The Cuyahoga Ohio Installment Promissory Note and Security Agreement is a legal contract that outlines the terms and conditions of a loan agreement between a lender and a borrower in Cuyahoga County, Ohio. It serves as a binding agreement for the borrower to repay the loan in a series of scheduled payments, known as installments, over a specified period of time. The installment promissory note is a vital document that sets out the principal amount borrowed, the interest rate, repayment terms, late payment penalties, and other crucial details. It specifies the schedule of payments, including the frequency (monthly, quarterly, annually) and the due dates. By signing this agreement, the borrower acknowledges their commitment to repay the loan according to these terms. Additionally, the Cuyahoga Ohio Installment Promissory Note and Security Agreement incorporates a security agreement, which provides collateral to protect the lender's interests in case the borrower defaults on the loan. This collateral could be in the form of assets such as real estate, vehicles, equipment, or other personal property owned by the borrower. The security agreement ensures that the lender has legal rights to access and seize the collateral to recover any outstanding debt. It is important to note that there might be different types of Cuyahoga Ohio Installment Promissory Note and Security Agreement, depending on the specific nature of the loan transaction. Some examples include: 1. Residential Property Installment Promissory Note and Security Agreement: This type of agreement pertains to loans extended for residential purposes, such as purchasing or refinancing a home, or securing a loan against real estate property. 2. Commercial Property Installment Promissory Note and Security Agreement: This agreement applies to loans associated with commercial properties, including office buildings, retail spaces, warehouses, or industrial facilities. 3. Vehicle Installment Promissory Note and Security Agreement: This agreement revolves around loans granted for purchasing automobiles, motorcycles, trucks, or any other types of vehicles. 4. Equipment Installment Promissory Note and Security Agreement: This type of agreement is used when lending money for the acquisition or lease of specific equipment or machinery, such as manufacturing machinery, medical devices, or construction equipment. In conclusion, the Cuyahoga Ohio Installment Promissory Note and Security Agreement is a legally binding contract that outlines the terms and conditions of a loan agreement. It ensures that both the lender and the borrower are aware of their responsibilities and rights throughout the loan repayment process. By incorporating a security agreement, the lender gains added protection by having collateral that can be utilized in case of default. Various types of agreements exist depending on the purpose of the loan, such as residential, commercial, vehicle, or equipment-related loans.

Cuyahoga Ohio Installment Promissory Note and Security Agreement

Description

How to fill out Cuyahoga Ohio Installment Promissory Note And Security Agreement?

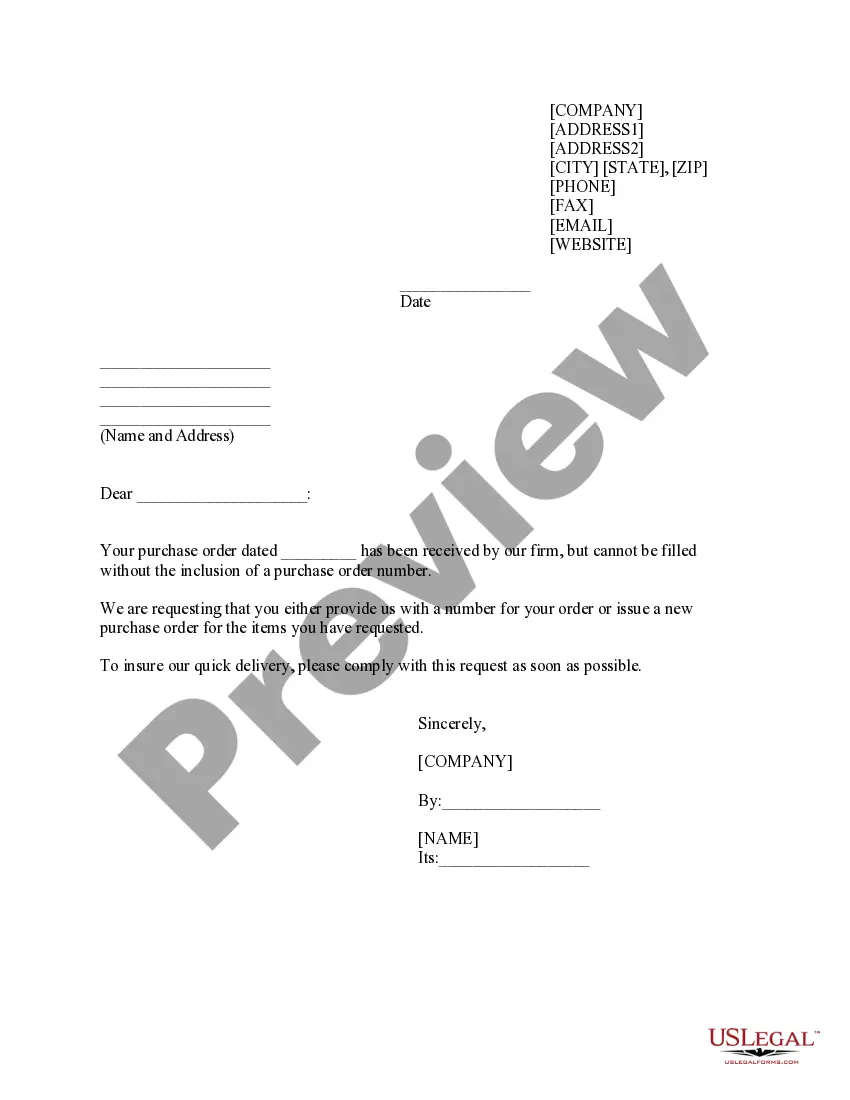

Are you looking to quickly create a legally-binding Cuyahoga Installment Promissory Note and Security Agreement or probably any other form to manage your own or business matters? You can select one of the two options: hire a professional to draft a legal paper for you or draft it completely on your own. Luckily, there's another option - US Legal Forms. It will help you receive professionally written legal documents without paying sky-high prices for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-specific form templates, including Cuyahoga Installment Promissory Note and Security Agreement and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, carefully verify if the Cuyahoga Installment Promissory Note and Security Agreement is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to check what it's intended for.

- Start the searching process again if the document isn’t what you were looking for by utilizing the search bar in the header.

- Select the subscription that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Cuyahoga Installment Promissory Note and Security Agreement template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Moreover, the templates we provide are updated by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!