Harris Texas Sample Letter for Review of Form 1210 refers to a specific type of letter that is used in the state of Texas, particularly in Harris County, to request a review of Form 1210. This form is typically utilized in legal and administrative matters, such as property tax appeals or reassessments. The purpose of the Harris Texas Sample Letter for Review of Form 1210 is to provide a comprehensive and detailed request for a thorough examination of the information provided in Form 1210. This letter aims to ensure the accuracy and fairness of the assessment of property values, tax liabilities, or any other relevant information mentioned in the form. Keywords relevant to this topic include: 1. Harris County, Texas: Referring to the specific geographical location where this form and letter are applicable. 2. Sample Letter: Denoting that this document serves as a template or example for composing an effective review request. 3. Review of Form 1210: Indicating the main purpose of the letter, which is to request a careful evaluation of the information provided in Form 1210. 4. Property Tax Appeals: Highlighting the context in which this letter may be used, typically for challenging property tax assessments or seeking a reassessment. 5. Accuracy and Fairness: Emphasizing the objectives of the review process, to ascertain the correctness and impartiality of the provided information. 6. Legal and Administrative Matters: Highlighting the wide range of situations where this letter is applicable, involving legal and administrative processes related to property taxation. 7. Assessment of Property Values: Indicating one of the specific areas that could be subject to review, ensuring the accuracy of property valuations. 8. Tax Liabilities: Highlighting another aspect that might be reviewed, focusing on ensuring that tax liabilities are correctly determined and allocated. Types of Harris Texas Sample Letter for Review of Form 1210 may include: 1. Property Tax Appeal Sample Letter for Review of Form 1210: Specifically used to question and request a review of property tax assessments mentioned in Form 1210. 2. Property Reassessment Sample Letter for Review of Form 1210: Aimed at seeking a reassessment of property values, potentially resulting in a change in tax liabilities, based on the information provided in Form 1210. In summary, the Harris Texas Sample Letter for Review of Form 1210 serves as a template or example document used in Harris County, Texas, to request a comprehensive review of Form 1210, primarily in the context of property tax appeals or reassessments. It aims to ensure accuracy, fairness, and correct determination of property values and tax liabilities.

Harris Texas Sample Letter for Review of Form 1210

Description

How to fill out Harris Texas Sample Letter For Review Of Form 1210?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Harris Sample Letter for Review of Form 1210, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Harris Sample Letter for Review of Form 1210 from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Harris Sample Letter for Review of Form 1210:

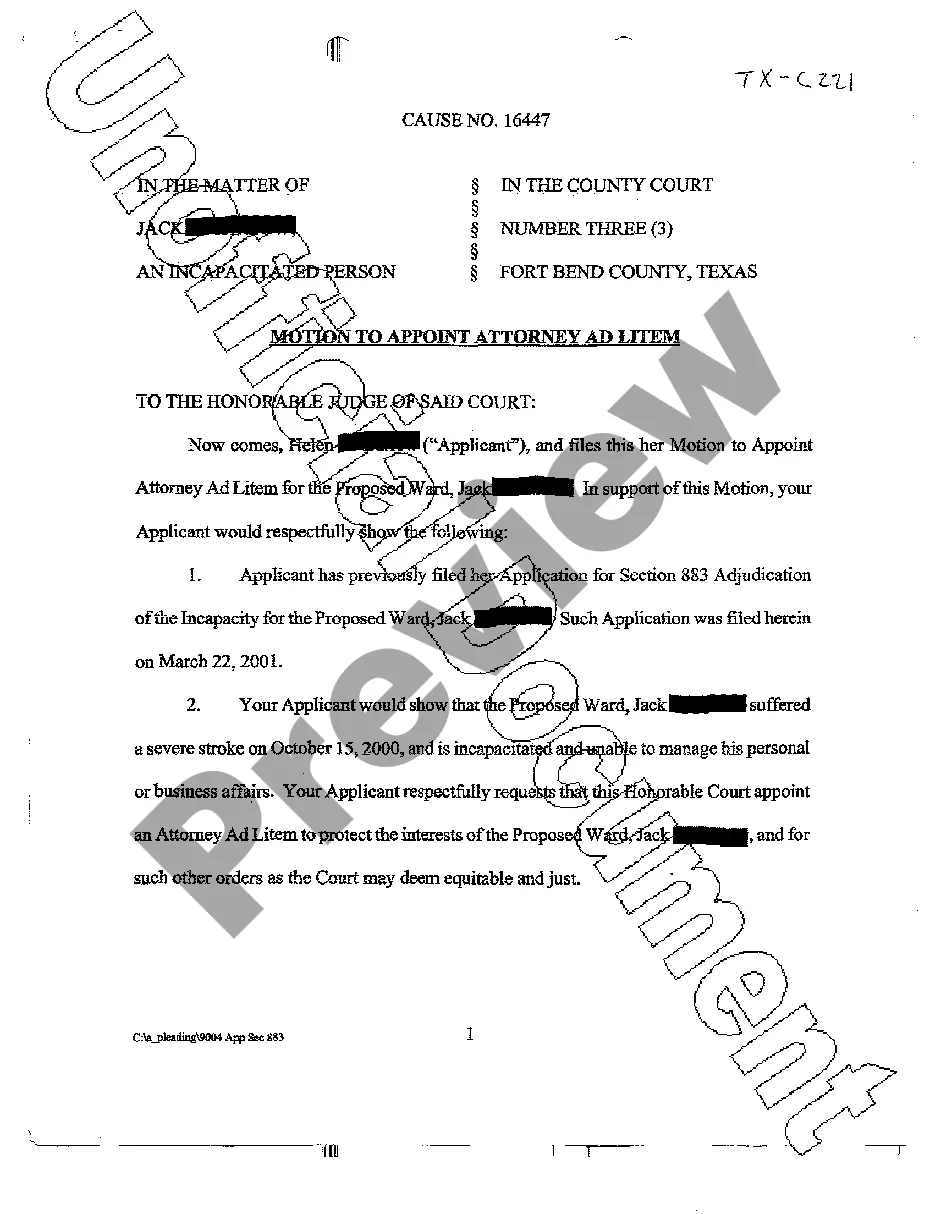

- Examine the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!