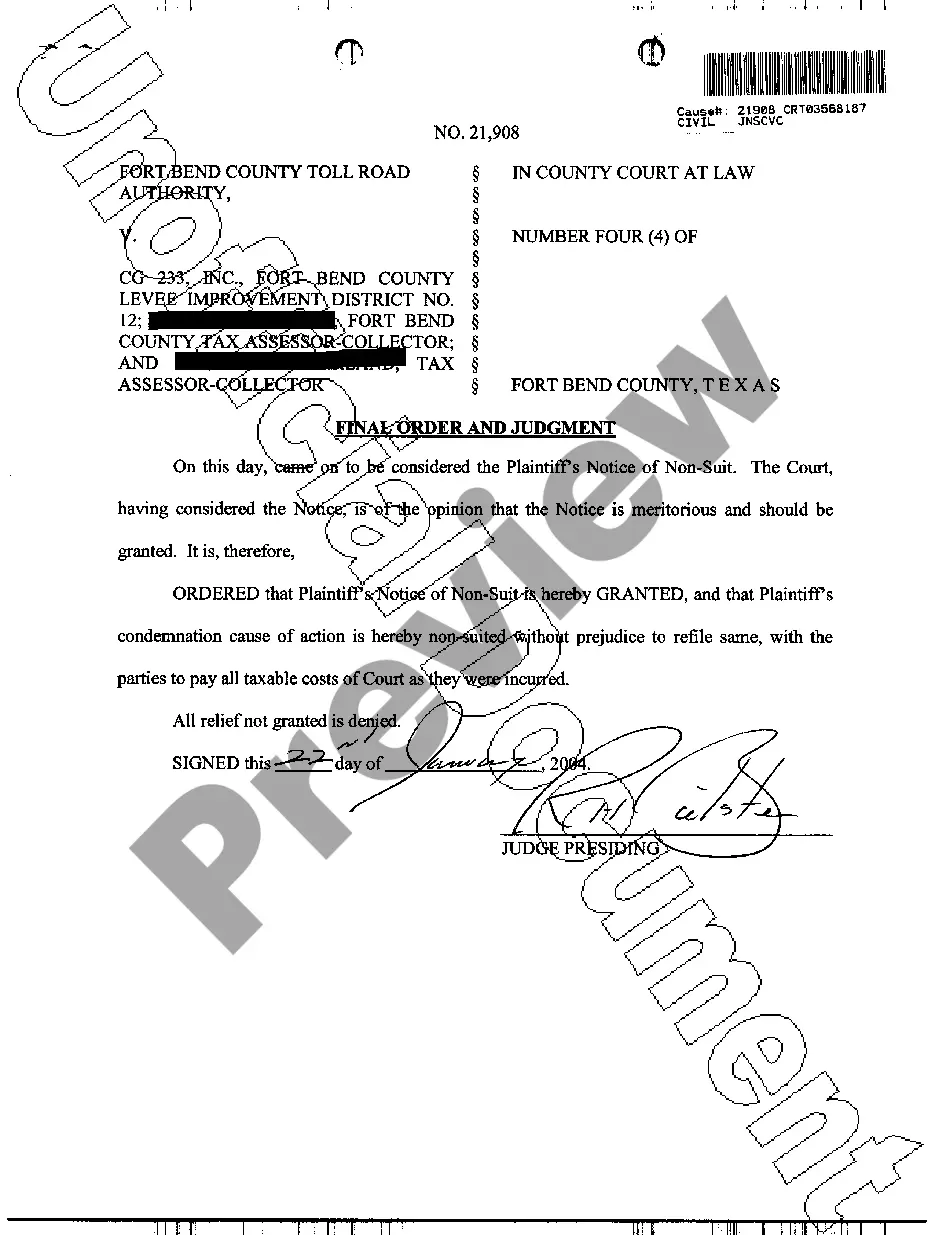

Sample Letter regarding Motion to Sell Property of an Estate in Franklin, Ohio [Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Recipient's Name] [Recipient's Address] [City, State, ZIP Code] Subject: Motion to Sell Property of the Estate Dear [Recipient's Name], I hope this letter finds you in good health. I am writing to you as the personal representative of the estate of [Deceased Person's Name], in regard to filing a Motion to Sell Property of the Estate in Franklin, Ohio. As you are aware, the estate of [Deceased Person's Name] is currently in the probate process, and after careful consideration and consultation with the estate's legal team, it has been determined that it is in the best interest of all parties involved to sell the property owned by the estate located at [Property Address], Franklin, Ohio. The reasons for selling the property are as follows: 1. Financial considerations: The estate is burdened with significant debts, including outstanding mortgage payments and other expenses that are becoming increasingly difficult to manage. Selling the property will allow the estate to settle these obligations and distribute the remaining assets to the beneficiaries in a fair and equitable manner. 2. Property maintenance: The property requires ongoing maintenance and repairs, which involves additional costs for the estate. Selling the property will relieve the estate of these financial responsibilities and ensure that necessary repairs are taken care of by the buyer. 3. Market conditions: Conducting extensive market research and assessing the current real estate trends in Franklin, Ohio, it has been determined that selling the property at this time is advantageous. The market is favorable, housing prices are competitive, and interest rates are low, maximizing the potential return on investment for the estate. Based on the aforementioned reasons, I kindly request your assistance in preparing and filing the Motion to Sell Property of the Estate with the appropriate court in Franklin, Ohio. I have enclosed all relevant documents and information required for this process, including the property title, appraisal reports, and any other necessary legal documentation. If there are any