A Suffolk, New York Installment Promissory Note and Security Agreement is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Suffolk, New York. This agreement serves as a financial instrument that establishes the borrower's promise to repay the loan in scheduled installments, while also providing the lender with a security interest in collateral to secure the debt. The main purpose of a Suffolk, New York Installment Promissory Note and Security Agreement is to provide clarity and protection to both parties involved in a loan transaction. It sets forth specific details such as the loan amount, interest rate, payment schedule, and maturity date. These terms can vary depending on various factors, such as the borrower's creditworthiness and the purpose of the loan. When drafting a Suffolk, New York Installment Promissory Note and Security Agreement, it is essential to include key elements such as: 1. Parties: Clearly identify the lender (often referred to as the "Payee") and the borrower (often referred to as the "Maker" or "Obliged") involved in the agreement. Include their legal names, addresses, and contact information. 2. Loan Amount: Specify the total amount of money being lent to the borrower, along with any additional fees or charges associated with the loan. 3. Interest Rate: Clearly state the interest rate being applied to the loan amount, whether it is a fixed rate or a variable rate based on an index. Include any applicable late fees or penalties. 4. Payment Schedule: Outline the dates and amounts due for each installment payment, including the payment duration (months or years). Specify acceptable payment methods and where payments should be sent. 5. Collateral: Identify and describe the collateral being provided to secure the loan. This can include real estate, vehicles, equipment, or any other assets with sufficient value. It's crucial to describe the collateral in detail to avoid ambiguity. 6. Default and Remedies: Define the circumstances that would constitute a default, such as missed payments or violation of other terms. Discuss the repercussions of default, such as foreclosure on the collateral or legal action. 7. Governing Law: Specify that the agreement will be governed by the laws of Suffolk, New York, and indicate the designated jurisdiction for resolving any disputes. Two common types of Suffolk, New York Installment Promissory Note and Security Agreement are: 1. Real Estate Installment Promissory Note and Security Agreement: Specifically used for loans associated with real estate transactions, where the real estate serves as collateral to secure the debt. 2. Vehicle Installment Promissory Note and Security Agreement: Used when financing the purchase of a vehicle, where the vehicle itself acts as collateral for the loan. It is crucial to consult with a qualified legal professional when creating or entering into a Suffolk, New York Installment Promissory Note and Security Agreement to ensure compliance with local and state laws, as well as to protect the rights and interests of all parties involved.

Suffolk New York Installment Promissory Note and Security Agreement

Description

How to fill out Suffolk New York Installment Promissory Note And Security Agreement?

Whether you plan to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business case. All files are collected by state and area of use, so opting for a copy like Suffolk Installment Promissory Note and Security Agreement is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to get the Suffolk Installment Promissory Note and Security Agreement. Follow the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

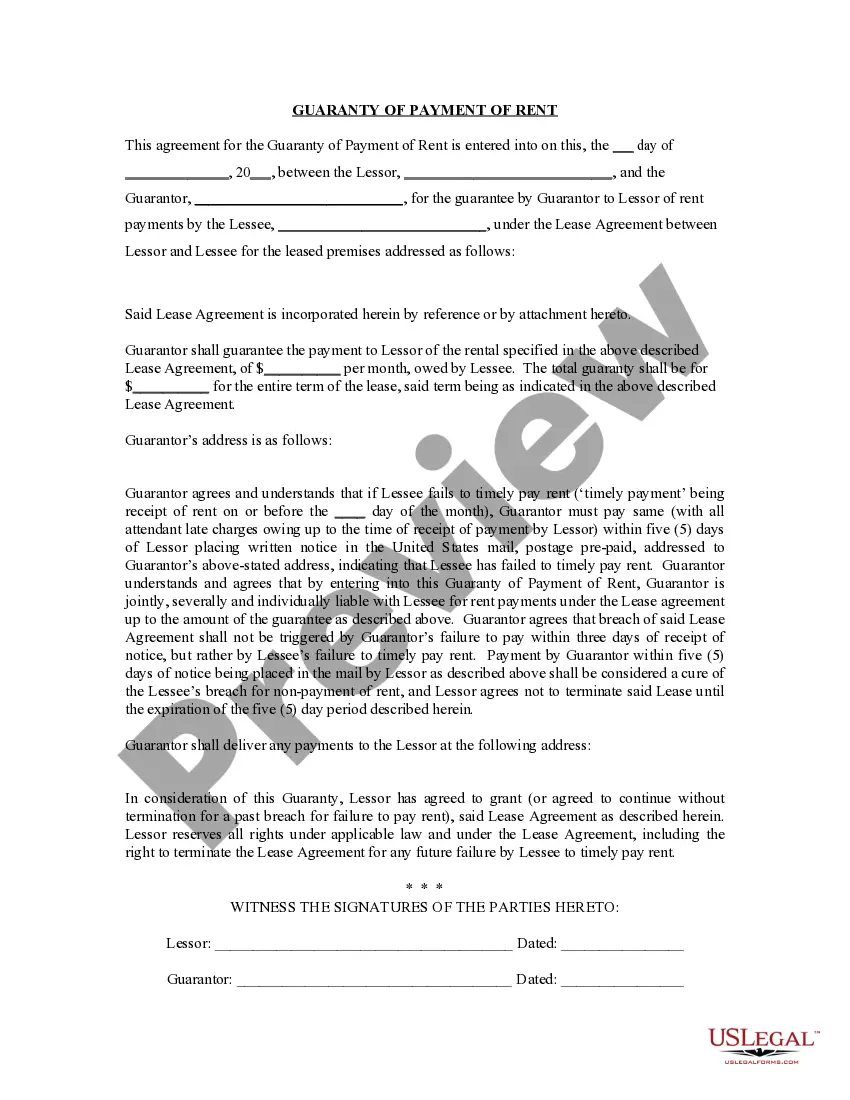

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to obtain the file once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Installment Promissory Note and Security Agreement in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!