[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] Internal Revenue Service [Address] [City, State, ZIP Code] Subject: Request for IRS Not to Offset Tax Refund Dear Sir/Madam, I hope this letter finds you well. I am writing to request your assistance in preventing the offset of my tax refund by the Internal Revenue Service (IRS). I am a resident of Mecklenburg County, North Carolina, and I believe that the offset would be an undue burden on my financial situation. Furthermore, I understand that the IRS has the authority to withhold all or a portion of my tax refund to satisfy outstanding debts owed to federal or state agencies. However, I kindly request that you consider my circumstances and extend some leniency in this matter. To provide you with a detailed explanation, I have encountered unforeseen financial difficulties due to [describe the reason for the financial hardship, such as job loss, medical expenses, or other circumstances]. These challenges have put a significant strain on my ability to meet basic living expenses and fulfill my financial obligations. I have attached supporting documents, such as medical bills, termination letter, or any other relevant proof, to provide evidence of these difficulties. I believe that retaining my tax refund would exacerbate my financial hardship and make it even more challenging to recover from my current situation. Considering the circumstances, I kindly request that the IRS grants an exemption and refrains from offsetting my tax refund this year. This exemption would allow me to utilize the refund to address my immediate financial needs, provide support for my family, and work towards improving my overall financial stability. I assure you that any grant of exemption will be utilized responsibly and in good faith to address the financial challenges I currently face. I am committed to resolving my outstanding debts as soon as my financial situation allows, and I understand that proper communication and cooperation are essential in achieving this goal. Furthermore, I kindly request that you acknowledge receipt of this letter and inform me if any additional information is required to support my request. Furthermore, I value your assistance and understanding in this matter and hope for a positive resolution. Thank you for your attention to this request. I look forward to your timely response. Sincerely, [Your Name]

Mecklenburg North Carolina Sample Letter for Request for IRS not to Off Set against Tax Refund

Description

How to fill out Mecklenburg North Carolina Sample Letter For Request For IRS Not To Off Set Against Tax Refund?