additional requirements or fees associated with filing this motion, please provide me with the necessary details so that I may promptly fulfill all obligations. Thank you for your attention to this matter. I am available for any further discussions or clarifications required regarding the motion or any other aspect of the estate administration process. Yours sincerely, [Your Name]

Franklin Ohio Sample Letter regarding Motion to Sell Property of an Estate

Description

How to fill out Franklin Ohio Sample Letter Regarding Motion To Sell Property Of An Estate?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Franklin Sample Letter regarding Motion to Sell Property of an Estate is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to get the Franklin Sample Letter regarding Motion to Sell Property of an Estate. Follow the guide below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Franklin Sample Letter regarding Motion to Sell Property of an Estate in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

How does the executor's year work? The executors have a number of duties to both creditors and beneficiaries during the administration of the deceased's estate. Starting from the date of death, the executors have 12 months before they have to start distributing the estate.

No probate at all is necessary if the estate is worth less than $5,000 or the amount of the funeral expenses. In that case, anyone (except the surviving spouse) who has paid or is obligated to pay those expenses may ask the court for a summary release from administration.

If the executor or administrator distributes any part of the assets of the estate within three months after the death of the decedent, the executor or administrator shall be personally liable only to those claimants who present their claims within that three-month period.

A. On all personal property, gross sale price of real estate, and income subject to administration, as follows: For the first $50,000.00 at a rate of 5.5%; All above $50,000.00 and not exceeding $100,000.00 at the rate of 4.5%;

You can use the simplified small estate process in Ohio if: The estate is worth less than $5,000 or someone paid funeral and burial expenses (up to $5,000) and asks the court for reimbursement.

