Title: Harris Texas Sample Letter for Requesting IRS to Prevent Tax Refund Offsetting Introduction: In Harris County, Texas, taxpayers who experience financial hardship may request the Internal Revenue Service (IRS) to refrain from offsetting their tax refund against outstanding debts owed to federal or state authorities. This article presents a detailed description of a sample letter that can be used to officially request the IRS not to offset tax refunds. From the provided keywords, different types of Harris Texas sample letters can be categorized based on specific situations. Let's explore them below. Sample Letter: [Your Name] [Your Address] [City, State, ZIP] [Date] [Internal Revenue Service Address] [City, State, ZIP] Subject: Request for IRS Not to Offset Tax Refund Dear Sir/Madam, I hope this letter finds you well. I am writing to formally request the Internal Revenue Service not to offset my tax refund against any outstanding debts owed to federal or state authorities. I am encountering significant financial difficulties at this time, and retaining my tax refund is crucial for addressing pressing financial obligations. [Begin customization based on specific situations] 1. If facing medical expenses: I have been enduring substantial medical expenses due to an unexpected illness/injury, which has severely strained my financial resources. The funds from my tax refund are crucial for covering these expenses and ensuring continued medical care for myself/my family member(s). 2. If experiencing a sudden job loss: I recently lost my job due to [reason], resulting in a sudden loss of income. My tax refund plays a critical role in sustaining my basic living expenses and meeting essential financial commitments until I can secure alternative employment. 3. If supporting dependents: As a single parent/single-income household, I am solely responsible for the financial welfare of my [number] dependent(s). My tax refund enables me to provide necessities such as food, clothing, and educational support for them. Offset of these funds would significantly impede my ability to fulfill my parental responsibilities. 4. Any other specific circumstances: In this paragraph, provide details of your unique situation, ensuring you clearly explain how retaining the tax refund is crucial for your financial stability, such as debts already in repayment plans, impending foreclosure/eviction, etc. It is essential to substantiate your circumstances with supporting documents whenever possible. [End customization] In light of these circumstances, I kindly request that you exercise your discretion to not offset my tax refund against any outstanding debts. Retaining this refund will provide much-needed relief during this challenging time and allow me to regain financial stability. Enclosed with this letter, please find supporting documents that validate my current financial hardship. Should you require any additional information or documentation, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address]. I genuinely appreciate your consideration of my request and the support you can provide in ensuring continued financial stability. Thank you for your attention to this matter. Sincerely, [Your Name] [Your Signature] Keywords: Harris Texas, sample letter, request, IRS, offset, tax refund, financial hardship, outstanding debts, federal authorities, state authorities, medical expenses, job loss, dependents, customize, circumstances, supporting documents, discretionary decision, financial stability.

Harris Texas Sample Letter for Request for IRS not to Off Set against Tax Refund

Description

How to fill out Harris Texas Sample Letter For Request For IRS Not To Off Set Against Tax Refund?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Harris Sample Letter for Request for IRS not to Off Set against Tax Refund, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various types ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find information materials and guides on the website to make any tasks related to document execution simple.

Here's how to find and download Harris Sample Letter for Request for IRS not to Off Set against Tax Refund.

