Kansas City Missouri Lease of Equipment with Lessee to Pay all Taxes Imposed Relating to Equipment

Category:

State:

Multi-State

City:

Kansas City

Control #:

US-0831BG

Format:

Word;

Rich Text

Instant download

Description

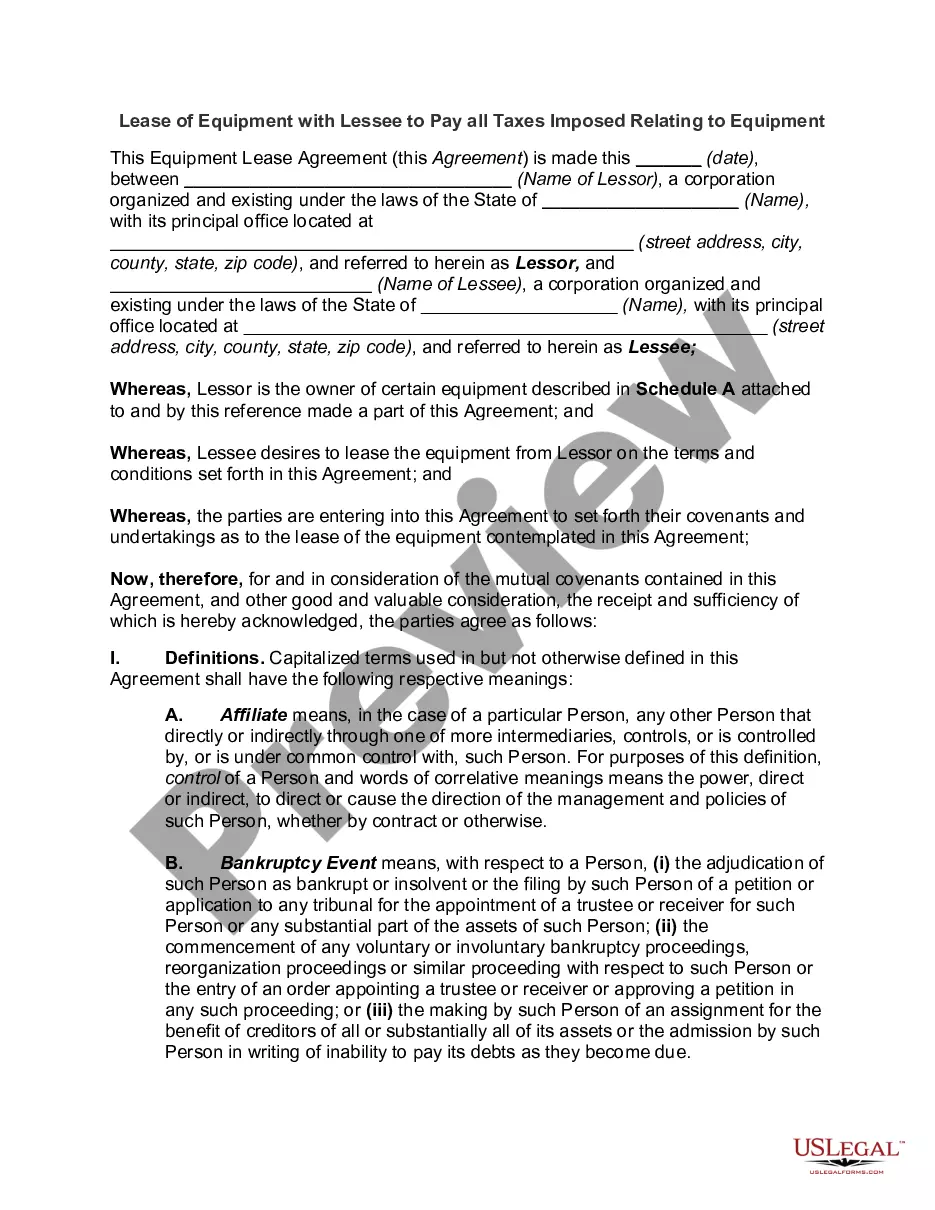

According to Article 2A of the Uniform Commercial Code, personal property leases requiring total payments of $1,000 or more are not enforceable unless there is a writing, signed either by the party against whom enforcement is sought or by that party's authorized agent. The writing must sufficiently indicate that a lease contract has been made between the parties, and must contain a description of the goods leased, and the term of the lease. A description of the goods to be leased or the lease term is sufficient if it reasonably identifies what is described.

Free preview

Form popularity

Interesting Questions

More info

Be sure to include all income information and any supporting documentation. After connecting to your Withholding account, simply click the "Make an EFT Payment" link to complete your filing and payment.To complete a filing using WebFile, a KanAccess account is required. Sign in or create your free account in the next step. It is telling me to file a Kansas City Mo earning tax form. I have never filed one before. I live in Kansas City, Missouri and work in the state of Kansas. When KC is selected in the City drop list, program will prepare Form RD-108. A separate form will be prepared for each income source. Submit a regular MO W-4 Form.