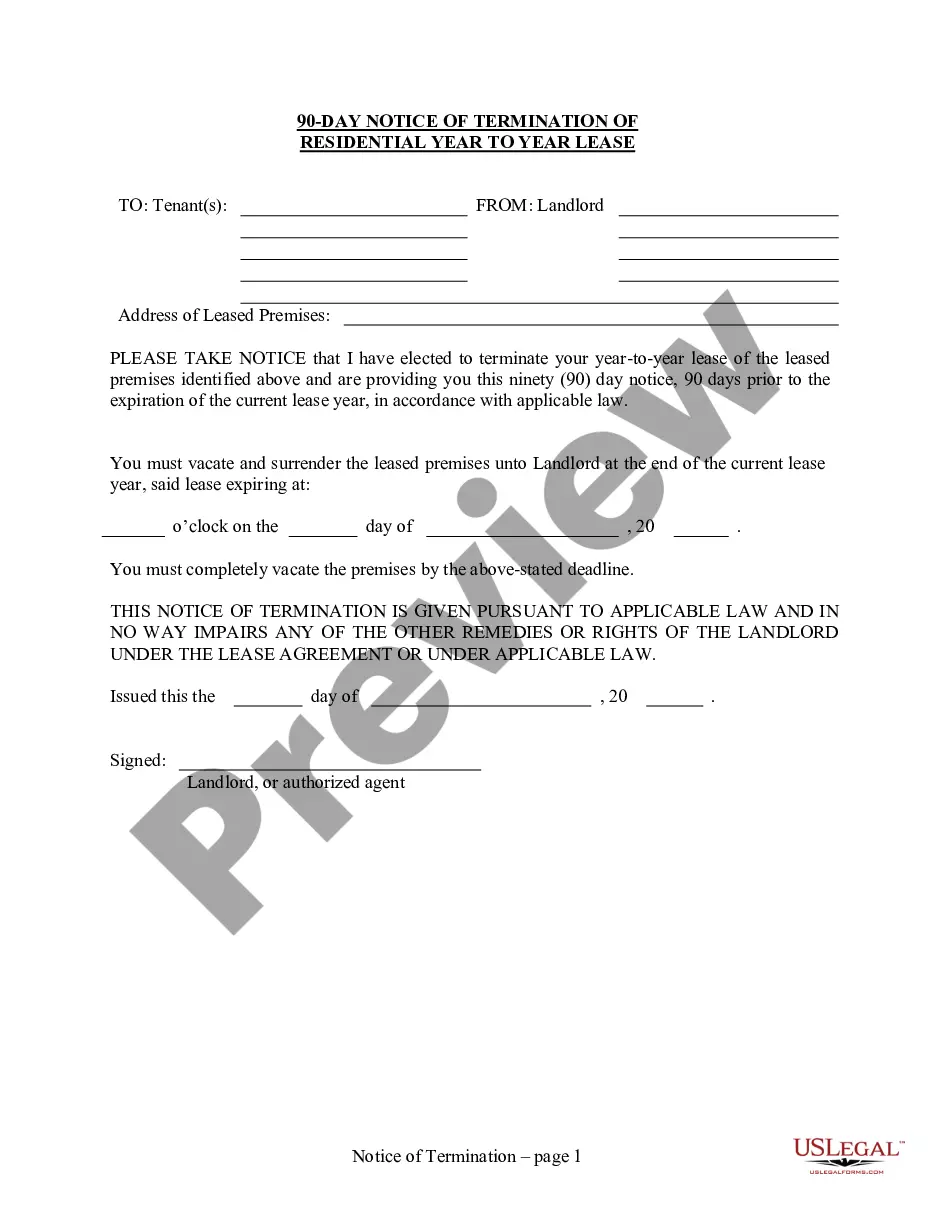

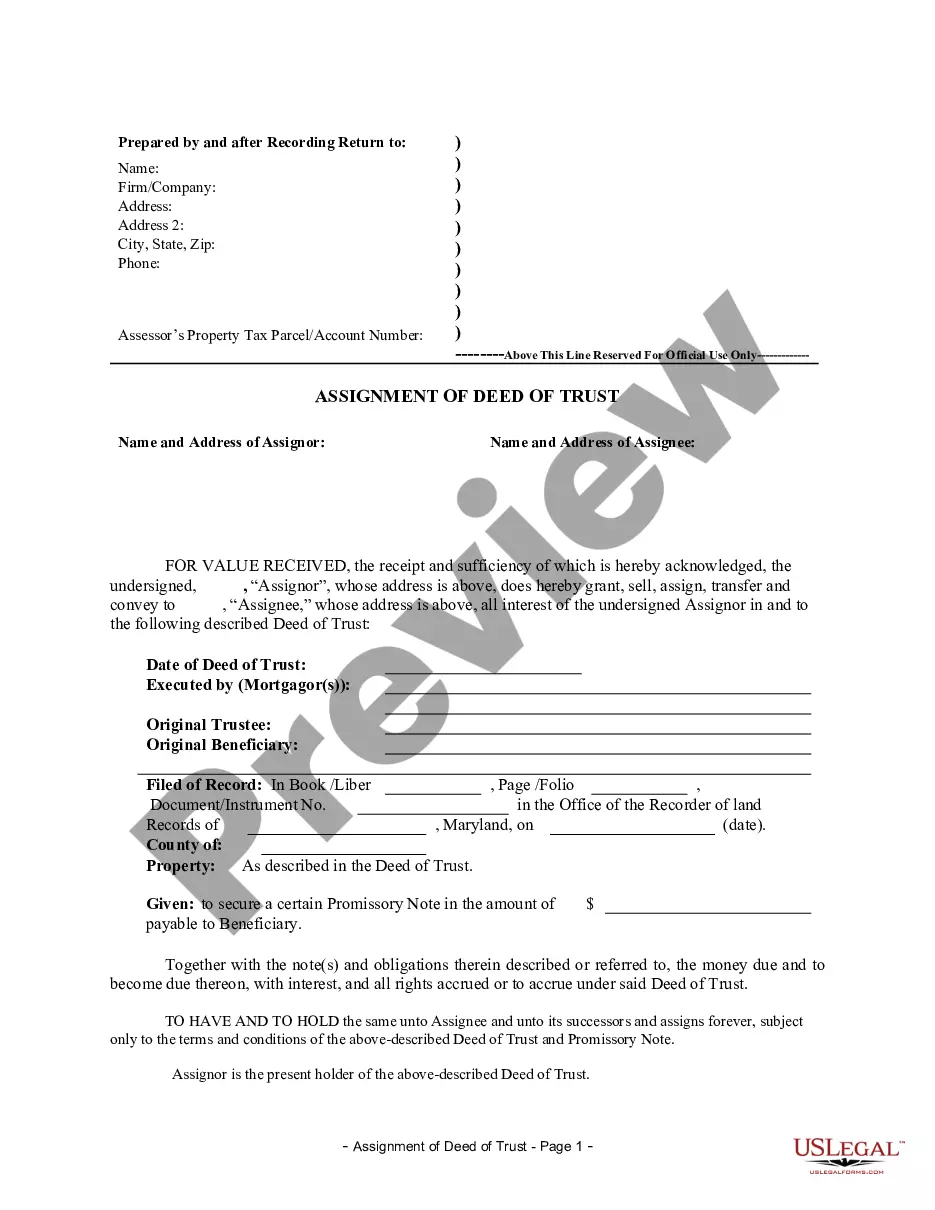

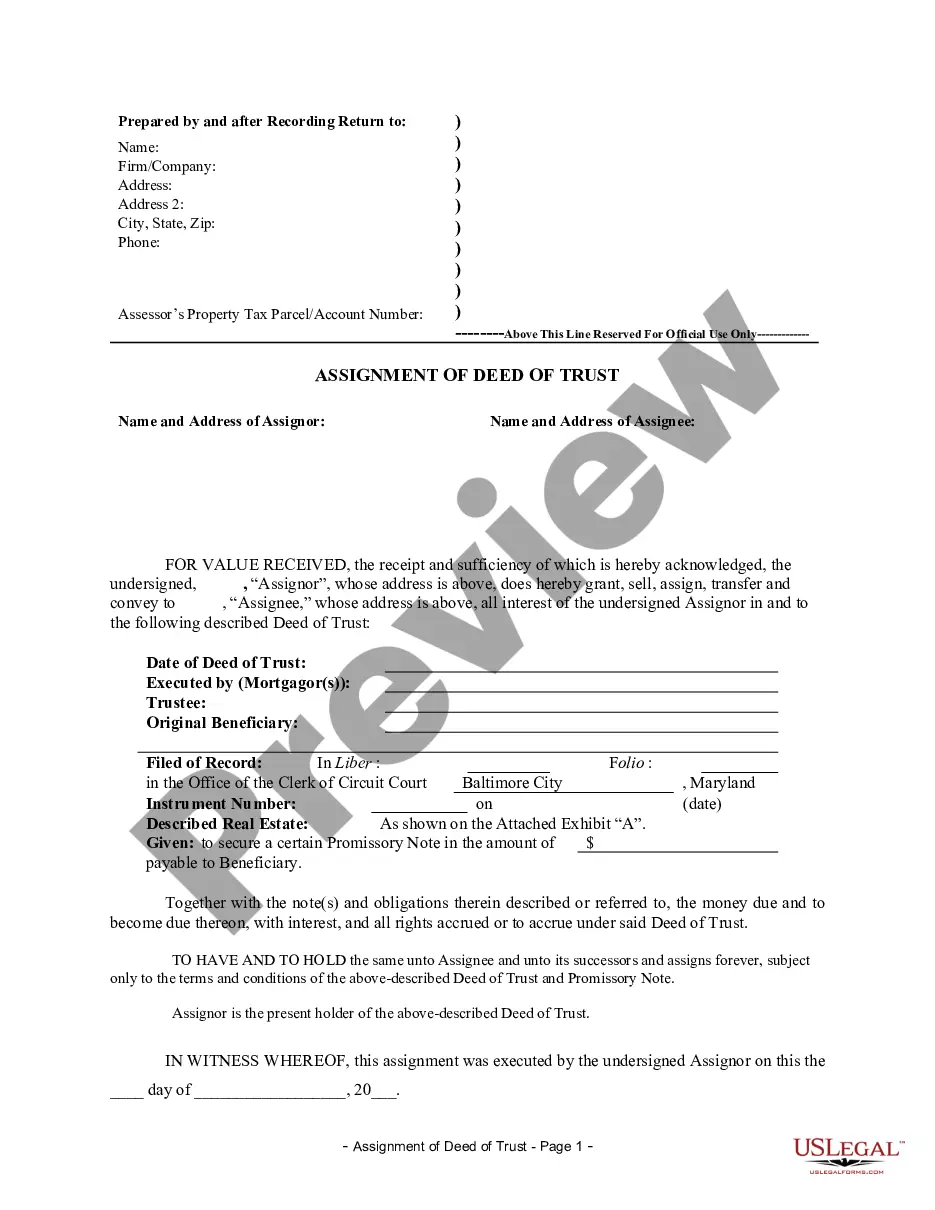

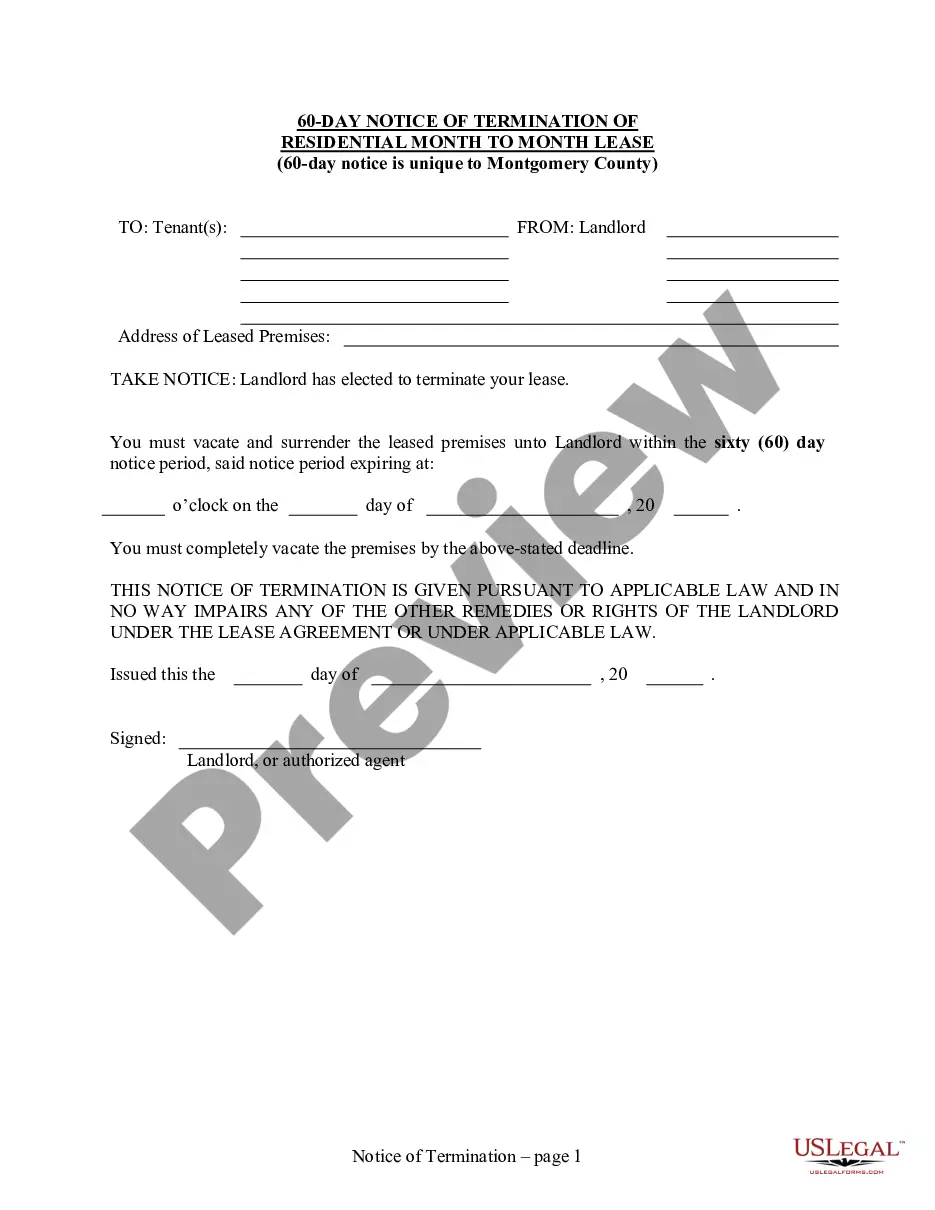

In Clark County, Nevada, a closing statement is an essential part of the real estate transaction process. It is a document that outlines all the financial details regarding the purchase or sale of a property, providing a summary of all the costs, fees, and funds involved. A Clark Nevada sample letter for a closing statement serves as an example or template for creating this document. The purpose of a closing statement is to ensure transparency and accuracy in the transaction, allowing both the buyer and the seller to have a clear understanding of the financial obligations and rights. The closing statement typically includes the following information: 1. Property details: The closing statement starts with the identification of the property being bought or sold, including the address and legal description. 