San Antonio Texas Blocked Account Agreement is a legal contract that outlines the terms and conditions for a specific type of bank account known as a blocked account. This agreement is designed to protect the interests of both the account holder and the financial institution. A blocked account refers to a type of account where certain restrictions are placed on the funds deposited. These accounts are typically used for various purposes like immigration requirements, international students, or legal matters where funds need to be held securely. In San Antonio, Texas, there are several types of Blocked Account Agreements available to cater to different needs and circumstances. Some key types of blocked accounts include: 1. Immigration Blocked Account Agreement: This agreement is specifically designed for immigrants who need to deposit a certain amount of funds as proof of financial capability. It is often a requirement for visa applications and ensures that the funds remain secure until they are released according to the agreed-upon terms. 2. Student Blocked Account Agreement: This type of agreement is commonly used by international students studying in San Antonio, Texas. It serves as a means to maintain the required funds for their education and living expenses. The agreement prevents the withdrawal of funds without meeting specific conditions, ensuring that the funds are available throughout the duration of their studies. 3. Legal Blocked Account Agreement: This agreement is frequently utilized in legal proceedings, such as divorce or inheritance cases. It establishes a secure holding account for disputed funds until a resolution is reached. Regardless of the type of Blocked Account Agreement in San Antonio, they generally include key provisions such as: a. Deposit Terms: The agreement will specify the minimum deposit required to open the account and any subsequent deposit requirements. b. Withdrawal Restrictions: It outlines the conditions under which funds can be withdrawn, such as providing necessary documentation or meeting specific criteria. c. Account Maintenance: The agreement will outline rules regarding account maintenance, including annual fees, transaction limits, and any penalties for non-compliance. d. Termination Clause: This section details the circumstances under which the agreement may be terminated by the account holder or the financial institution. e. Account Security and Liability: The agreement defines the responsibility of the financial institution in terms of protecting account information and liability issues in case of theft or unauthorized access. San Antonio Texas Blocked Account Agreements play a vital role in safeguarding the funds of individuals in various circumstances. Regardless of the specific type, these agreements aim to provide financial security, legal compliance, and peace of mind for both account holders and banking institutions in San Antonio, Texas.

San Antonio Texas Blocked Account Agreement

Description

How to fill out San Antonio Texas Blocked Account Agreement?

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life situation, finding a San Antonio Blocked Account Agreement meeting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the San Antonio Blocked Account Agreement, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Professionals verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can pick the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your San Antonio Blocked Account Agreement:

- Examine the content of the page you’re on.

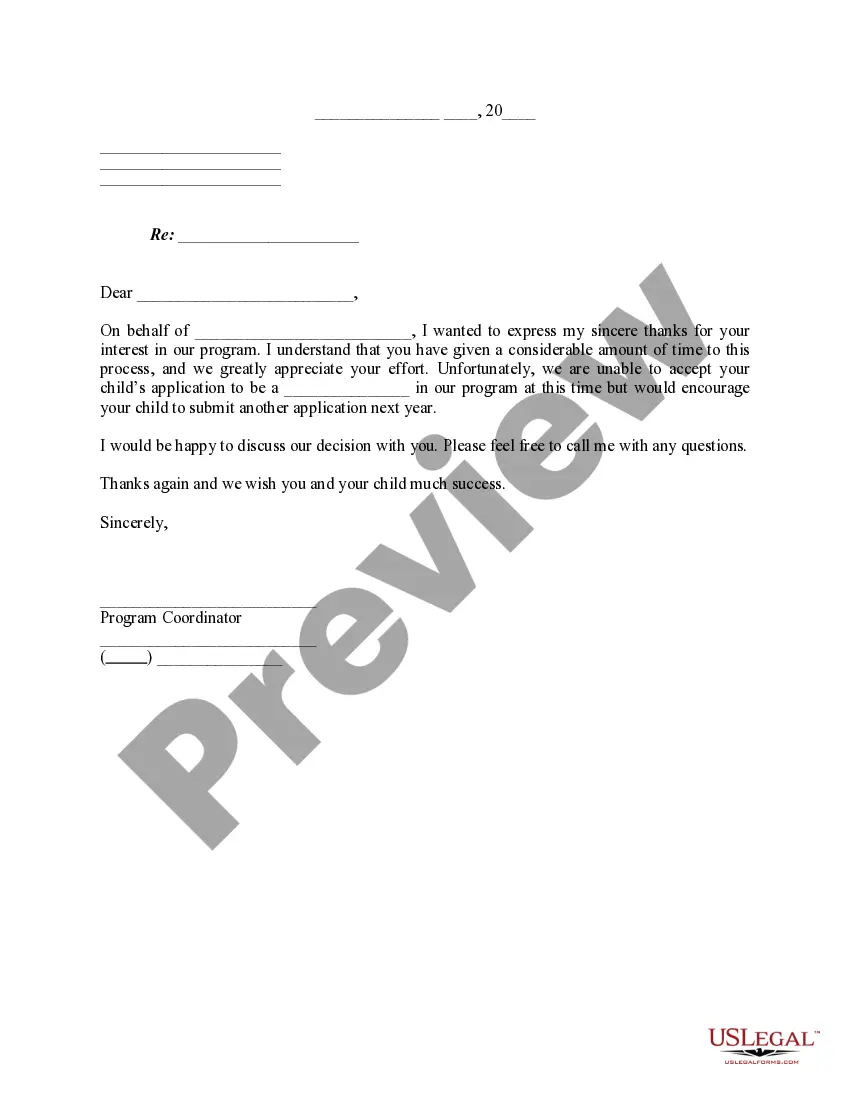

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Antonio Blocked Account Agreement.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!