[Your Name] [Your Address] [City, State, ZIP Code] [Date] Internal Revenue Service [City, State, ZIP Code] Subject: Request for IRS Not to Offset Against Tax Refund Dear Sir/Madam, I hope this letter finds you in good health. I am writing to request that the Internal Revenue Service (IRS) refrain from offsetting any portion of my tax refund for the tax year [Year] against any outstanding debts or obligations. I understand that the IRS has the authority to offset tax refunds to satisfy certain outstanding obligations, such as overdue federal or state taxes, child support payments, or federal student loans. However, I kindly request your consideration not to withhold any part of my tax refund for the following reasons: 1. Financial Hardship: I am currently experiencing significant financial difficulties due to unforeseen circumstances [provide brief details here]. These circumstances have created an overwhelming burden on my financial stability, making it essential for me to utilize my tax refund to alleviate some financial strain. 2. Family Responsibilities: I am the sole provider for my family, which includes [number of dependents]. They rely on my tax refund to cover essential expenses, including housing, utilities, food, and healthcare. With the current state of the economy and increased cost of living, it would be challenging for me to fulfill these obligations without the refund. 3. Repayment Plan: I am actively working towards resolving any outstanding debts or obligations to the best of my abilities. I have established a repayment plan with the respective agencies and have been diligently making payments in a timely manner. With this commitment, it would be greatly appreciated if the IRS could allow me to use my tax refund to maintain the progress made thus far. Attached to this letter, you will find supporting documentation that further elaborates on my financial situation and justifies my request. These documents include [list the relevant documents submitted, such as bank statements, medical bills, or income statements]. I understand the importance of fulfilling my obligations, and I assure you that I am committed to resolving any outstanding debts. However, I kindly urge the IRS to consider my current situation and grant my request to be allowed to retain my full tax refund. If there are any additional forms, documents, or information required to support my request, please do not hesitate to contact me at the address or phone number provided above. I would be more than willing to provide any necessary information promptly. Thank you for your attention to this matter. I genuinely appreciate your consideration and hope for a positive resolution. Sincerely, [Your Name]

San Jose California Sample Letter for Request for IRS not to Off Set against Tax Refund

