Title: San Bernardino, California Sample Letter for Requesting IRS Not to Offset Tax Refund Introduction: San Bernardino, located in the heart of Southern California, is a vibrant city with a diverse population and a rich cultural heritage. As taxpayers, it is crucial to be aware of our rights and how to advocate for ourselves when dealing with the Internal Revenue Service (IRS). In certain situations, it may become necessary to draft a letter of request to prevent the IRS from offsetting our tax refund against outstanding debts. This article will provide a detailed description of what a San Bernardino, California sample letter for requesting the IRS not to offset the tax refund entails, including various types or scenarios that might require such a request letter. Types of San Bernardino, California Sample Letters for Requesting IRS Not to Offset Tax Refund: 1. Letter for Financial Hardship: If a taxpayer is experiencing financial hardship and relies heavily on their expected tax refund for essential expenses such as housing, food, or medical bills, they may need to include a detailed explanation of their challenging circumstances in the letter. Supporting documentation, such as medical bills, unemployment benefits claim, or proof of unexpected expenses, can accompany the request to strengthen the case. 2. Letter for Unfair Collection Actions: In certain situations, taxpayers might believe that the IRS has employed unfair collection actions or incorrect calculations, leading to an offset against their tax refund. This type of letter should outline the specific errors or discrepancies in the IRS communication and provide supporting evidence to rectify the situation. It is recommended that the letter be concise, clear, and objective, maintaining a professional tone throughout. 3. Letter for Resolution of Dispute: Sometimes, taxpayers may have ongoing disputes with the IRS regarding a particular tax liability or claim. In such cases, if there is an impending offset against the tax refund, a letter requesting the IRS to reconcile the dispute or to temporarily suspend any actions can be submitted. This letter should highlight the reasons for the dispute, any relevant past correspondence, and any pending legal proceedings associated with the dispute. 4. Letter for Identity Theft or Fraudulent Activity: If a taxpayer suspects or has solid evidence of identity theft or fraudulent activity associated with their tax account, they should include this crucial information in the request letter. The terminology used within this letter should emphasize the urgency and sensitivity of the matter, as well as provide any relevant supporting documentation, such as identity theft affidavits or police reports. Conclusion: When faced with the prospect of the IRS offsetting our tax refund against debts, it is essential to assert our rights through a well-crafted request letter. The types of San Bernardino, California sample letters mentioned herein, including those for financial hardships, unfair collection actions, dispute resolution, and identity theft or fraudulent activity, provide guidance for effectively addressing specific concerns with the IRS. It is essential to adapt the sample letter to meet individual circumstances, maintaining a polite and professional approach while clearly conveying the reasons for the request.

San Bernardino California Sample Letter for Request for IRS not to Off Set against Tax Refund