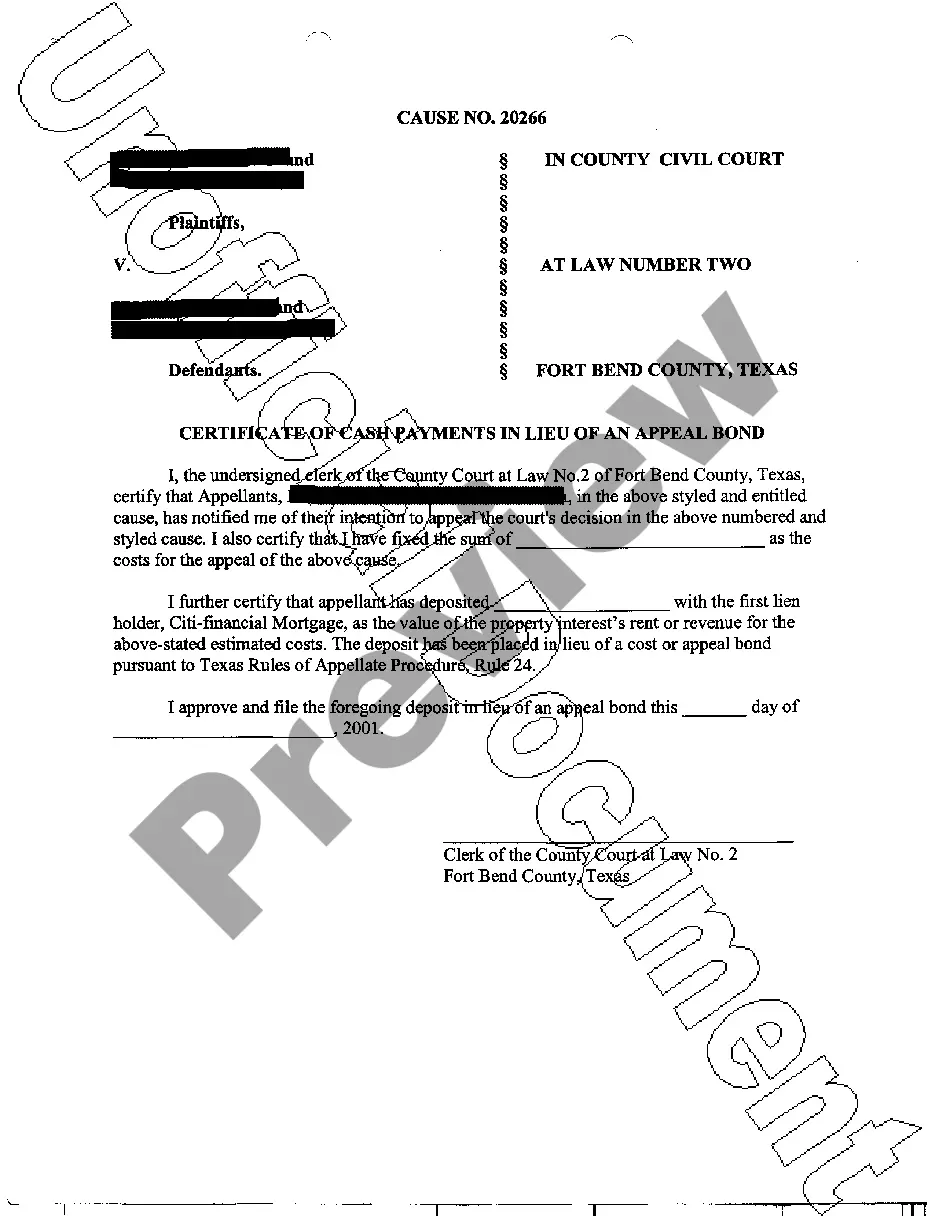

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the validity of some records.

- Examine the related document templates or start the search over to locate the right file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Harris Sample Letter for Request for IRS not to Off Set against Tax Refund.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Harris Sample Letter for Request for IRS not to Off Set against Tax Refund, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional entirely. If you need to cope with an exceptionally challenging situation, we advise using the services of a lawyer to check your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-compliant documents with ease!

Form popularity

FAQ

The IRS can hold your current-year refund if it thinks you made an error on your current-year return, or if the IRS is auditing you or finds a discrepancy on a filed return from the past. If the IRS thinks you made an error on your return, the IRS can change your refund.

Why the IRS might reject your return Tax returns get rejected frequently because a name or number on the return doesn't match information in the IRS or Social Security Administration databases. Typos and misspellings can be quick and easy to fix. You might even be able to correct the issue online and e-file again.

There are several ways to stop the state and federal governments from taking your tax refunds including contacting your local Department of Child Support and Enforcement (DCSE) agency to file an appeal, setting up a payment plan for your delinquent payments, and requesting a hearing.

Can I receive a tax refund if I am currently making payments under an installment agreement or payment plan for another federal tax period? No, one of the conditions of your installment agreement is that the IRS will automatically apply any refund (or overpayment) due to you against taxes you owe.

Use Form 12203, Request for Appeals ReviewPDF, the form referenced in the letter you received to file your appeal or prepare a brief written statement. List the disagreed item(s) and the reason(s) you disagree.

Use Form 12203, Request for Appeals ReviewPDF, the form referenced in the letter you received to file your appeal or prepare a brief written statement. List the disagreed item(s) and the reason(s) you disagree.

Usually, a garnishment can only be stopped before the refund is issued, not after. There are certain exceptions in place for joint filers and taxpayers experiencing an economic hardship.

Send in Form 433-A with any necessary documentation and wait for a response. If you qualify, you are switched to Currently Not Collectible status, and the IRS doesn't garnish your refund. Talk with your tax advocate about how long this status will be in place and what your next steps should be.

The IRS website states to include all of the following in a written protest: Your name, address and a daytime telephone number. A statement that you want to appeal the IRS findings to the Office of Appeals. A copy of the letter you received that shows the proposed change(s) The tax period(s) or year(s) involved.

The IRS provides a toll-free number, (800) 304-3107, to call for information about tax offsets. You can call this number, go through the automated prompts, and see if you have any offsets pending on your social security number.