A San Antonio Texas Installment Promissory Note and Security Agreement is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the city of San Antonio, Texas. This agreement is commonly used when a borrower needs to borrow a specific amount of money and agrees to repay it in installments over a predetermined period of time. The agreement includes the terms and conditions of the loan, repayment details, interest rates, and collateral or security that the borrower may provide to secure the loan. There are different types of San Antonio Texas Installment Promissory Note and Security Agreements that may be applicable depending on the specific circumstances and legal requirements. These variations include: 1. Personal Installment Promissory Note and Security Agreement: This type of agreement is typically used for personal loans between individuals, friends, or family members in San Antonio. It outlines the terms for repayment and may include personal property or assets as collateral. 2. Business Installment Promissory Note and Security Agreement: This agreement is designed for loans between a business entity and a lender. It establishes the repayment schedule, interest rates, and may include business assets or accounts receivable as collateral to secure the loan. 3. Real Estate Installment Promissory Note and Security Agreement: This type of agreement is commonly used for loans related to real estate transactions in San Antonio, such as mortgage financing. The agreement specifies the terms for repayment and often includes the property as collateral. 4. Auto Installment Promissory Note and Security Agreement: This agreement is used for financing vehicle purchases in San Antonio. It outlines the terms of repayment, interest rates, and may include the vehicle itself as collateral. In summary, a San Antonio Texas Installment Promissory Note and Security Agreement is a legally binding document that establishes the terms and conditions of a loan agreement, including repayment details and collateral requirements. Different variations of this agreement exist depending on the nature of the loan, such as personal loans, business loans, real estate loans, or auto loans.

San Antonio Texas Installment Promissory Note and Security Agreement

Description

How to fill out San Antonio Texas Installment Promissory Note And Security Agreement?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from scratch, including San Antonio Installment Promissory Note and Security Agreement, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various types ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any tasks associated with document execution simple.

Here's how you can purchase and download San Antonio Installment Promissory Note and Security Agreement.

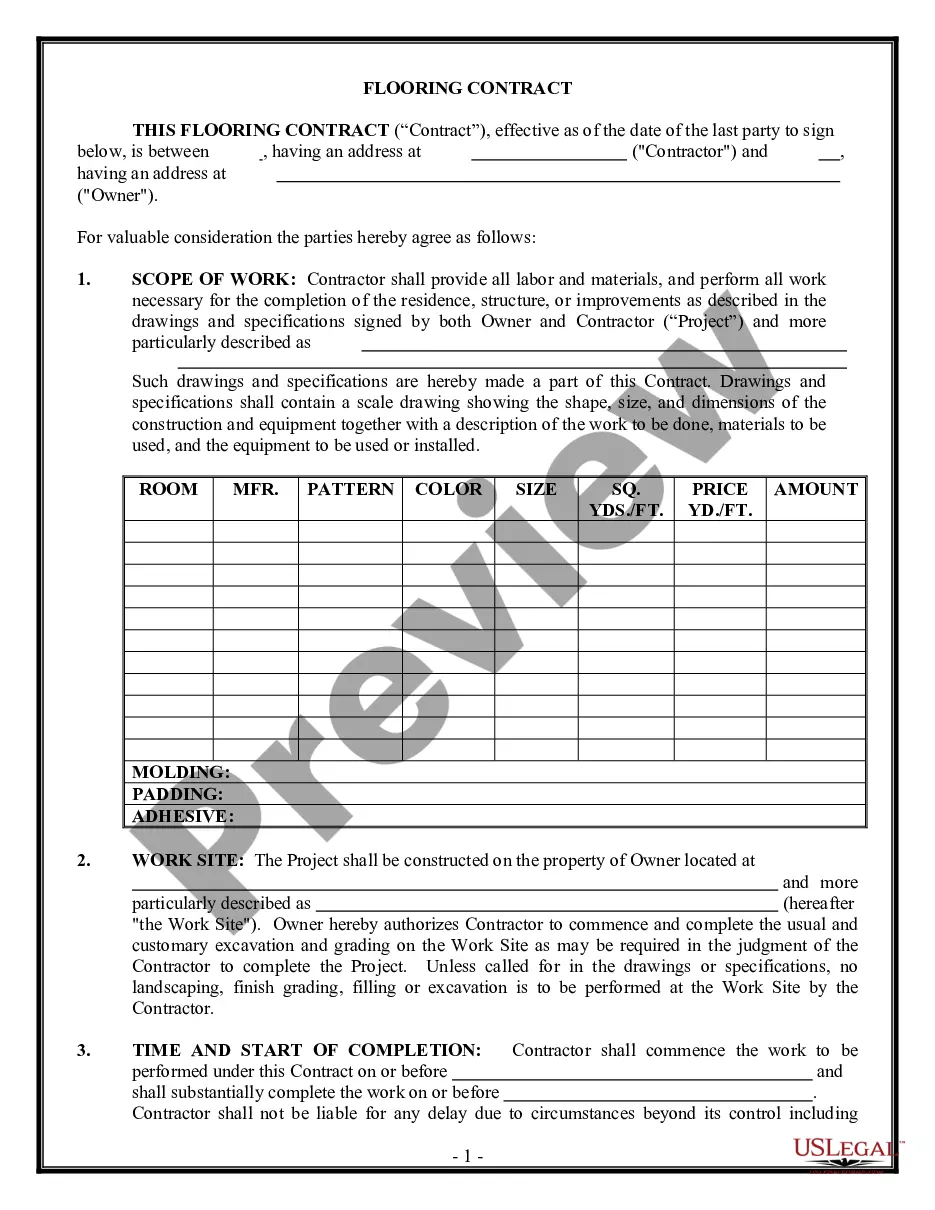

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the legality of some records.

- Examine the related document templates or start the search over to find the right file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and purchase San Antonio Installment Promissory Note and Security Agreement.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed San Antonio Installment Promissory Note and Security Agreement, log in to your account, and download it. Needless to say, our platform can’t take the place of a legal professional entirely. If you have to deal with an extremely challenging case, we advise using the services of an attorney to review your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Become one of them today and get your state-compliant paperwork effortlessly!