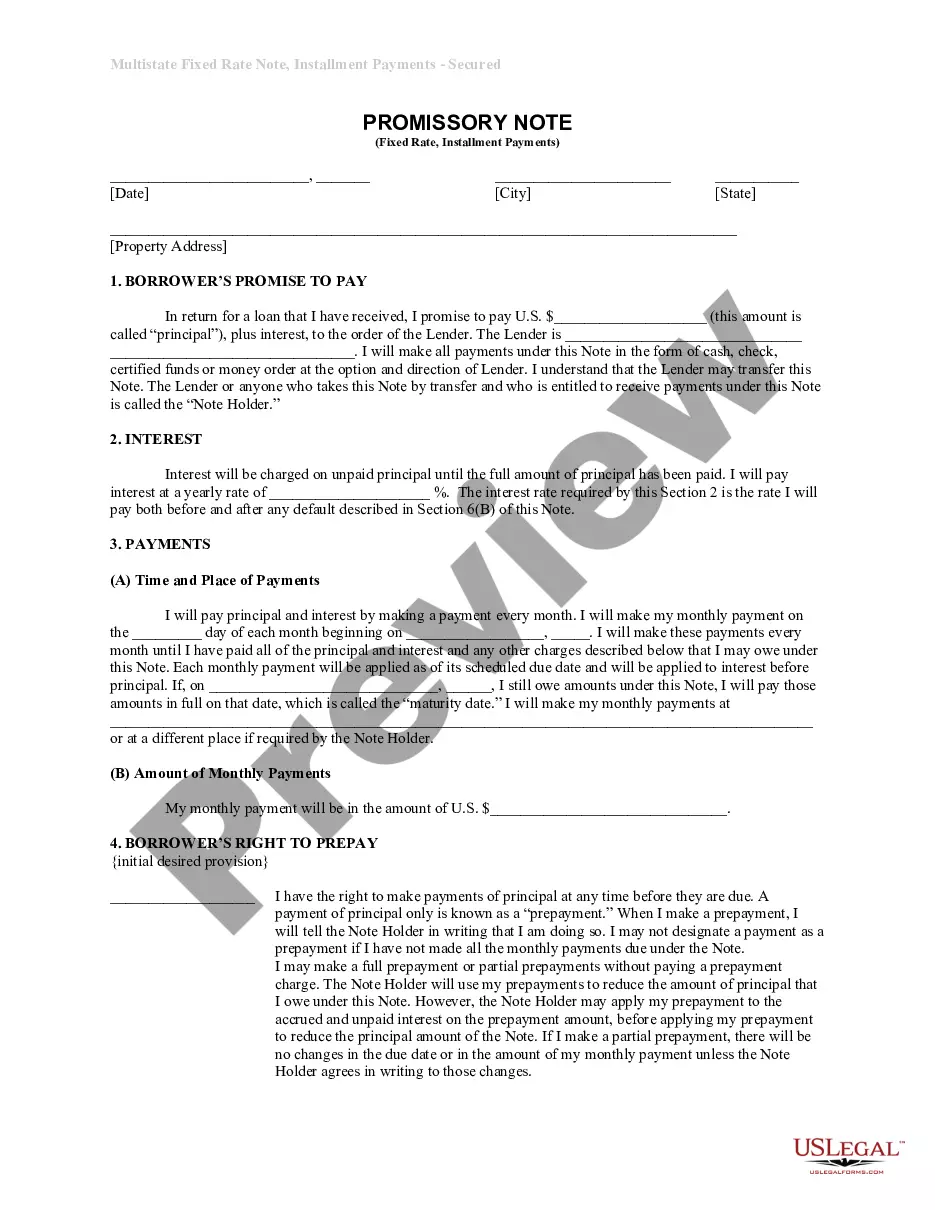

Dallas Texas Family Limited Partnership Agreement and Certificate is a legal document that establishes a business structure where family members can pool their assets and resources to form a partnership in the state of Texas, with the purpose of managing and operating a business together. This agreement outlines the rights, responsibilities, and obligations of each family member involved, as well as the terms and conditions of the partnership. The Dallas Texas Family Limited Partnership Agreement and Certificate is designed to offer various types of partnerships that cater to the unique needs and preferences of families in Dallas, Texas. Some different types of Family Limited Partnership Agreement and Certificate in Dallas, Texas may include: 1. General Family Limited Partnership (FLP): This type of partnership agreement allows family members to combine their financial resources and expertise to run a business, where one or more family members act as general partners with unlimited liability, and the remaining family members become limited partners with limited liability. 2. Limited Liability Family Limited Partnership (LLP): This agreement offers similar arrangements as a general FLP, but adds the benefit of limiting the liability of all partners, including general partners. This helps protect the personal assets of family members from business-related debts and legal liabilities. 3. Advisory Family Limited Partnership (AFLP): An AFLP agreement allows the founding family members (general partners) to retain control and decision-making authority over the partnership, while engaging outside advisors or professionals as limited partners to benefit from their guidance and expertise. 4. Asset Protection Family Limited Partnership (AFLP): The AFLP agreement primarily focuses on protecting family assets from potential legal claims and lawsuits. This type of partnership shields family assets within the partnership from being targeted in legal proceedings, providing an added layer of asset protection. 5. Succession Planning Family Limited Partnership (SP FLP): SP FLP is specifically tailored to facilitate wealth transfer and succession planning within a family-owned business or investment portfolio. This agreement enables the smooth transition of assets and management control to the next generation, while minimizing tax consequences and potential conflicts. In order to form any of these Dallas Texas Family Limited Partnership Agreements and Certificates, families need to comply with the relevant legal requirements and consult with an experienced attorney to ensure compliance with state laws and regulations. It is crucial to draft a comprehensive and customized agreement that addresses the unique circumstances, goals, and aspirations of the family members involved.

Dallas Texas Family Limited Partnership Agreement and Certificate

Description

How to fill out Dallas Texas Family Limited Partnership Agreement And Certificate?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare official documentation that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any individual or business purpose utilized in your region, including the Dallas Family Limited Partnership Agreement and Certificate.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Dallas Family Limited Partnership Agreement and Certificate will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to get the Dallas Family Limited Partnership Agreement and Certificate:

- Make sure you have opened the right page with your local form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Dallas Family Limited Partnership Agreement and Certificate on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!