The Collin Texas Family Limited Partnership Agreement and Certificate is a legally binding document that establishes a partnership between members of a family in Collin County, Texas. This agreement outlines the terms and conditions governing the partnership, including the rights, responsibilities, and obligations of each partner involved. The Collin Texas Family Limited Partnership Agreement aims to protect and manage family assets, promote effective communication and decision-making, limit liability, and facilitate the efficient transfer of wealth within the family unit. By entering into this partnership agreement, family members can unite their resources and collectively manage their assets for the benefit of all involved. There are various types of Collin Texas Family Limited Partnership Agreements and Certificates, which may differ depending on the specific needs and objectives of the family. Some common types include: 1. General Partnership Agreement: This agreement establishes a partnership where all family members have unlimited liability and share both the profits and losses equally. Partners are actively involved in the management and decision-making processes. 2. Limited Partnership Agreement: This agreement differentiates between general partners and limited partners. General partners bear unlimited liability and are actively involved in the day-to-day operations, while limited partners have limited liability and do not participate in management decisions. 3. Family Limited Liability Partnership (LLP) Agreement: This agreement provides liability protection to family members involved in the partnership. It combines features of both a limited partnership and a general partnership, allowing family members to participate in management decisions while limiting personal liability risks. 4. Limited Liability Limited Partnership (LL LP) Agreement: This type of agreement combines the characteristics of a limited partnership and a limited liability company (LLC). This structure offers limited liability protection to all partners, including general partners, while maintaining the flexibility and tax benefits of a partnership. Each type of Collin Texas Family Limited Partnership Agreement and Certificate will have its own purpose and provisions, tailored to the specific circumstances and objectives of the family members involved. By carefully considering the options available and seeking professional advice, families can establish a framework that suits their unique needs and ensures the efficient management and preservation of their assets for future generations.

Collin Texas Family Limited Partnership Agreement and Certificate

Description

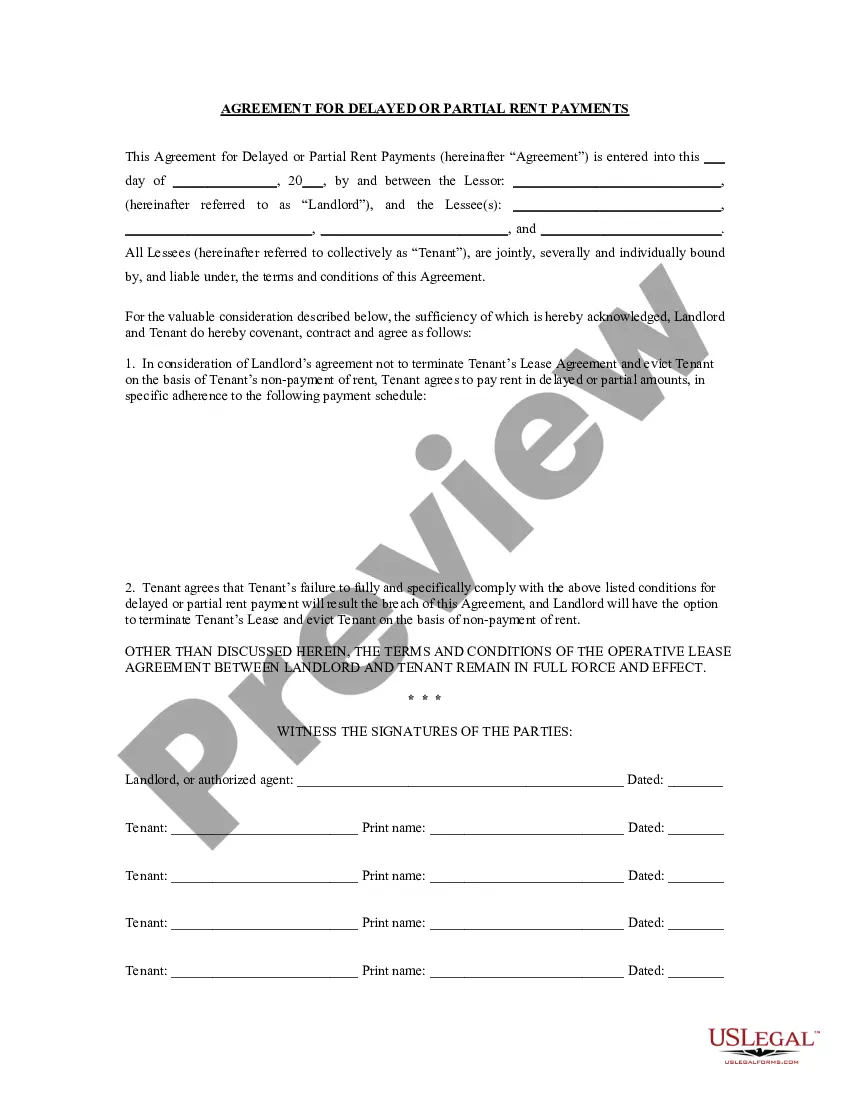

How to fill out Collin Texas Family Limited Partnership Agreement And Certificate?

Creating forms, like Collin Family Limited Partnership Agreement and Certificate, to take care of your legal affairs is a challenging and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms created for a variety of cases and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Collin Family Limited Partnership Agreement and Certificate template. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before downloading Collin Family Limited Partnership Agreement and Certificate:

- Ensure that your document is specific to your state/county since the rules for writing legal documents may differ from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Collin Family Limited Partnership Agreement and Certificate isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start using our website and download the document.

- Everything looks great on your end? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your template is all set. You can try and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

A family partnership is a partnership where two or more members are related to each other.

The names and addresses of the general partners must be listed, as well as the street address of the LLP's principal office. You must also provide a brief statement of the partnership's business.

A Limited Partnership Agreement is an agreement between the general partner, the limited partners and the Limited Partnership itself in which the partners can set forth in writing the particular agreements that they have among themselves.

Some states only require that the certificate contains the name of the limited partnership, the name and address of the registered agent and registered office, and the names and addresses of all of the general partners.

Basics of an LP Agreement The address and name of your business. Your reason for establishing your limited partnership. Voting rights of limited partners, if any. A process of making business decisions. Ownership percentages and each partner's capital contribution.

5 Steps to Forming a Family Limited Partnership (FLP) Step 1 Set-up the FLP and the managing General Partner.Step 2 Transfer assets into the FLP.Step 3 Place a value on the FLP ownership interest.Step 4 Set up trust(s) to become Limited Partners in the FLP.

This means that the formation of a limited partnership requires at least two partners one limited partner and one general partner. These can be natural or legal persons, as well as other partnerships.

Do you need a written partnership agreement? Partnerships can operate without a written partnership agreement.

A Limited Partnership (LP) is a legal business structure, formed with more than one business owner. An LP consists of at least one general partner and at least one limited partner. There may be more than one of each. General partners are those who make business decisions and manage day-to-day operations.

A family limited partnership (FLP) is an arrangement in which family members pool money to run a business project. Each family member buys units or shares of the business and can profit in proportion to the number of shares they own, as outlined in the partnership operating agreement.