2. Purchase price: The closing statement details the agreed-upon purchase price between the buyer and the seller. This is a crucial element as it serves as the basis for all the calculations and financial arrangements. 3. Prorated expenses: It includes any prorated expenses that need to be split between the buyer and the seller. These expenses can include property taxes, homeowners association fees, or prepaid utility bills. 4. Closing costs: This section outlines all the closing costs associated with the transaction. Closing costs can include lender fees, title fees, legal fees, recording fees, and other miscellaneous charges. It is important to accurately calculate these costs to ensure a smooth closing process. 5. Credits and adjustments: The closing statement should also mention any credits or adjustments that affect the final amount due from the buyer or seller. This can include prorated rent, security deposits, or any other agreed-upon financial arrangements between the parties. 6. Loan details: If the purchase involves a loan, the closing statement will include information about the lender, the loan amount, and any loan-related fees. Considering all the variations in real estate transactions, there might be different types of Clark Nevada sample letters for closing statements, depending on factors such as the type of property (residential, commercial, or land), the involvement of a mortgage, or the specific terms agreed upon by the parties involved. However, the underlying structure and purpose of the closing statement will remain the same, focusing on accurately summarizing the financial aspects of the transaction. In conclusion, a Clark Nevada sample letter for a closing statement is a crucial tool used in real estate transactions to ensure a smooth and transparent financial transition. It outlines all the necessary details, costs, and credits, providing both the buyer and seller with a comprehensive overview of the financial obligations and arrangements involved in the purchase or sale of a property.

Clark Nevada Sample Letter for Closing Statement

Description

How to fill out Clark Nevada Sample Letter For Closing Statement?

Drafting papers for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Clark Sample Letter for Closing Statement without expert help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Clark Sample Letter for Closing Statement by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step guide below to get the Clark Sample Letter for Closing Statement:

- Look through the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any situation with just a few clicks!