Hennepin Minnesota Sample Letter for Request for Payment Plan concerning Default

Description

How to fill out Sample Letter For Request For Payment Plan Concerning Default?

Generating legal documents is essential in the current landscape. Nevertheless, you don’t always have to consult expert assistance to create some of them from the ground up, including Hennepin Sample Letter for Request for Payment Plan concerning Default, by utilizing a service like US Legal Forms.

US Legal Forms offers over 85,000 templates to select from across diverse categories ranging from living wills to property documents to divorce papers. All forms are categorized by their respective state, streamlining the search process. Information resources and tutorials are also available on the website to simplify any tasks related to paperwork completion.

Here’s how to find and download Hennepin Sample Letter for Request for Payment Plan concerning Default.

If you are already a member of US Legal Forms, you can locate the necessary Hennepin Sample Letter for Request for Payment Plan concerning Default, Log In to your account, and download it. It goes without saying that our platform is not a complete substitute for an attorney. If you are confronted with an exceptionally complex case, we suggest hiring a lawyer to review your document before signing and submitting.

With over 25 years in the industry, US Legal Forms has established itself as a reliable resource for various legal documents for millions of users. Join them today and obtain your state-compliant paperwork effortlessly!

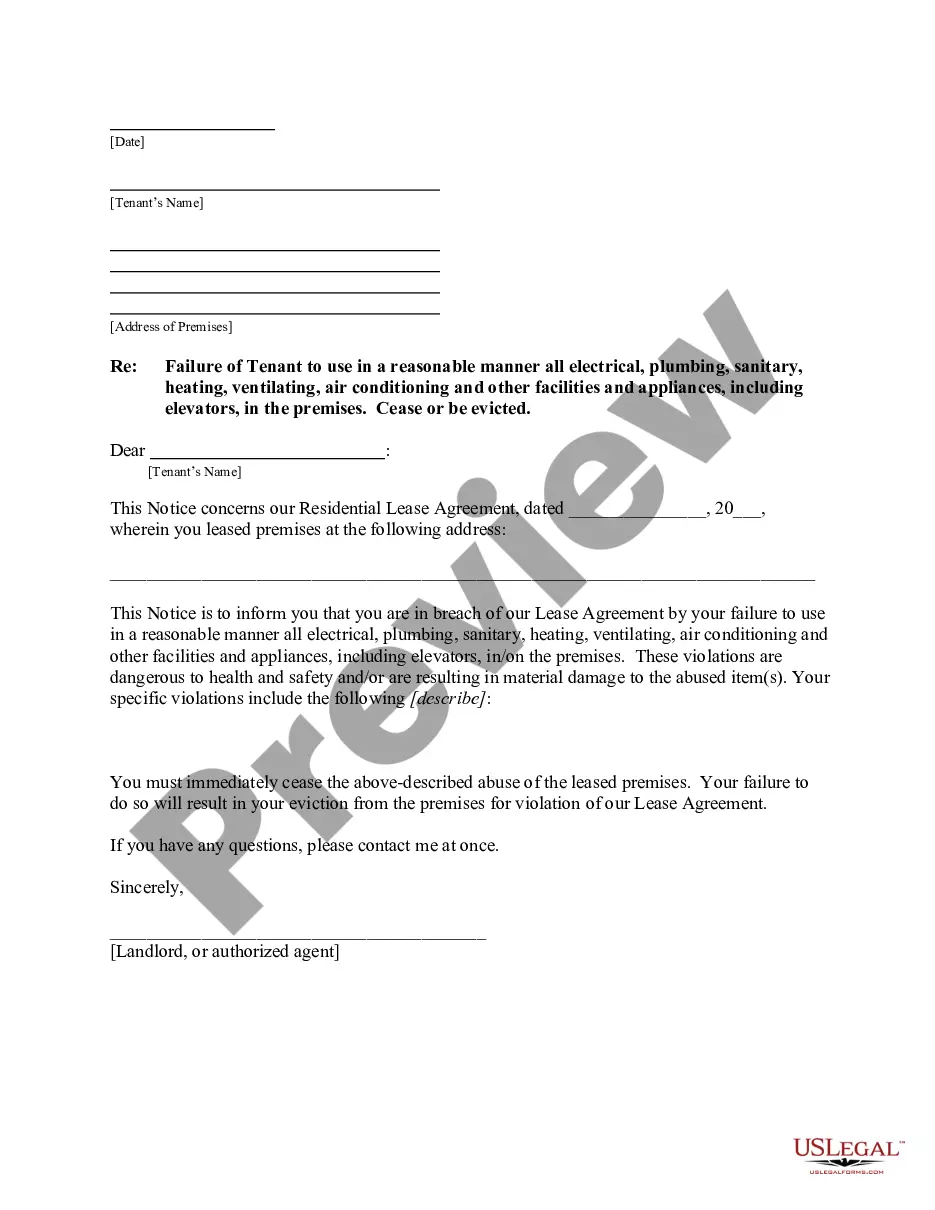

- Review the document's preview and structure (if available) to grasp a general understanding of what you will receive after acquiring the form.

- Ensure that the template you select corresponds with your state/county/region, as state laws can influence the validity of certain documents.

- Explore the similar forms or initiate a new search to identify the correct file.

- Click Buy now and create your account. If you already possess an account, opt to Log In.

- Select the desired option, then choose a suitable payment method, and purchase Hennepin Sample Letter for Request for Payment Plan concerning Default.

- Decide to save the form template in any available format.

- Go to the My documents section to re-download the file.

Form popularity

FAQ

Let them know your situation and directly ask that someone from the company or agency contact you to set up a payment plan because you are unable to pay your bill in full at the present time. Provide a phone number, physical address or e-mail address where you wish to be contacted.

Tips for Writing a Hardship Letter Keep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

You can renew a judgment before it expires by filing a motion to renew a judgment. You can use the Ex Parte Motion and Order to Renew Civil Judgment form from the Michigan One Court of Justice website. File the motion in the court that issued the judgment. The judge may have a hearing on the motion.

Letter Proposing Payments in Installments Basic details of the dealer (such as name, address, phone and account number) Basic details of the buyer (such as name, address, phone and account number) Date of the request. Details of request (proposing to pay (or get paid in parts every month)

How do I make payment arrangements? SARS eFiling: To see the steps on how to make payment arrangements on eFiling, click here.The Contact Centre on 0800 00 7277; A Debt Management Office. Email any outstanding debt queries and deferred arrangements requests to Sarsdebtmanagement2@sars.gov.za.

I am requesting that you accept payments of $paid on the. I assure you that I will add no further debt until my financial situation improves. I will begin making normal payments again as soon as possible. I regret that I have to ask for this consideration and hope that you will understand.

Ask for the most Be reasonable in your ask, but aim to ask for the higher end of what you need. This is a negotiation, meaning there will be some back and forth as come to terms that work for both parties. For instance, if you need more time than your normal 30-day payment terms, ask for 60 days.

If you are sued and can't pay, the creditor can get a judgment in court against you for the money you owe, plus interest. Being judgment proof means that your property and income can't be seized by creditors, because it is exempt by law from the creditor's claims.

Enforcing a judgment against a defendant who does not pay If a defendant does not pay a judgment, the plaintiff can try to enforce the judgment by filing another lawsuit. For example, if the defendant owns several cars, the plaintiff can sue to have the car transferred to the plaintiff.

You MAY be able to pay your judgment in installments by setting up a payment plan with the court or the judgment creditor. First, you can try talking to the creditor to see if he or she is willing to work out a payment plan with you.