Dear [Lender's Name], I hope this letter finds you well. I am writing to discuss the insufficient amount required to reinstate my loan for the property located in Fairfax, Virginia. First and foremost, allow me to provide a detailed description of Fairfax, Virginia. Located in Northern Virginia, Fairfax is a vibrant and thriving city, known for its rich history, diverse community, and excellent quality of life. It is a part of Fairfax County, which is one of the most populous and affluent counties in the United States. Fairfax is strategically positioned, offering its residents a perfect blend of urban amenities and natural beauty. Now, turning back to my specific situation, I regret to inform you that due to unforeseen circumstances, I am unable to provide the full amount necessary to reinstate my loan. However, I am committed to resolving this issue promptly, as I understand the importance of keeping the mortgage current and maintaining a good standing with your esteemed institution. Upon careful consideration of my financial situation, I have devised a two-phase plan to address the insufficient amount and reinstate my loan effectively. Phase 1: Immediate Actions I am prepared to provide a partial payment of [amount], demonstrating my dedication to rectifying this matter promptly. This payment, though insufficient to cover the full amount, will serve as a good faith gesture and a sign of my commitment to resolving this issue. Phase 2: Repayment Plan In order to cover the remaining balance and reinstate my loan, I kindly request your assistance in formulating a repayment plan. I understand that each case is unique, and I am willing to cooperate with your financial team to reach a mutually agreeable solution. It is my sincere intention to make regular payments until the full amount owed is cleared. I assure you that my financial situation is temporary, and I am actively taking steps to improve it. I believe that by working together, we can find a solution that benefits both parties involved. In conclusion, I sincerely apologize for the insufficient amount to reinstate my loan and for any inconvenience it may have caused. I am committed to resolving this matter swiftly and restoring my loan to good standing. You're understanding and cooperation during this challenging time are greatly appreciated. Thank you for your attention to this matter, and I look forward to discussing the details further. Yours faithfully, [Your Name] [Your Contact Information]