Description

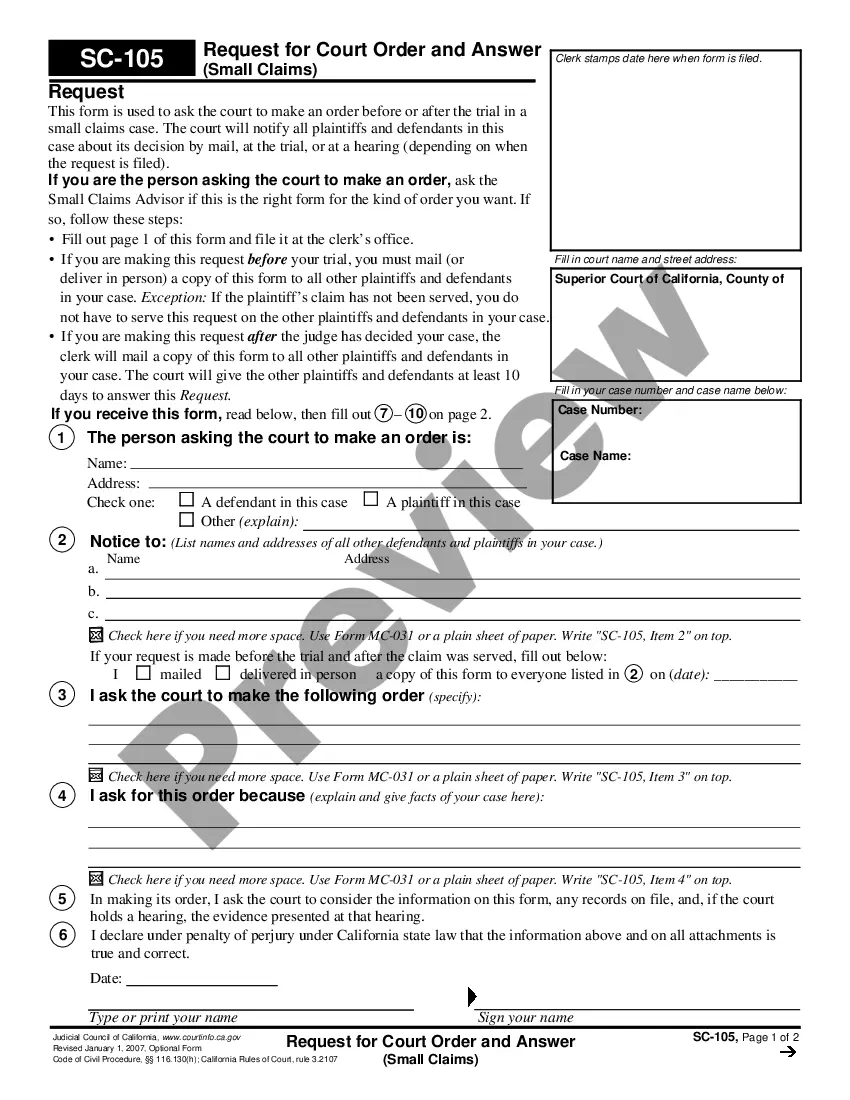

How to fill out San Bernardino California Sample Letter For Request For IRS Not To Off Set Against Tax Refund?

