San Antonio, Texas is a vibrant city located in the southern part of the state. Known for its rich history, diverse culture, and thriving economy, San Antonio offers a wide range of attractions and opportunities for residents and visitors alike. One of the types of San Antonio Texas Sample Letters for Pro Rata Share of Bankruptcy Estate is the "Notice of Pro Rata Share Distribution." This letter is typically sent out by the bankruptcy trustee to creditors who are entitled to receive a portion of the bankruptcy estate. It informs them of the amount they will be receiving and the distribution schedule. The letter includes specific information such as the bankruptcy case number, the date of the distribution, the total amount of the estate, and the creditor's pro rata share. It also advises the creditor to provide the necessary documentation to receive their share and provides contact information for any questions or concerns. Another type of San Antonio Texas Sample Letter for Pro Rata Share of Bankruptcy Estate is the "Waiver of Pro Rata Share." This letter is sent by a creditor who wishes to waive their right to receive a portion of the bankruptcy estate. It is commonly used when the creditor believes that the cost of claiming their share outweighs the potential benefit. The letter includes the creditor's information, the bankruptcy case details, and a clear statement of intention to waive the pro rata share. It also provides space for the creditor to sign and date the waiver, acknowledging that they understand the consequences of their decision. In summary, San Antonio, Texas is a flourishing city with various types of Sample Letters for Pro Rata Share of Bankruptcy Estate available. These letters serve different purposes, including notifying creditors of their share distribution and allowing them to waive their rights to receive a portion of the bankruptcy estate. These letters play an essential role in the bankruptcy process and ensure transparency and efficiency for all involved parties.