Fairfax Virginia Sample Letter for Insufficient Amount to Reinstate Loan

Description

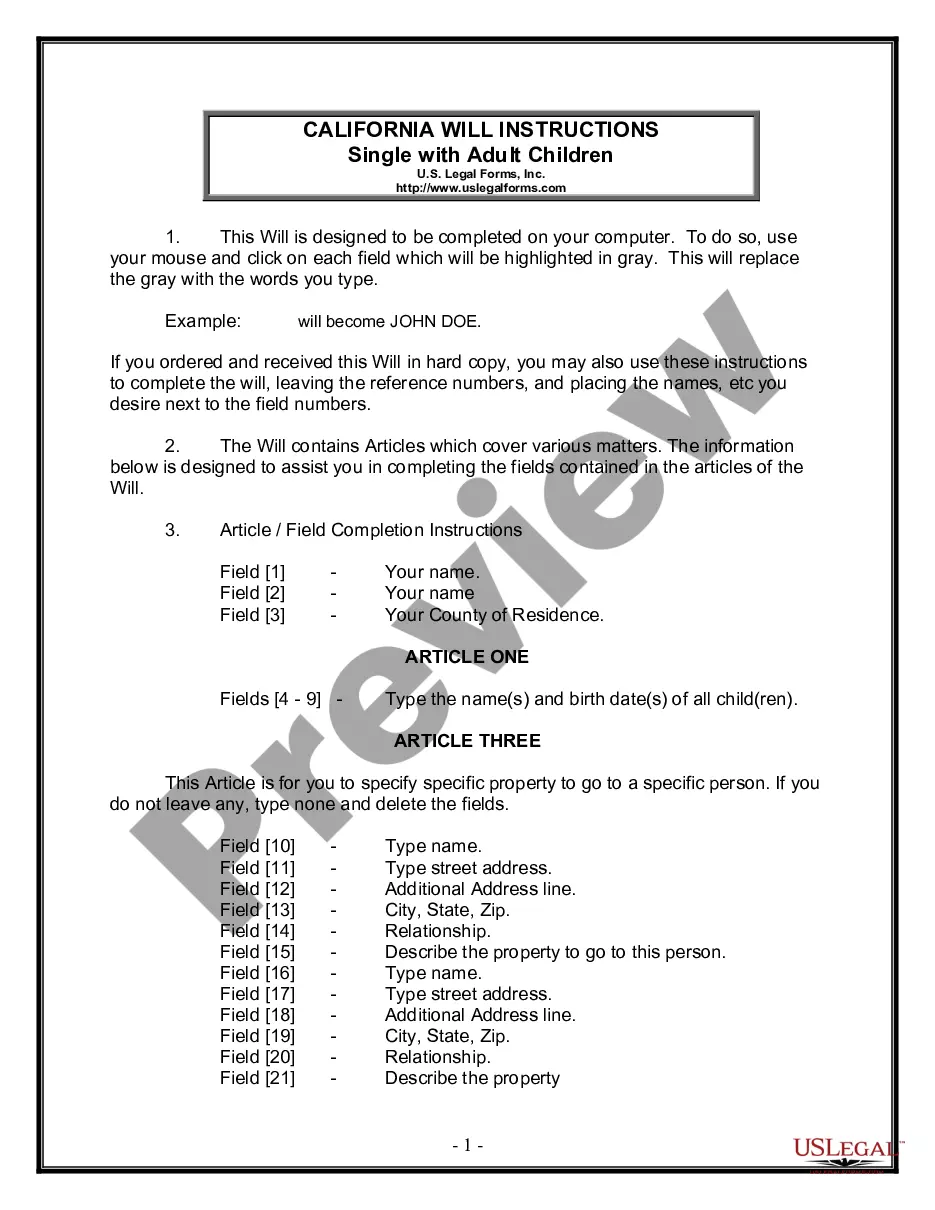

How to fill out Fairfax Virginia Sample Letter For Insufficient Amount To Reinstate Loan?

Do you need to quickly create a legally-binding Fairfax Sample Letter for Insufficient Amount to Reinstate Loan or maybe any other document to handle your personal or business affairs? You can select one of the two options: contact a legal advisor to write a legal paper for you or create it entirely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you get neatly written legal documents without paying sky-high prices for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-specific document templates, including Fairfax Sample Letter for Insufficient Amount to Reinstate Loan and form packages. We offer documents for an array of life circumstances: from divorce papers to real estate documents. We've been on the market for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra troubles.

- To start with, double-check if the Fairfax Sample Letter for Insufficient Amount to Reinstate Loan is tailored to your state's or county's regulations.

- If the form has a desciption, make sure to check what it's suitable for.

- Start the search over if the form isn’t what you were seeking by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Fairfax Sample Letter for Insufficient Amount to Reinstate Loan template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our services. In addition, the documents we provide are reviewed by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Reinstating a loan. A "reinstatement" occurs when the borrower brings the delinquent loan current in one lump sum. Reinstating a loan stops a foreclosure because the borrower catches up on the defaulted payments. The borrower also has to pay any overdue fees and expenses incurred because of the default.

A "reinstatement" occurs when the borrower brings the delinquent loan current in one lump sum. Reinstating a loan stops a foreclosure because the borrower catches up on the defaulted payments. The borrower also has to pay any overdue fees and expenses incurred because of the default.

Reinstatement period is a phase where a borrower has an opportunity to stop a foreclosure by paying money which the borrower owes to a lender. The mortgage reinstatement period begins when the lender files legal document with the court to start foreclosure proceedings.

Reinstatement is not automatic unless it is provided by state law or the mortgage terms, but you may be able to reinstate your loan even if the lender is not technically required to allow it. The lender may find it easier to continue with the loan than to go through the foreclosure process.

Mortgage reinstatement provides an option to avoid foreclosure. Instead, you can catch up on your payments and cover any late fees to restore the mortgage by paying the total amount past due. Once you are caught up, the defaulted mortgage will receive a clean slate.

You have up until 5 days before the foreclosure sale to cure the default and stop the process. This is called reinstatement of the loan.

To reinstate a loan, you must first find out the amount needed to bring the loan current. You can get this information by requesting a "reinstatement quote" or "reinstatement letter" from the loan servicer.

What is a reinstatement letter? A reinstatement letter is a missive a former employee sends to a previous employer asking for their job back.

Looking for Mortgage Analysis Services Homeowners are also allowed to negotiate the reinstatement of their mortgages loans with the lenders. Negotiating a reinstatement of a defaulted mortgage with the lender is a bit more involved than simply paying all missed payments and late fees, though.

If you asked the creditor to close the account or you paid off a loan, there's nothing necessary for you to do. Contact your lender. If you don't know why the account shows as closed, the creditor might be able to tell you. If your creditor closed it, you can ask if it'll reopen the account, but it's not required to.