Subject: Urgent Notice: Maricopa Arizona Sample Letters to Stop Foreclosure Sale Dear [Recipient's Name], I hope this letter finds you in good health. I am writing to provide you with imperative information about preventing the impending foreclosure sale on your property in Maricopa, Arizona. Time is of the essence, and it is crucial to take immediate action to halt the foreclosure process. Maricopa County offers various types of sample letters that can be used to formally request a stop to foreclosure sales. Below, I will outline three different Maricopa Arizona Sample Letters, each designed to address specific circumstances: 1. Maricopa Arizona Sample Letter of Loan Modification Request: If you have faced financial difficulties due to unforeseen circumstances or are experiencing difficulty in meeting your mortgage obligations, this letter is specifically tailored to request the modification of existing loan terms. By expressing your current financial situation, providing supporting documents, and proposing revised payment schedules, you can demonstrate your commitment to meeting your financial obligations while preventing the foreclosure sale. 2. Maricopa Arizona Sample Letter of Repayment Plan Request: This letter applies if you can afford to resume your regular payments but are unable to clear the arrears in one lump sum. You can request a repayment plan to allow you to gradually repay your mortgage arrears over a specified period, thereby reinstating your loan and halting the foreclosure sale. This letter should clearly state your intent to meet the repayment terms meticulously to regain financial stability. 3. Maricopa Arizona Sample Letter of Hardship/Loss Mitigation Request: This letter is particularly suitable if you have experienced a significant life event, such as the loss of a job, reduction in income, or unforeseen medical expenses, making it challenging to meet your mortgage obligations. By explaining your specific hardship situation in detail and providing supporting documentation, you can request alternative options from your mortgage lender to prevent foreclosure, such as forbearance, loan deferment, or a short sale. It is essential to customize these sample letters to your unique circumstances, ensuring that all necessary details such as your property address, loan account number, and contact information are mentioned accurately. Remember to remain polite, concise, and professional throughout the letter, providing any supporting documents that can strengthen your case. In addition to these letters, I highly recommend seeking legal advice and consulting with a reputable foreclosure attorney who can guide you through the process and ensure your rights are protected during this challenging time. Please take action promptly to protect your home from foreclosure. Ignoring this matter may result in irreversible consequences. If you require any further assistance, I am available to address your concerns. Together, we can explore all available options to help you overcome this financial hardship and keep your home. Sincerely, [Your Name]