San Antonio Texas Sample Letter for Pro Rata Share of Bankruptcy Estate

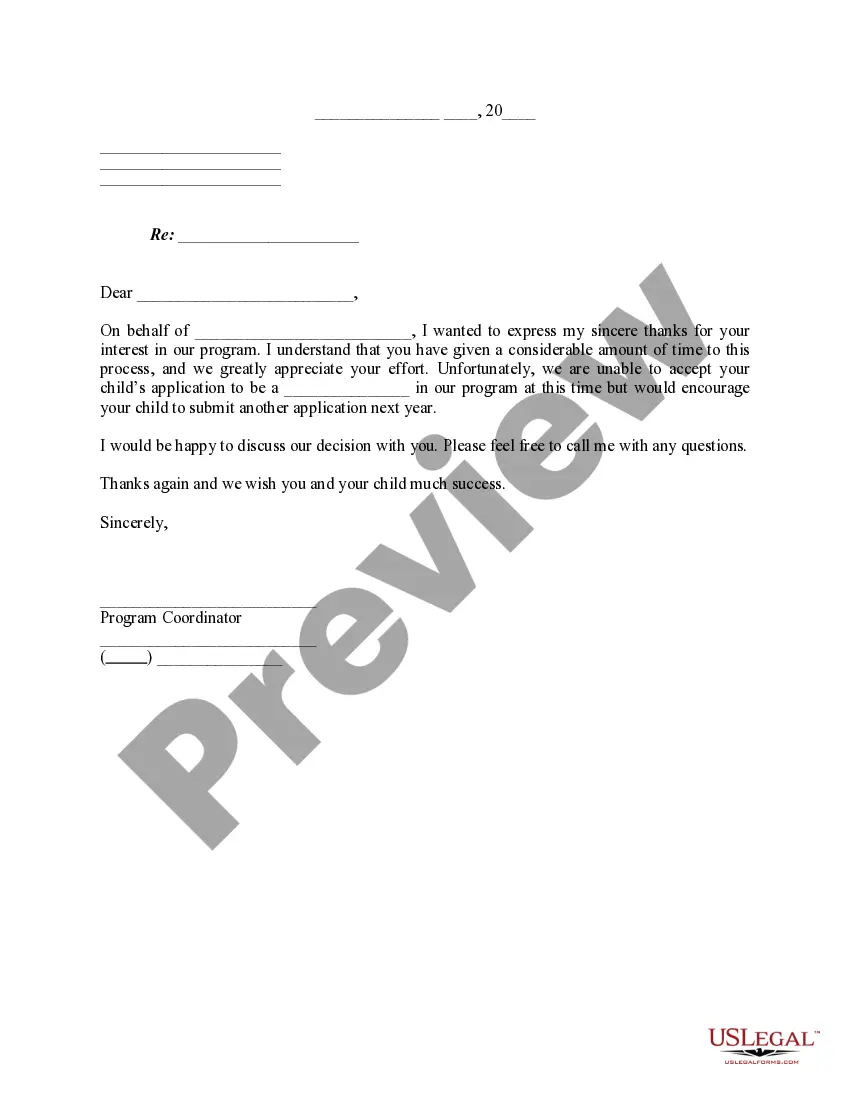

Description

How to fill out San Antonio Texas Sample Letter For Pro Rata Share Of Bankruptcy Estate?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal documentation that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business objective utilized in your region, including the San Antonio Sample Letter for Pro Rata Share of Bankruptcy Estate.

Locating samples on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the San Antonio Sample Letter for Pro Rata Share of Bankruptcy Estate will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to get the San Antonio Sample Letter for Pro Rata Share of Bankruptcy Estate:

- Make sure you have opened the right page with your regional form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the San Antonio Sample Letter for Pro Rata Share of Bankruptcy Estate on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

What is claims against the assets? When both the creditor and owner have a claim on the assets as they have either provided the funds used to aquire the assets or they have provided the asstes themselves.

In a Bankruptcy case, when the debtor is insolvent, creditors generally agree to accept a pro rata share of what is owed to them. If the debtor has any remaining funds, the money is divided proportionately among the creditors, according to the amount of the individual debts.

While your trustee will most likely periodically check all of your financial accounts such as your bank accounts, in order to ensure that you have enough money to continue making your bankruptcy payments, they are not permitted to touch any of your funds, other than the funds which are allocated for your secured loan

The trustee is the one responsible for gathering the bankrupt's assets and dividing them among creditors.

More Definitions of creditor process creditor process means a levy, attachment, garnishment, notice of lien, sequestration, or similar process issued by or on behalf of a creditor or other claimant with respect to an account or entity.

The U.S. Trustee, the bankruptcy arm of the Justice Department, will appoint one or more committees to represent the interests of creditors and stockholders in working with the company to develop a plan of reorganization to get out of debt.

Alimony and child support obligations are considered priority claims.

Creditor's claim (sometimes referred to as a proof of claim) is a filing with a bankruptcy or probate court to establish a debt owed to that individual or organization.

1) Liabilities are creditors' claims on asset. 2) They reflect obligations to transfer assets or provide products or service to others. 3) Equity is owners' claim to assets. 4) Equity is also called net assets or residual interest.

Usually, creditor's rights refers to what creditors can do to get back money owed to them and their positioning to other creditors of the debtor. Federal and state laws such as the Fair Debt Collection Practices Act (FDCPA) restrict the ways in which creditors may attempt to collect debts.

Interesting Questions

More info

The Company has the ability to operate under a special provision of the United States Constitution — A corporation can become a private corporation for federal banking purposes without creating any personal liability. In other words, Liberty Mutual is not liable for debts owed to individuals. That is good enough for a corporation. The only other reason to file a Bankruptcy is if a bank account is closed. There is a clause under the Bankruptcy code that allows a few people to get out of bad debts by making a request to the United States bankruptcy courts. All the debts of the debtor's family members are discharged. If there is a child, a parent or a spouse that has a financial obligation to the debtor, the debtor is not required to pay the obligation. If the person has sufficient assets in order to pay the amount of debt that he/she owes, and the debtor was aware of the obligation, he/ she could petition for Chapter 7. Bankruptcy does not create personal liability.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.