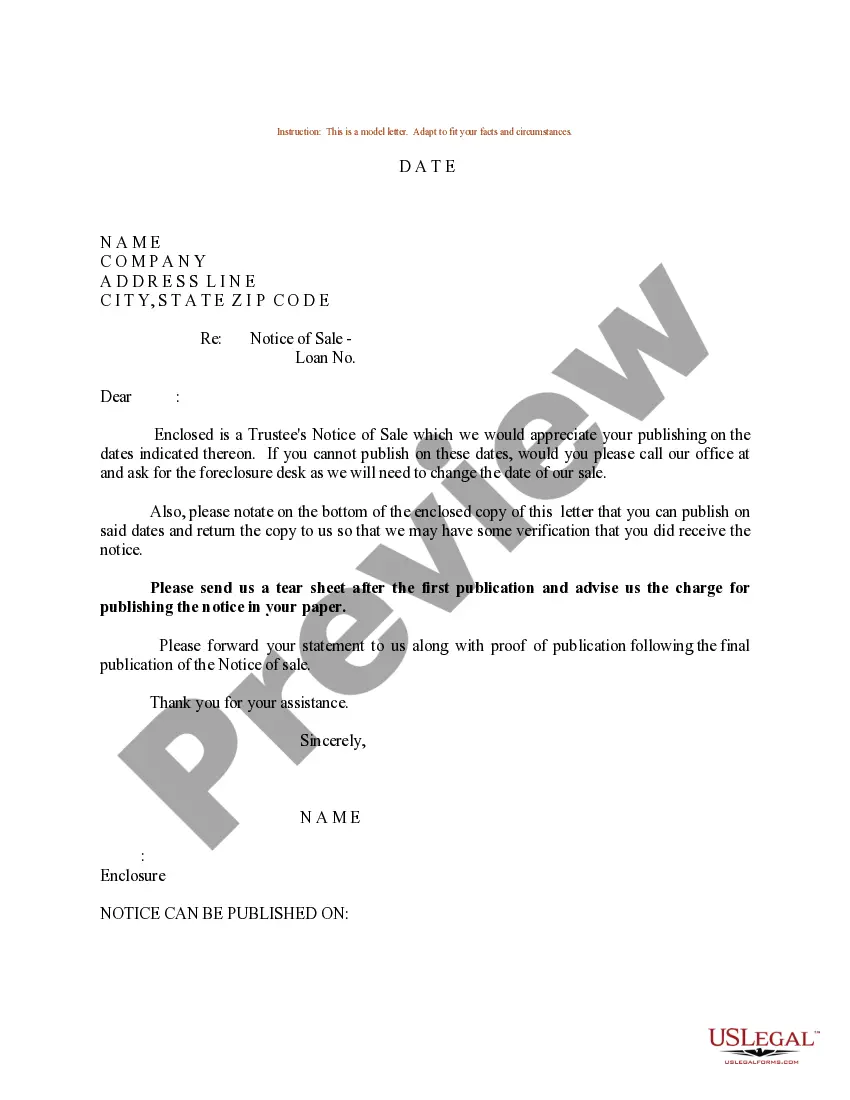

Mecklenburg County, located in the state of North Carolina, offers a variety of sample letters and forms for foreclosure cases. These resources aim to assist individuals in navigating the foreclosure process effectively. Here are some examples of the types of letters and forms you may find in a Mecklenburg North Carolina Sample Letters package: 1. Notice of Intent to Foreclose: This letter informs the homeowner that their mortgage lender intends to initiate the foreclosure process due to the default on their loan payments. It outlines the steps to be taken and provides a timeframe for the homeowner to respond or rectify the situation. 2. Request for Loan Modification: This letter is used to request a modification of the existing loan terms in order to make repayments more manageable for the homeowner. It may include information about financial hardships, changes in income, or substantial medical expenses that have led to the need for modification. 3. Letter of Explanation: This type of letter is often required by lenders when homeowners fall behind on their mortgage payments. It allows the homeowner to explain the reasons behind the default, such as an unforeseen job loss or major life event, clarifying the circumstances that led to the situation. 4. Financial Hardship Affidavit: This form provides detailed information about the homeowner's assets, income, and expenses. It helps the lender assess the borrower's ability to meet their financial obligations and determine if alternative options, such as forbearance or repayment plans, may be suitable. 5. Notice of Abandonment: If the homeowner has vacated the property, this letter informs them of the lender's awareness of the abandonment and may include instructions for property inspection or securing the residence. 6. Letter from Housing Counseling Agency: This form serves as a recommendation or referral letter from a HUD-approved housing counseling agency, confirming that the homeowner is seeking assistance and guidance in resolving their foreclosure situation. These Mecklenburg North Carolina Sample Letters aim to provide homeowners facing foreclosure with a range of resources to help them communicate effectively with mortgage lenders, gathering the necessary information and documentation to explore potential alternatives and potential solutions to foreclosure. By utilizing these sample letters and forms, individuals can navigate the foreclosure process more easily and improve their chances of finding a sustainable solution for their mortgage situation in Mecklenburg County, North Carolina.

Mecklenburg North Carolina Sample Letters - A Package of Sample Letters and Forms for Foreclosure

Description

How to fill out Mecklenburg North Carolina Sample Letters - A Package Of Sample Letters And Forms For Foreclosure?

Drafting papers for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft Mecklenburg Sample Letters - A Package of Sample Letters and Forms for Foreclosure without professional help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Mecklenburg Sample Letters - A Package of Sample Letters and Forms for Foreclosure on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Mecklenburg Sample Letters - A Package of Sample Letters and Forms for Foreclosure:

- Look through the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that suits your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a few clicks!

Form popularity

FAQ

The Foreclosure Statement will be processed within 15 working days from the date of request. Please place this request to know the principal amount outstanding for closure of loan and applicable charges.

In North Carolina, foreclosure under a power of sale must be preceded by a pre-sale hearing before the clerk of the court in the county where the property is located. This is essentially an administrative requirement put in place to ensure that the relatively quick power of sale process is not abused.

To buy a foreclosed home, you will need two things: a mortgage pre-approval and a great real estate agent. You can get pre-approved for a mortgage by finding a lender and providing them with the financial information they request. If you are approved, they will set a maximum loan amount they will lend you.

The seller will conduct the sale by reading the entirety of the posting, which includes the property location, rules of the sale, and that the property is being sold as is. The sale will start with an opening bid from the foreclosing mortgage company, then you and other bidders will then increase the bid amount until

To buy a foreclosed home, you will need two things: a mortgage pre-approval and a great real estate agent. You can get pre-approved for a mortgage by finding a lender and providing them with the financial information they request. If you are approved, they will set a maximum loan amount they will lend you.

Foreclosure Procedure a step by step complete guide Step 1 Find the nearest branch.Step 2 Submit an application.Step 3 Submit all the required documents.Step 4 Pre payment of the outstanding loan.Step 5 Receipt of documents.Step 6 Inform the credit rating agencies.

Under standard procedures, a foreclosure letter for home loan is addressed to the lending branch's manager, with necessary personal details of the borrower. When filling up the request letter, provide loan account details like the account number, type of loan, prepayment amount, and the date of prepayment.

It's designed to give homeowners options to stay in their homes before a foreclosure. Preforeclosure occurs when a homeowner fails to make mortgage payments, prompting the lender to issue a notice of default. This is a legal notice and means that the lender has begun the legal process of foreclosure.

How Long Does the Typical Foreclosure Process Take in North Carolina? It takes approximately three months to complete a non judicial foreclosure in North Carolina if everything goes smoothly. It may take longer than three months if the borrower fights the foreclosure or if the lender seeks a judicial foreclosure.

Your letter should start with an introduction of who you are and what kind of loan you are applying for. Lead into your story with something like "We want to explain our foreclosure from six years ago." Then, launch right into the details that led you to lose your home. This is not the time to be shy or modest.