Maricopa Arizona Sample Letter regarding Stop of Foreclosure Sale

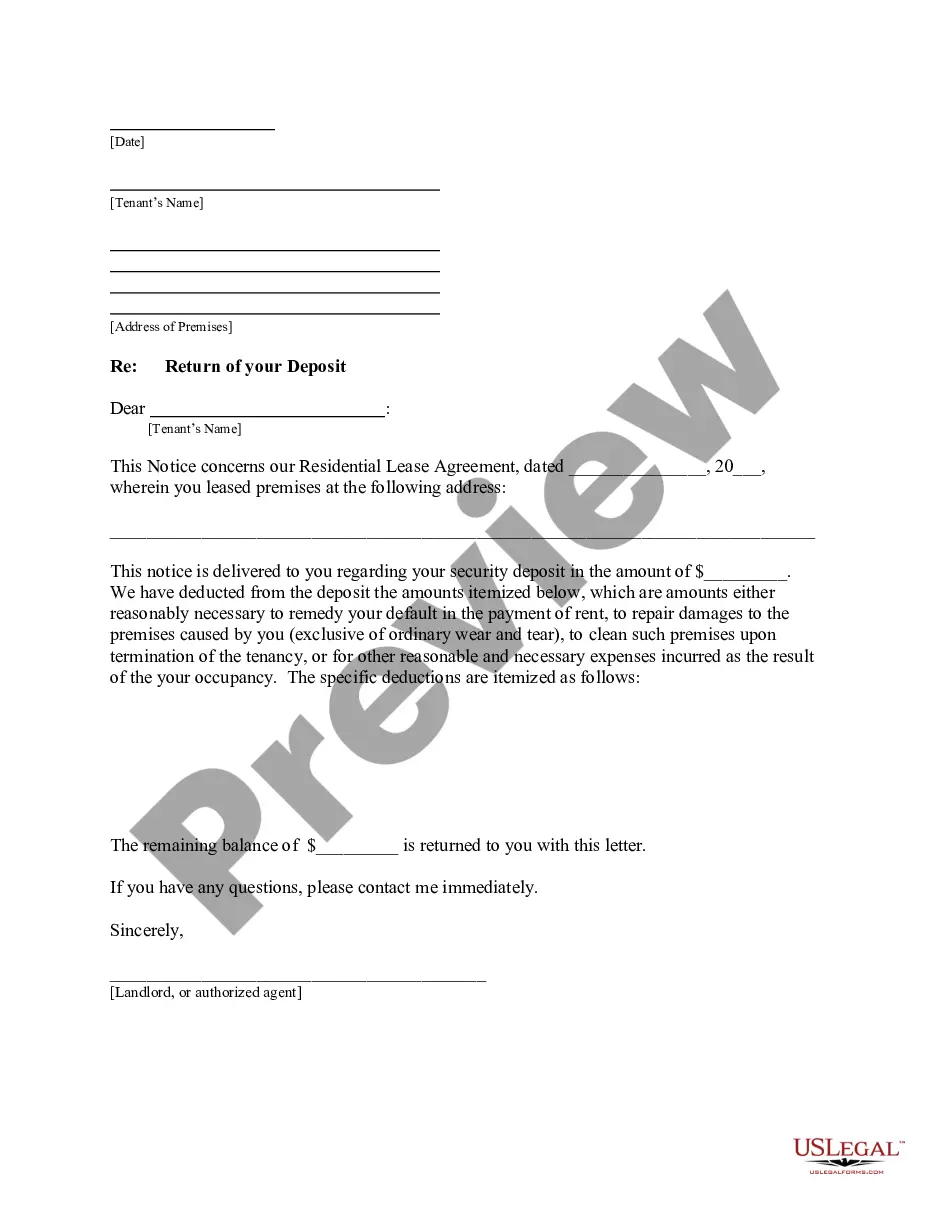

Description

How to fill out Maricopa Arizona Sample Letter Regarding Stop Of Foreclosure Sale?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Maricopa Sample Letter regarding Stop of Foreclosure Sale, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Maricopa Sample Letter regarding Stop of Foreclosure Sale from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Maricopa Sample Letter regarding Stop of Foreclosure Sale:

- Examine the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

A reinstatement is the simplest solution for a foreclosure, however it is often the most difficult. The homeowner simply requests the total amount owed to the mortgage company to date and pays it.

The right of rescission refers to the right of a consumer to cancel certain types of loans. If you are refinancing a mortgage, and you want to rescind (cancel) your mortgage contract; the three-day clock does not start until. You sign the credit contract (usually known as the Promissory Note)

The Demand letter is a much more formal notice that if the loan is not paid and is brought current in a very short period of time, that the lender will proceed with filing the foreclosure at the local court.

How Can I Stop a Foreclosure in Arizona? A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before or after the sale, or filing for bankruptcy. (Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.)

Another element of Arizona HOAs and the law you should be aware of is that if your HOA is about to foreclose on your home, you may be able to stop collection efforts by filing for bankruptcy and working with a judge toward a reorganization plan.

You can avoid repossession by reinstating or refinancing the loan, selling/surrendering your car, or contacting your lender to ask for other options. If you're having issues handling your car loan or other debt, bankruptcy might be a good option for you.

A notice of rescission is a form given with the intention of terminating a contract, provided that the contract entered into is a voidable one. It releases the parties from obligations set forth in the contract, effectively restoring them to the positions they were in before the contract existed.

Foreclosure Sale Rescission is the legal process of reversing a foreclosure sale and removing Fannie Mae as titleholder to the property. There are circumstances in which a foreclosure sale rescission may not involve elimination.

6 Ways To Stop A Foreclosure Work It Out With Your Lender.Request A Forbearance.Apply For A Loan Modification.Consult A HUD-Approved Counseling Agency.Conduct A Short Sale.Sign A Deed In Lieu Of Foreclosure.

How Long Does the Typical Foreclosure Process Take in Arizona? Arizona lenders typically need between 90 and 120 days to foreclose on a property in a non judicial foreclosure process that is uncontested by the borrower.