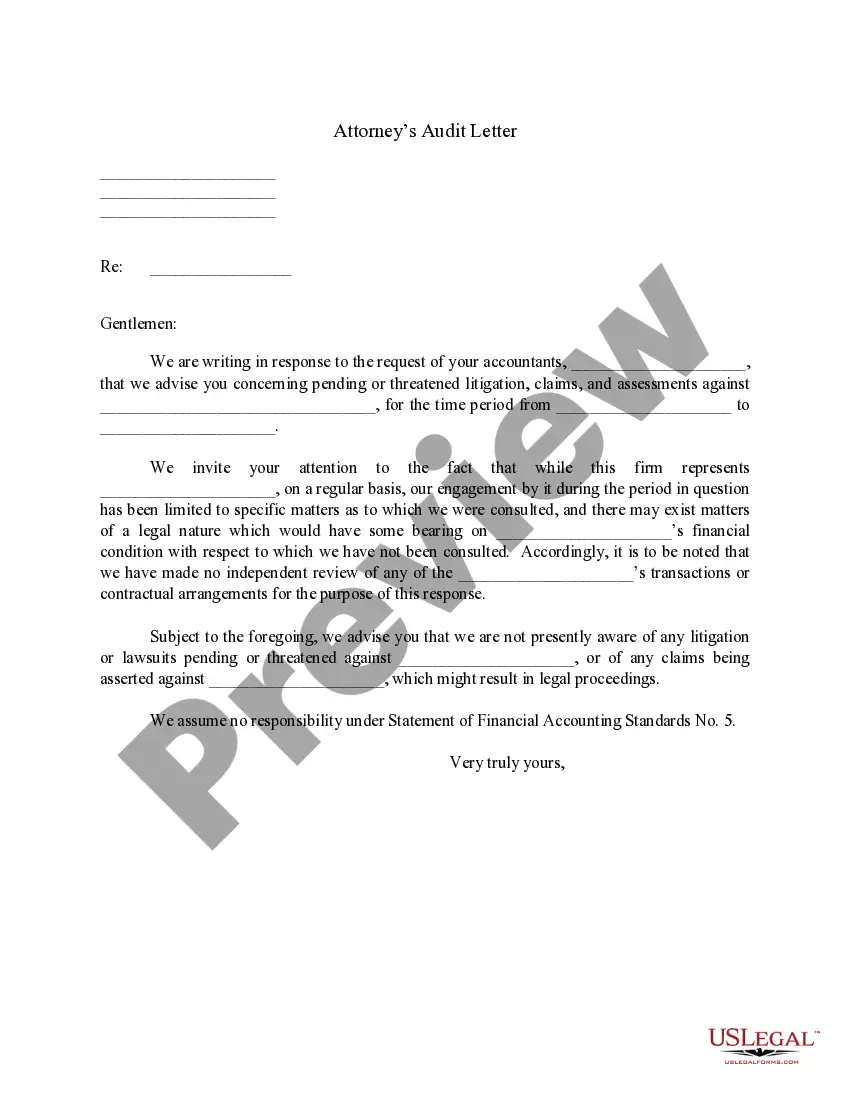

San Diego, California is a vibrant city located on the Pacific coast of the United States. Known for its stunning beaches, pleasant climate, and thriving urban culture, San Diego is a popular tourist destination and a great place to live or visit. When it comes to financial matters, sometimes individuals or businesses need to draft a Sample Letter for Check Stipulations to outline specific conditions or instructions related to a check they are issuing or receiving. This letter helps ensure both parties are aware of their obligations and responsibilities regarding the payment. There are several types of San Diego, California Sample Letter for Check Stipulations: 1. Sample Letter for Check Payment Deadline Stipulations: This type of letter specifies the exact timeframe within which the recipient of the check must deposit or cash it. It may mention penalties or consequences for late or early deposit. 2. Sample Letter for Stop Payment Stipulations: If the check writer wants to halt the payment process for any reason, they can use this letter to communicate their intention. It highlights the need for the recipient to refrain from depositing or cashing the check until further notice. 3. Sample Letter for Post-Dated Check Stipulations: A post-dated check is one that carries a future date for processing. This type of letter establishes that the recipient should not present the check for payment until the specified date. 4. Sample Letter for Check Endorsement Stipulations: Sometimes, a check may require specific endorsements to be valid. This letter outlines the endorsements needed, such as multiple signatures, designated beneficiaries, or authorized representatives. 5. Sample Letter for Check Memo Stipulations: The memo section of a check allows the writer to provide additional information about the payment. This letter sets forth any specific instructions or requirements regarding the memo details. In conclusion, San Diego, California offers a diverse range of sample letters for check stipulations to cater to various financial needs. Whether it's specifying payment deadlines, stopping payments, setting post-dated check terms, outlining endorsement requirements, or providing memo stipulations, these letters ensure clear communication and proper understanding of obligations in financial transactions.

San Diego California Sample Letter for Check Stipulations

Description

How to fill out San Diego California Sample Letter For Check Stipulations?

Whether you intend to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like San Diego Sample Letter for Check Stipulations is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the San Diego Sample Letter for Check Stipulations. Follow the instructions below:

- Make sure the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Sample Letter for Check Stipulations in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!