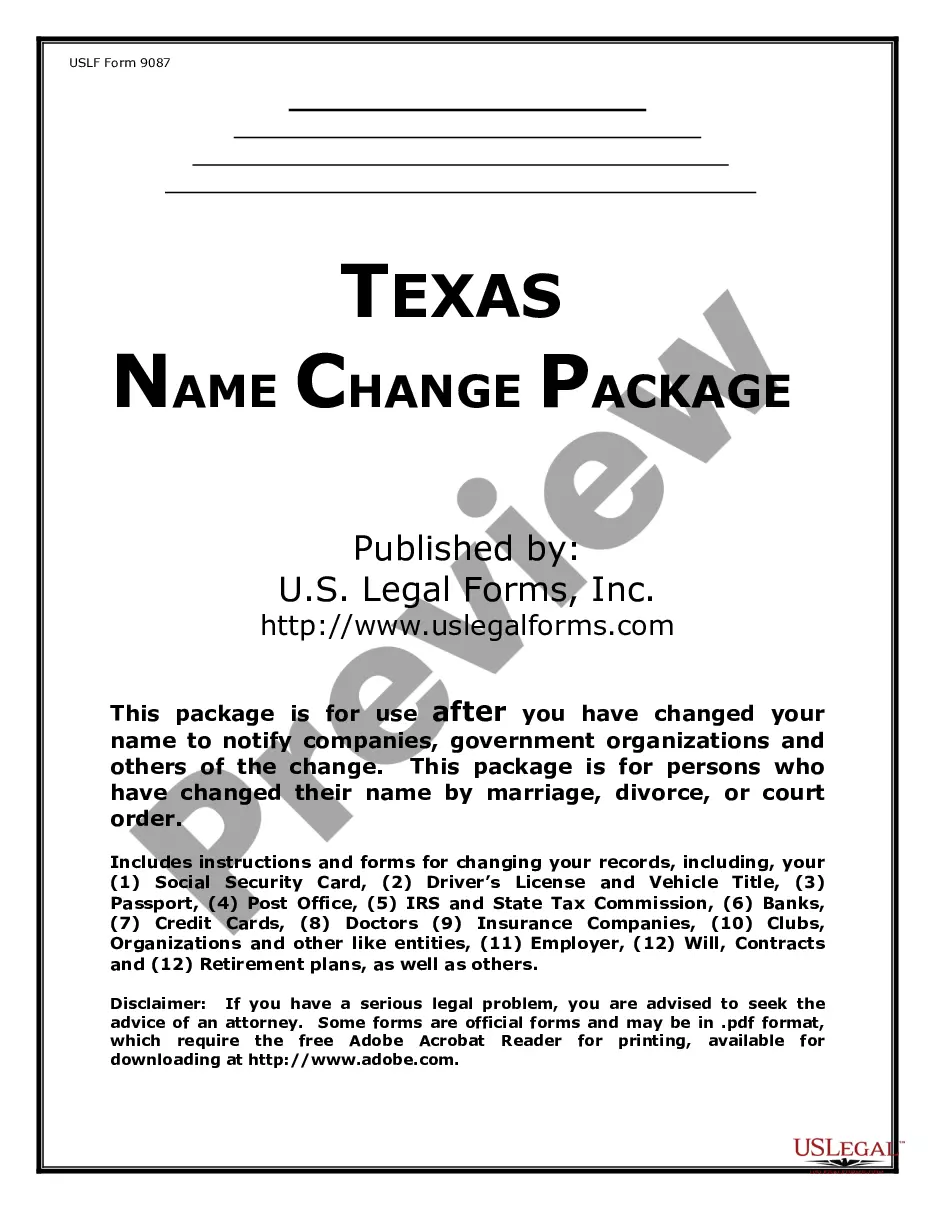

Drafting documents for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft San Bernardino Sample Letter for Request for IRS not to Off Set against Tax Refund without expert assistance.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid San Bernardino Sample Letter for Request for IRS not to Off Set against Tax Refund by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the San Bernardino Sample Letter for Request for IRS not to Off Set against Tax Refund:

- Examine the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

If your tax refund is offset, you should not call the IRS since they cannot reverse an offset or give you information about the debt. However, if you owe federal tax, you should contact the IRS to make arrangements to pay. The program works.

You can call your advocate, whose number is in your local directory, in Publication 1546, Taxpayer Advocate Service -- Your Voice at the IRSPDF, and on our website at IRS.gov/advocate. You can also call us toll-free at 877-777-4778.

You may be able to avoid offset by entering repayment during the 65-day period. Once the 65-day period ends, you still may be able to stop offset by entering into a rehabilitation agreement and making the first five of the nine required payments.

Complete Form 9423, Collection Appeals RequestPDF....If your only collection contact has been a notice or telephone call: Call the IRS telephone number shown on your notice. Explain why you disagree and that you want to appeal the decision. Be prepared to discuss your case and have all relevant information handy.

Company Matches Choose your battles. Before you decide to fight back against Uncle Sam, make sure that your gains will be worth it.Don't delay. If you get a notice from the IRS that you owe money to the government, make sure you file an appeal within 30 days.Seek advocacy.Negotiate.Go to court.

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship. We consider your unique set of facts and circumstances: Ability to pay.

Your letter needs to include the reasons you're asking for an audit reconsideration and an overview of the new information that makes the audit results inaccurate. Audit reconsiderations are complex, so it's a good idea to seek out the advice of an experienced tax attorney before sending your documentation to the IRS.

If you disagree you must first notify the IRS supervisor, within 30 days, by completing Form 12009, Request for an Informal Conference and Appeals Review. If you are unable to resolve the issue with the supervisor, you may request that your case be forwarded to the Appeals Office.

If you disagree you must first notify the IRS supervisor, within 30 days, by completing Form 12009, Request for an Informal Conference and Appeals Review. If you are unable to resolve the issue with the supervisor, you may request that your case be forwarded to the Appeals Office.

The IRS website states to include all of the following in a written protest: Your name, address and a daytime telephone number. A statement that you want to appeal the IRS findings to the Office of Appeals. A copy of the letter you received that shows the proposed change(s) The tax period(s) or year(s) involved.