Sample Letter for Request to IRS Not to Offset Tax Refund — Nassau, New York [Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] Internal Revenue Service [IRS Office Address] [City, State, ZIP] Re: Request to IRS Not to Offset Tax Refund Dear [IRS Office], I am writing to request your immediate attention to prevent the offsetting of my tax refund for the tax year [Insert Tax Year]. I am a resident of Nassau, New York and recently received a notice from the IRS indicating potential offset of my tax refund, which I deeply believe should not occur. I want to bring to your attention the following key points: 1. Tax Compliance: I have diligently complied with all my tax obligations, including timely filing of returns, timely payment of taxes owed, and have not been involved in any tax-related legal disputes. 2. Financial Hardship: An offset of my tax refund will inflict severe financial hardship on me, given my existing financial circumstances. [Include specific details regarding the financial burden, such as outstanding medical bills, unexpected emergency expenses, etc.]. 3. Supporting Documentation: Attached to this letter, please find relevant supporting documents, including copies of my tax returns, evidence of compliance, and documents substantiating the financial difficulties I am currently facing. I kindly request a thorough review of my case and consideration for the dismissal of the offsetting process. I believe it is unjust and would significantly impair my ability to meet my essential financial responsibilities. If necessary, I am open to discussing the matter further, submitting additional supporting documentation, or appearing for an in-person meeting. Please feel free to contact me at [Phone Number] or [Email Address] to arrange a convenient time to discuss this matter further. I sincerely hope that you will give my request the attention it deserves and take immediate action to prevent the offsetting of my tax refund. Thank you for your prompt attention to this matter. Sincerely, [Your Name]

Nassau New York Sample Letter for Request for IRS not to Off Set against Tax Refund

Description

How to fill out Nassau New York Sample Letter For Request For IRS Not To Off Set Against Tax Refund?

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life scenario, locating a Nassau Sample Letter for Request for IRS not to Off Set against Tax Refund meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Apart from the Nassau Sample Letter for Request for IRS not to Off Set against Tax Refund, here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Professionals check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can pick the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Nassau Sample Letter for Request for IRS not to Off Set against Tax Refund:

- Check the content of the page you’re on.

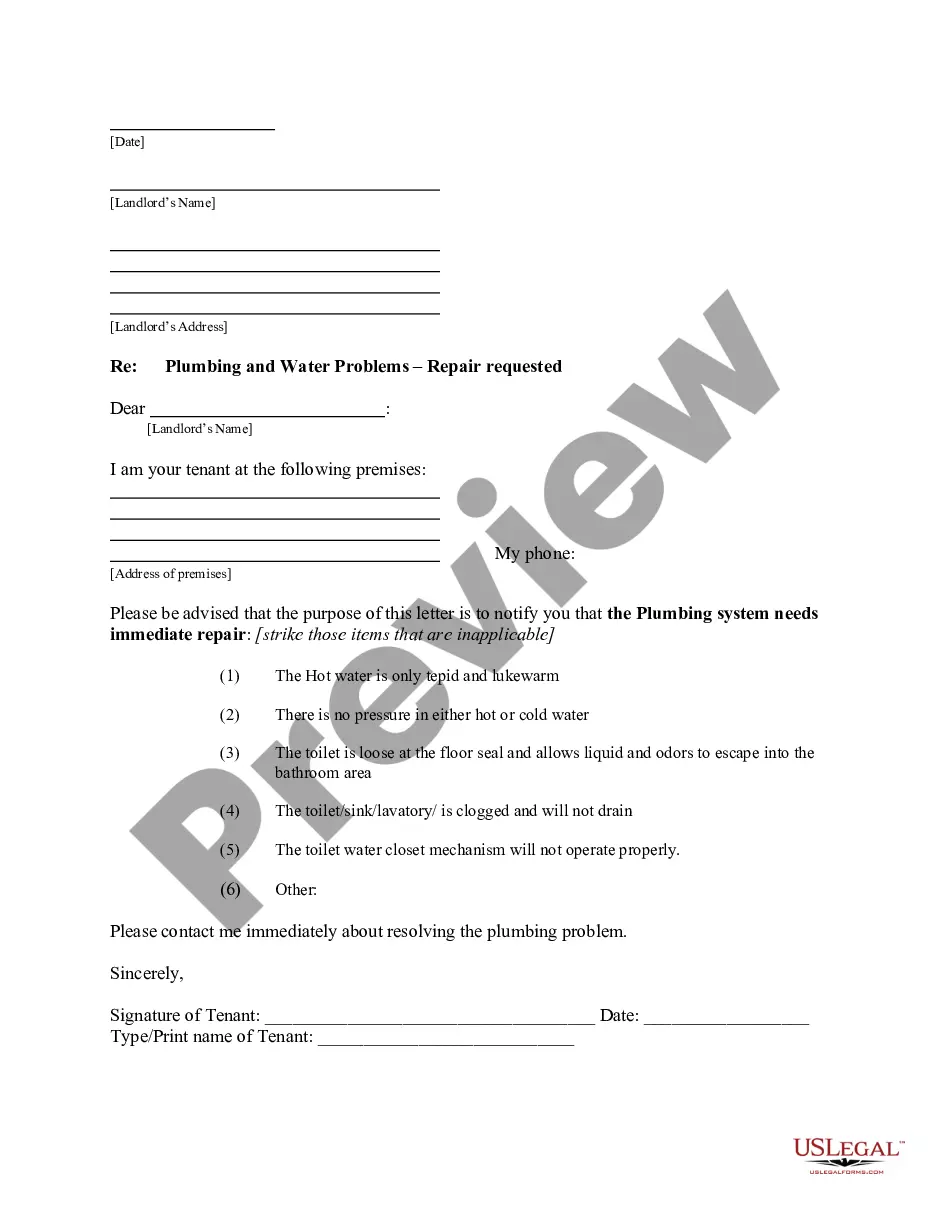

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Nassau Sample Letter for Request for IRS not to Off Set against Tax Refund.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!