Santa Clara California Installment Promissory Note and Security Agreement is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This agreement is commonly used in Santa Clara, California, to solidify the terms of an installment loan. The Installment Promissory Note is a written promise from the borrower to repay the loan amount borrowed, along with applicable interest, in fixed monthly installments over a specified period of time. It acts as evidence of the borrower's obligation to repay the loan and includes details such as the loan amount, interest rate, repayment schedule, and any late payment penalties. The Security Agreement, on the other hand, serves as a collateral agreement, adding a layer of security for the lender. It states that the borrower pledges certain assets, such as real estate, vehicles, or other valuable property, to secure the loan. In the event of default, the lender can seize and sell the collateral assets to recover their losses. There can be different types of Installment Promissory Note and Security Agreement based on specific requirements and circumstances. Some common variations include: 1. Fixed-Rate Installment Promissory Note: This agreement defines a fixed interest rate for the loan term, ensuring that the borrower's monthly payments remain consistent throughout the repayment period. 2. Adjustable-Rate Installment Promissory Note: This type of agreement features an interest rate that adjusts periodically based on predetermined factors. This may result in variable monthly payments, depending on the fluctuations in the interest rate. 3. Commercial Installment Promissory Note and Security Agreement: This agreement applies specifically to commercial loans, commonly used by businesses seeking financing for various purposes like expansion, purchasing equipment, or working capital. 4. Personal Installment Promissory Note and Security Agreement: This type of agreement is designed to cover personal loans, typically used for personal expenses, education, or other non-commercial purposes. It is important for both parties involved in the loan agreement to carefully review and understand the terms outlined in the Santa Clara California Installment Promissory Note and Security Agreement. Legal advice may be sought to ensure compliance with state laws and to protect the interests of both the lender and the borrower.

Santa Clara California Installment Promissory Note and Security Agreement

Description

How to fill out Santa Clara California Installment Promissory Note And Security Agreement?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Santa Clara Installment Promissory Note and Security Agreement, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching process less challenging. You can also find information resources and guides on the website to make any tasks related to paperwork completion simple.

Here's how to locate and download Santa Clara Installment Promissory Note and Security Agreement.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can impact the validity of some records.

- Examine the related forms or start the search over to find the right file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment method, and buy Santa Clara Installment Promissory Note and Security Agreement.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Santa Clara Installment Promissory Note and Security Agreement, log in to your account, and download it. Needless to say, our platform can’t take the place of a legal professional entirely. If you have to cope with an exceptionally difficult situation, we recommend using the services of a lawyer to review your document before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-compliant paperwork effortlessly!

Form popularity

FAQ

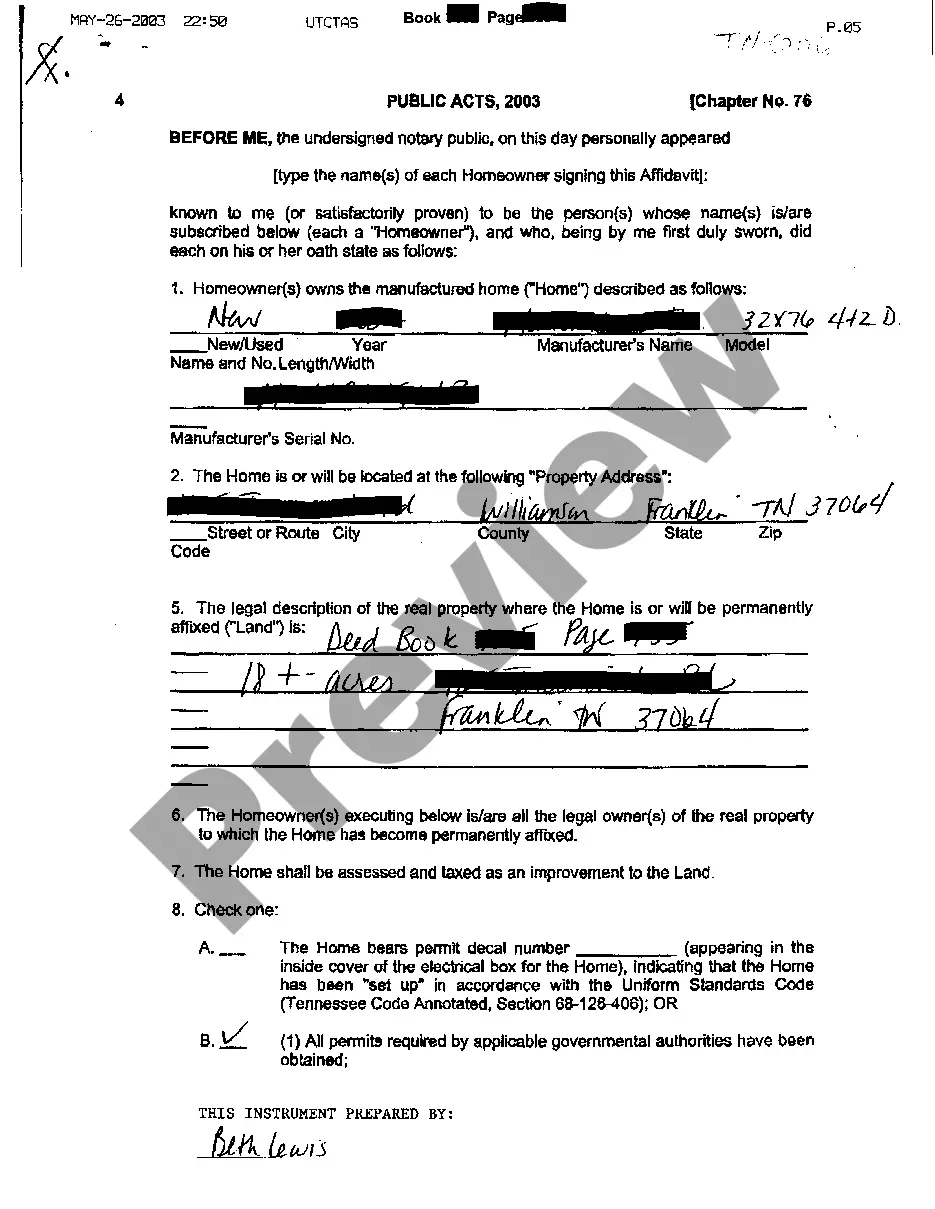

A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

How to Enforce a Promissory Note Types of Property that can be used as collateral.Speak to them in person.Draft a Demand / Notice Letter.Write and send a Follow Up Letter.Enlisting a Professional Collection Agency.Filing a petition or complaint in court.Selling the Promissory Note.Final Tips.

But the promissory note is the document that contains the promise to repay the amount borrowed. The purpose of the mortgage is to provide security for the loan that's evidenced by a promissory note. Those who sign the note are personally liable for repaying the amount borrowed.

In general, under the federal Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.

California Promissory Note Requirements A promissory note, although the name suggests is a promise, has the same legal consequences as a legally binding contract. In other words, a promissory note is a type of contract.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust. If the collateral is personal property, there will be a security agreement.

A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral. If the borrower defaults on a Secured Promissory Note, the lender gets to keep the collateral (the property that was used to secure the loan).

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.