Description

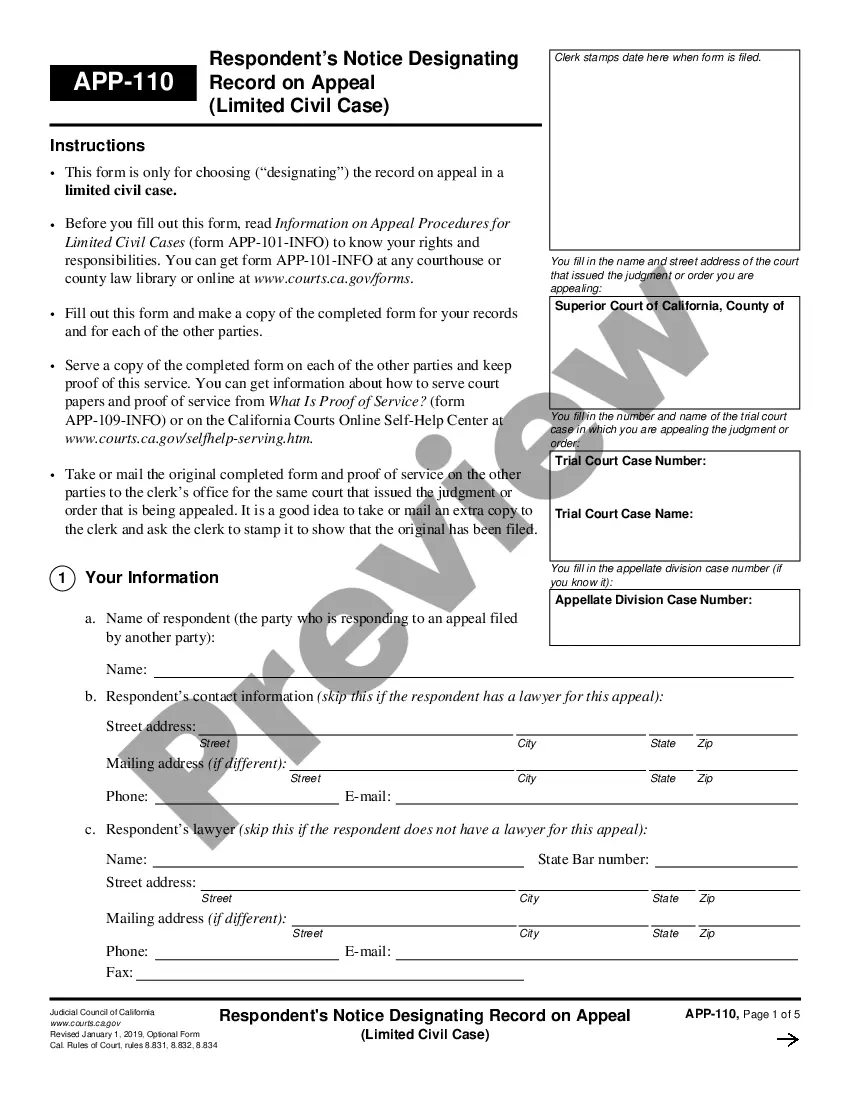

How to fill out San Jose California Sample Letter For Request For IRS Not To Off Set Against Tax Refund?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including San Jose Sample Letter for Request for IRS not to Off Set against Tax Refund, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various categories ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find detailed materials and guides on the website to make any activities associated with document execution simple.

Here's how you can locate and download San Jose Sample Letter for Request for IRS not to Off Set against Tax Refund.

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after downloading the form.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can affect the validity of some records.

- Examine the related document templates or start the search over to find the appropriate document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and purchase San Jose Sample Letter for Request for IRS not to Off Set against Tax Refund.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed San Jose Sample Letter for Request for IRS not to Off Set against Tax Refund, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney entirely. If you need to cope with an exceptionally difficult case, we advise getting an attorney to check your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and get your state-compliant documents effortlessly!

Form popularity

FAQ

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship. We consider your unique set of facts and circumstances: Ability to pay.

The IRS website states to include all of the following in a written protest: Your name, address and a daytime telephone number. A statement that you want to appeal the IRS findings to the Office of Appeals. A copy of the letter you received that shows the proposed change(s) The tax period(s) or year(s) involved.

You have two options to file an Offer in Compromise. You can work with a tax debt resolution service or you can try to file on your own. If you want to settle tax debt yourself, simply download the IRS Form 656 Booklet. In includes Form 656 and Form 433-A form that you need to fill out for your financial disclosure.

The IRS website states to include all of the following in a written protest: Your name, address and a daytime telephone number. A statement that you want to appeal the IRS findings to the Office of Appeals. A copy of the letter you received that shows the proposed change(s) The tax period(s) or year(s) involved.

A "lump sum cash offer" is defined as an offer payable in 5 or fewer installments within 5 or fewer months after the offer is accepted. If a taxpayer submits a lump sum cash offer, the taxpayer must include with the Form 656 a nonrefundable payment equal to 20 percent of the offer amount.

If you decide to request audit reconsideration, please send your request to the address of the IRS campus shown on your Examination Report listed below. If the office that completed your audit is not listed, call the toll free numbers below for the correct address to send your request.

An accepted audit reconsideration ordinarily takes about three months to assign to an IRS auditor. Thorough evidence and documentation can lower duration time. If the dispute is only for accuracy penalties, the process can take up to 3 years.

You can call your advocate, whose number is in your local directory, in Publication 1546, Taxpayer Advocate Service -- Your Voice at the IRSPDF, and on our website at IRS.gov/advocate. You can also call us toll-free at 877-777-4778.

Send in Form 433-A with any necessary documentation and wait for a response. If you qualify, you are switched to Currently Not Collectible status, and the IRS doesn't garnish your refund. Talk with your tax advocate about how long this status will be in place and what your next steps should be.

If you disagree you must first notify the IRS supervisor, within 30 days, by completing Form 12009, Request for an Informal Conference and Appeals Review. If you are unable to resolve the issue with the supervisor, you may request that your case be forwarded to the Appeals Office.