Orange California Installment Promissory Note and Security Agreement is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the Orange, California area. This agreement serves as a means of establishing a formal commitment between the two parties, outlining the specific details of the loan, including repayment terms, interest rates, and any applicable securities. The Orange California Installment Promissory Note and Security Agreement is an essential tool for individuals or businesses seeking financial assistance and for lenders looking to protect their investment. By signing this agreement, both parties are entering into a legal contract that ensures proper repayment of the loan amount within the agreed-upon terms. There are different types of Orange California Installment Promissory Note and Security Agreements, each tailored to suit specific lending situations. Some commonly encountered types include: 1. Traditional Installment Promissory Note and Security Agreement: This is a standard agreement that outlines the borrower's promise to repay the loan in equal monthly installments over a set period, including the interest rate and the security provided. 2. Balloon Payment Installment Promissory Note and Security Agreement: In this type of agreement, the borrower agrees to make smaller monthly payments, with a large final payment, known as a balloon payment, due at the end of the repayment term. 3. Secured Installment Promissory Note and Security Agreement: This agreement includes an additional layer of security for the lender by involving collateral, such as real estate, vehicles, or other valuable assets. In case of default, the lender has the right to seize and sell the collateral to recover their investment. 4. Unsecured Installment Promissory Note and Security Agreement: This agreement is for loans where no specific collateral is provided. Instead, the borrower's creditworthiness and financial history are the primary factors considered. Regardless of the type, the Orange California Installment Promissory Note and Security Agreement aims to protect the rights and interests of both the lender and the borrower, ensuring a clear understanding of responsibilities and obligations. It is crucial for both parties to carefully review and understand the terms laid out in the agreement before signing. In conclusion, the Orange California Installment Promissory Note and Security Agreement is a vital legal document that details the terms of a loan agreement, providing a framework for borrowers and lenders to establish a mutually beneficial relationship.

Orange California Installment Promissory Note and Security Agreement

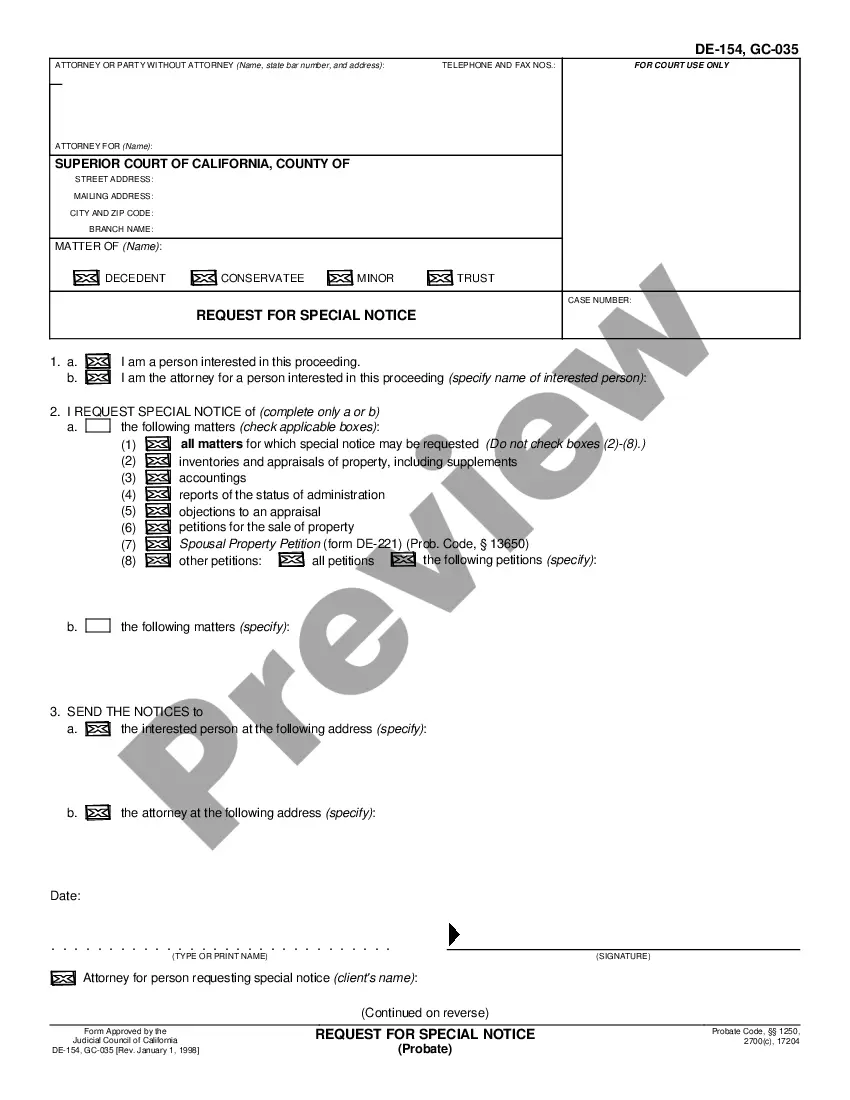

Description

How to fill out Orange California Installment Promissory Note And Security Agreement?

If you need to get a trustworthy legal paperwork supplier to obtain the Orange Installment Promissory Note and Security Agreement, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support make it simple to find and complete various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to search or browse Orange Installment Promissory Note and Security Agreement, either by a keyword or by the state/county the form is created for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Orange Installment Promissory Note and Security Agreement template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be immediately available for download as soon as the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less pricey and more reasonably priced. Create your first business, arrange your advance care planning, create a real estate contract, or complete the Orange Installment Promissory Note and Security Agreement - all from the comfort of your home.

Sign up for US Legal Forms now!