[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Bank Name] [Bank's Address] [City, State, ZIP] Subject: Request to Halt Foreclosure Sale on [Property Address] Dear [Bank's Name], I hope this letter finds you well. I am writing in regard to the impending foreclosure sale on my property located at [Property Address], which is scheduled to take place on [Foreclosure Sale Date]. I am reaching out to request a stop on the foreclosure sale to allow me the opportunity to explore alternative options to resolve my mortgage arrears. Furthermore, I understand the gravity of the situation and acknowledge my current financial challenges. However, I remain committed to maintaining my home and fulfilling my financial obligations to the best of my abilities. I believe that by halting the foreclosure sale temporarily, we can work together towards finding a mutually beneficial solution that avoids the detrimental consequences of foreclosure for both parties involved. I kindly request that you consider the following points: 1. Financial Hardship: State the specific reasons behind your financial hardship, such as loss of employment, a medical emergency, or any other significant life event that contributed to your inability to meet the mortgage payments. Emphasize your commitment to overcoming these challenges and returning to a stable financial position. 2. Alternative Options: Explain your efforts in seeking alternative options to resolve the arrears, such as applying for loan modification, forbearance, or any relevant government assistance programs available. If you have any supporting documentation regarding these efforts, attach them to your letter. 3. Foreclosure Consequences: Mention the negative impact that foreclosure would have on both you and the bank. Highlight the potential financial losses for the bank in the event of a sale, as well as the negative implications for your credit rating and personal financial stability. 4. Proposed Plan: Suggest a feasible plan to catch up on the missed mortgage payments, detailing how you intend to fulfill your obligations moving forward. This may include a repayment schedule, an increased monthly payment, or a lump-sum payment using any available resources. I believe that through open communication and understanding, we can come to a mutually beneficial solution that protects the interests of both parties involved. I kindly request your immediate attention to this matter and a prompt halt to the foreclosure sale proceedings on my property. Thank you for your time and consideration. I look forward to your positive response. Sincerely, [Your Name]

San Antonio Texas Sample Letter regarding Stop of Foreclosure Sale

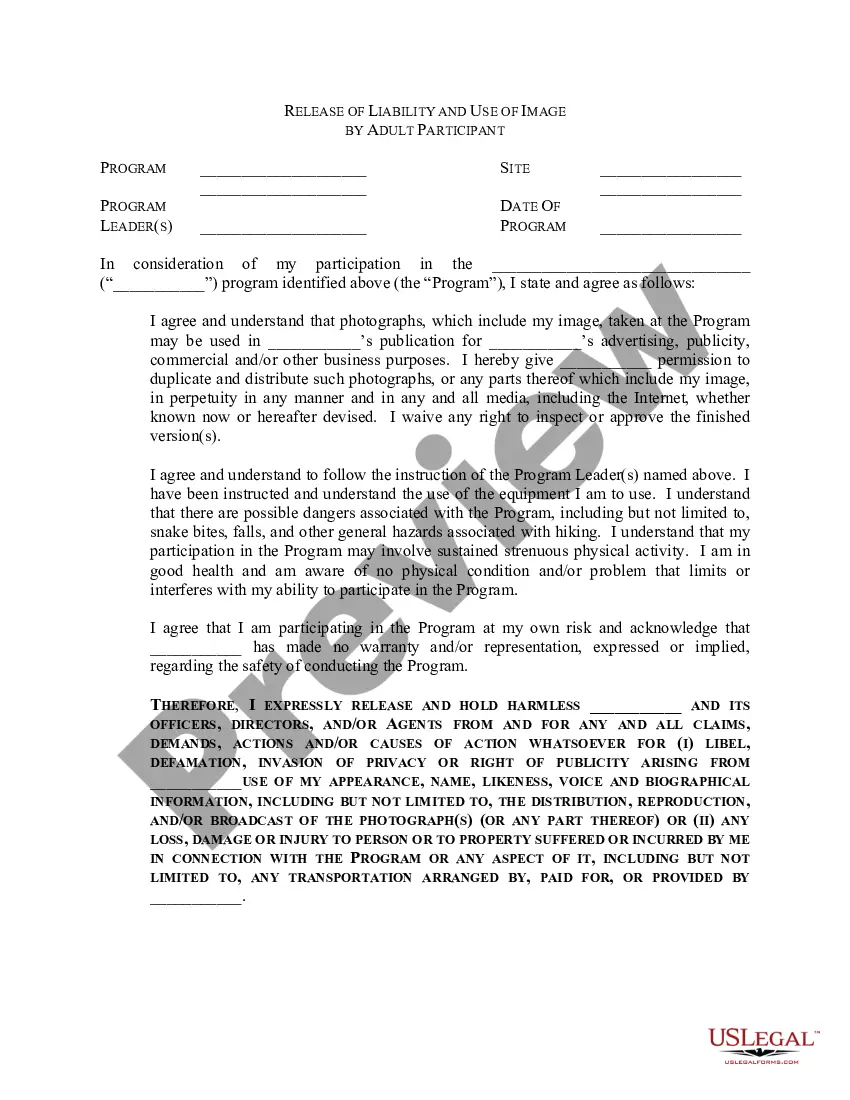

Description

How to fill out San Antonio Texas Sample Letter Regarding Stop Of Foreclosure Sale?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the San Antonio Sample Letter regarding Stop of Foreclosure Sale, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Therefore, if you need the recent version of the San Antonio Sample Letter regarding Stop of Foreclosure Sale, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Antonio Sample Letter regarding Stop of Foreclosure Sale:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your San Antonio Sample Letter regarding Stop of Foreclosure Sale and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!