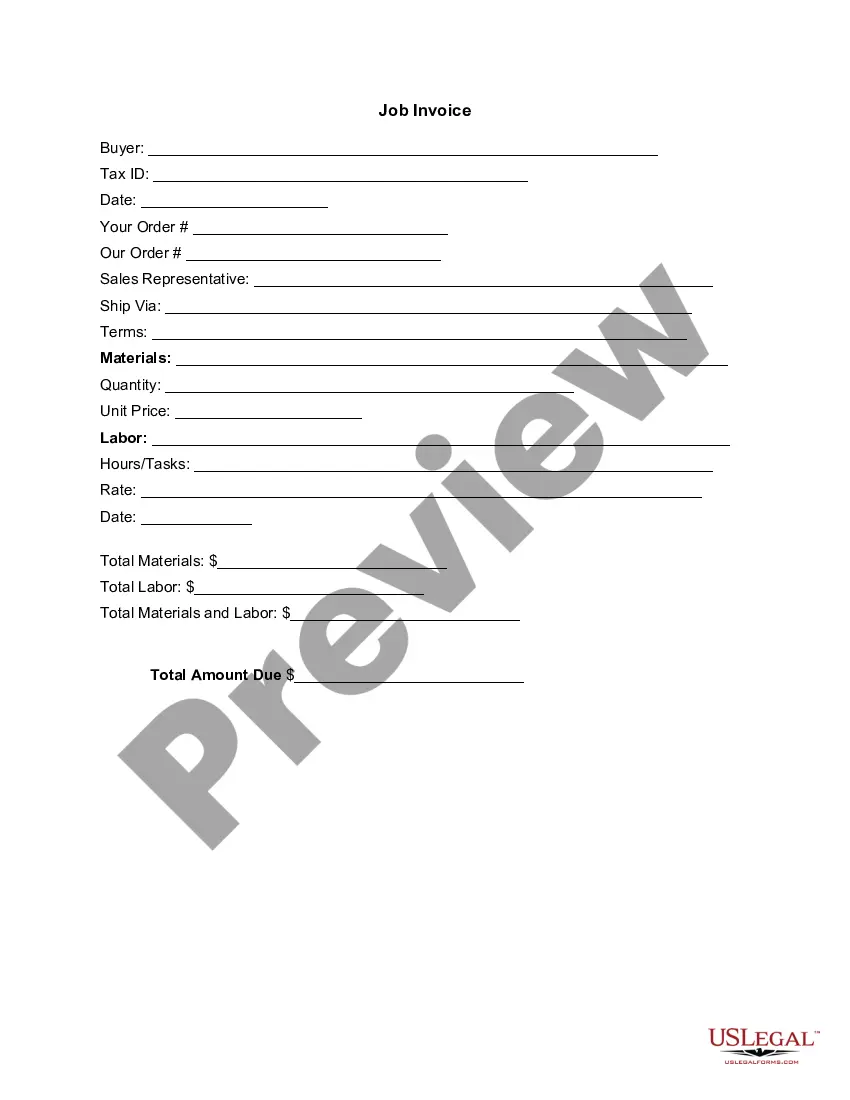

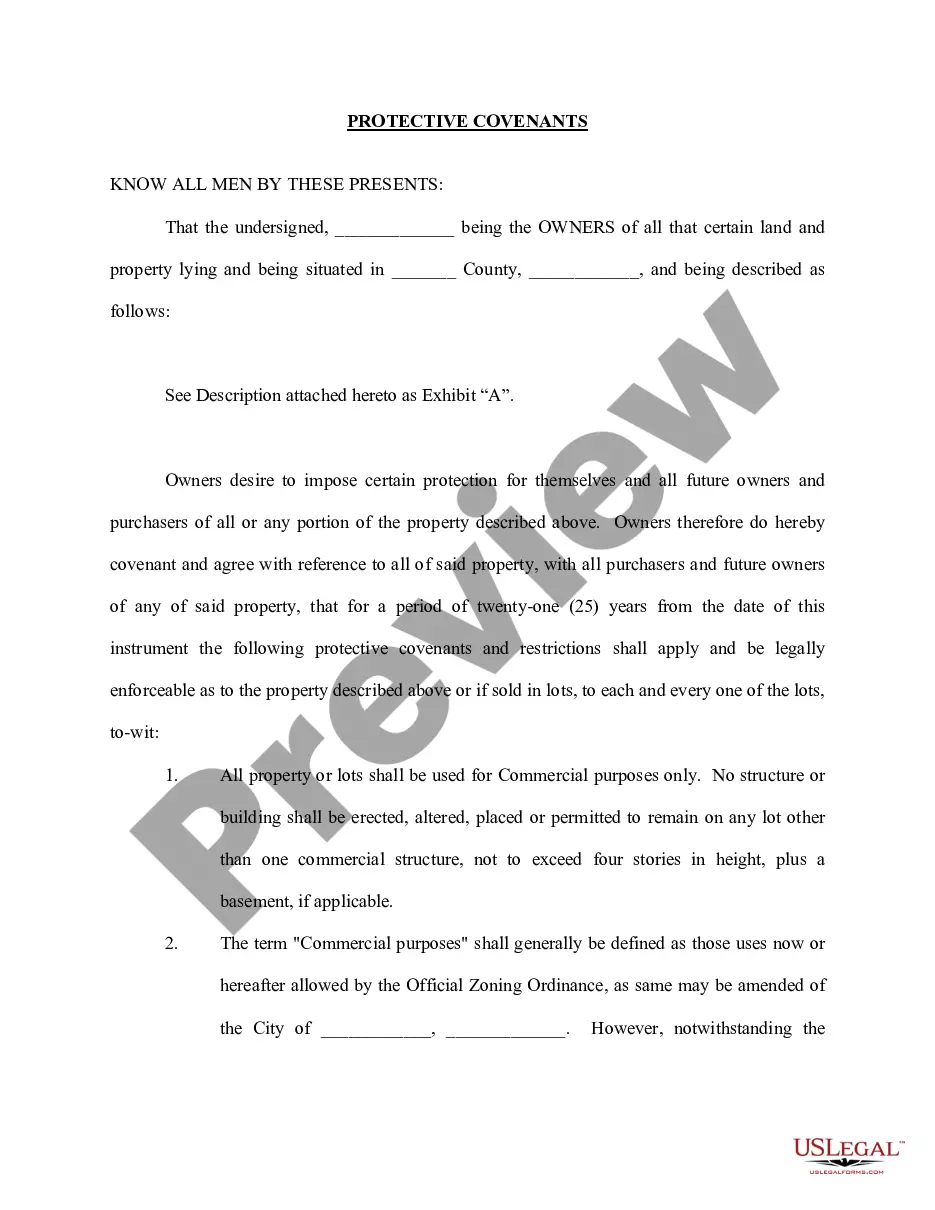

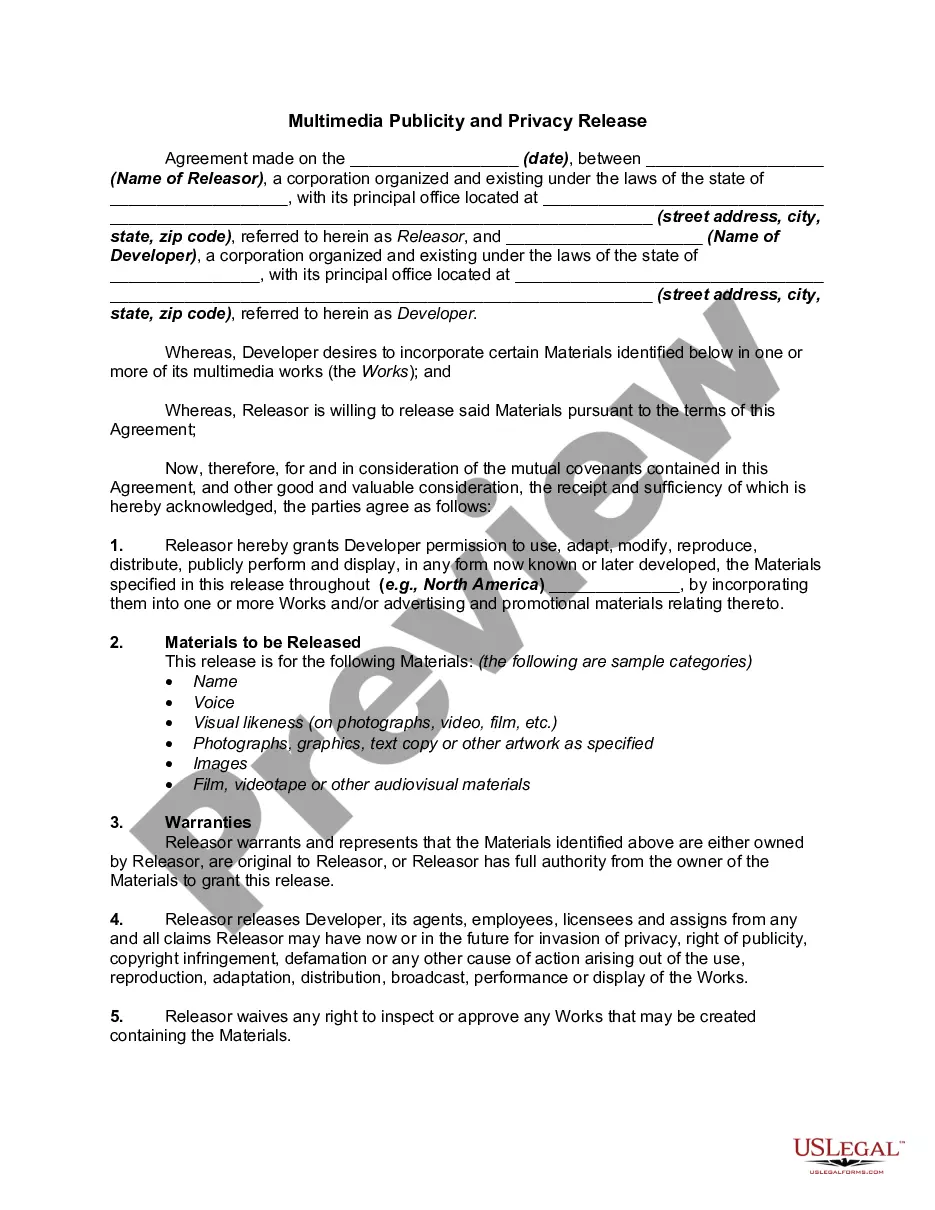

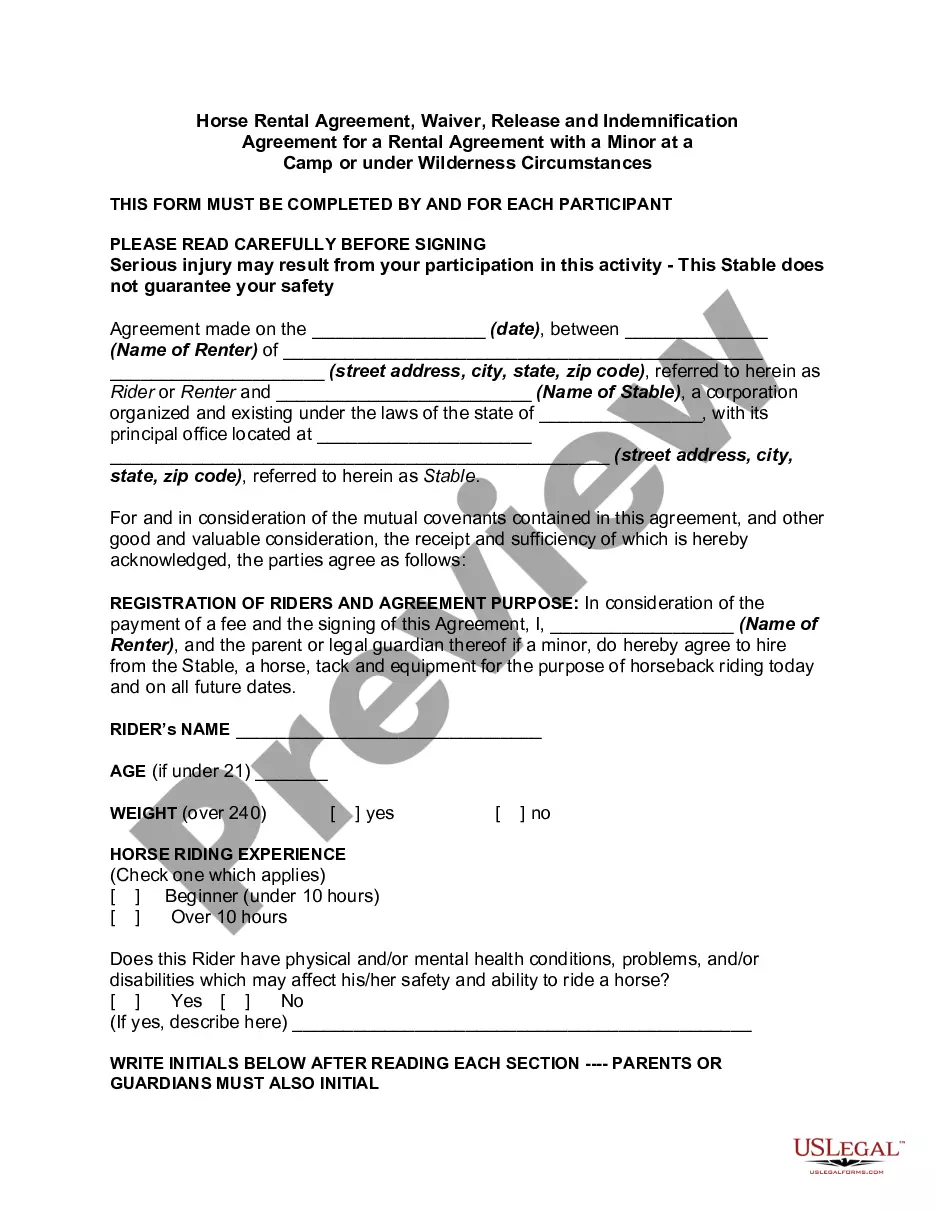

Do you need to quickly create a legally-binding Mecklenburg Sample Letter for Request for IRS not to Off Set against Tax Refund or maybe any other document to handle your personal or corporate affairs? You can go with two options: contact a professional to draft a legal paper for you or draft it completely on your own. Thankfully, there's a third option - US Legal Forms. It will help you get professionally written legal papers without paying unreasonable fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant document templates, including Mecklenburg Sample Letter for Request for IRS not to Off Set against Tax Refund and form packages. We provide templates for an array of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the needed template without extra troubles.

- To start with, double-check if the Mecklenburg Sample Letter for Request for IRS not to Off Set against Tax Refund is tailored to your state's or county's regulations.

- In case the form has a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the template isn’t what you were hoping to find by utilizing the search box in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Mecklenburg Sample Letter for Request for IRS not to Off Set against Tax Refund template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the documents we provide are reviewed by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!