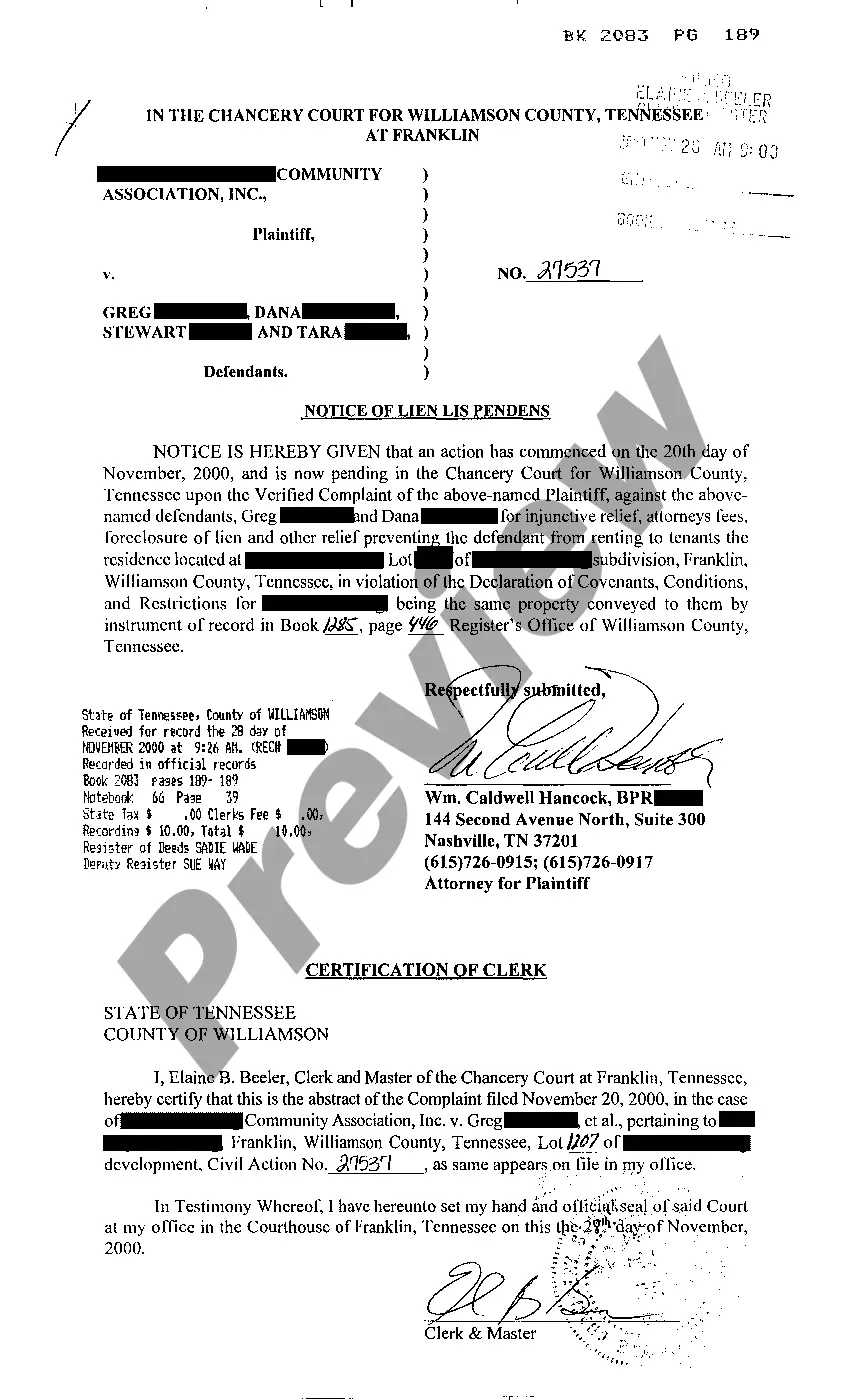

Ohio Revised Code Section 2107.01 et. seq. What Assets Go Through Probate? Probate is necessary when a person dies leaving property in his or her own name (such as a house titled only in the name of the decedent) or having rights to receive property.

A person having a claim against an estate as a result of a judgment or decree must file his claim within the time specified in § 473.360, RSMo. This may be accomplished by filing a copy of the judgment or decree in the Probate Division within that time. See In re Estate of Wisely, 763 S.W. 2d 691 (Mo.

Claims against the estate may be made up to six months from the date of death. A small estate that does not require the filing of a federal estate tax return and has no creditor issues often can be settled within six months of the appointment of the executor or administrator.

You may qualify for one of these simplified probate procedures in Ohio if: The value of the estate is $35,000 or less, or. The value of the estate is $100,000 or less and the surviving spouse inherits 100%, or. The estate is valued at $5000 or less OR the funeral expenses are greater than the estate.

Do All Estates Have to Go Through Probate in Ohio? Most estates will need to go through probate in Ohio unless they are part of a living trust. However, there are different types of probate, and some estates may qualify for a simplified version.