Dear [Lender's Name], I am writing to express my interest in applying for a loan from [Lender's Name] under the terms of the Salt Lake Utah Revolving Note and Loan Agreement. I understand that this agreement outlines the terms and conditions for acquiring a revolving credit facility from your institution. Salt Lake City, located in the state of Utah, is the capital and largest city in the state. Known for its picturesque mountainous backdrop, the city is also recognized as a major economic hub. Its vibrant economy, diverse industries, and thriving business community make it an ideal location for businesses and individuals seeking financial support. The Salt Lake Utah Revolving Note and Loan Agreement offer individuals and businesses the opportunity to access a revolving credit line. This type of loan facility provides the flexibility of borrowing funds up to an agreed-upon limit, repaying the borrowed amount, and borrowing again in a revolving cycle. The Salt Lake Utah Revolving Note and Loan Agreement offer several key benefits to borrowers: 1. Flexibility: The revolving credit facility allows borrowers to access funds whenever needed, giving them the flexibility to manage their financial needs effectively. 2. Variable Interest Rates: Depending on market conditions, the interest rates on the revolving credit facility may vary, providing the potential for cost savings when interest rates are favorable. 3. Collateral Options: The agreement may allow for a range of collateral options, providing borrowers with various avenues to secure the loan. This makes it easier for both individuals and businesses to access credit. 4. Repayment Options: Borrowers have the flexibility to repay the principal amount and interest based on their financial capacity within the defined timeframe specified in the agreement. It's essential to review the specific terms and conditions of the Salt Lake Utah Revolving Note and Loan Agreement before proceeding with the application. The document will outline the required information, including personal or business financial statements, credit history, and other supporting documents that may be necessary for the evaluation process. In conclusion, I would appreciate the opportunity to discuss further the Salt Lake Utah Revolving Note and Loan Agreement with you and explore the potential to secure a revolving credit facility. Please let me know the next steps required to move forward with the application process. Thank you for your time and consideration. I look forward to hearing from you soon. Sincerely, [Your Name]

Salt Lake Utah Sample Letter regarding Revolving Note and Loan Agreement

Description

How to fill out Salt Lake Utah Sample Letter Regarding Revolving Note And Loan Agreement?

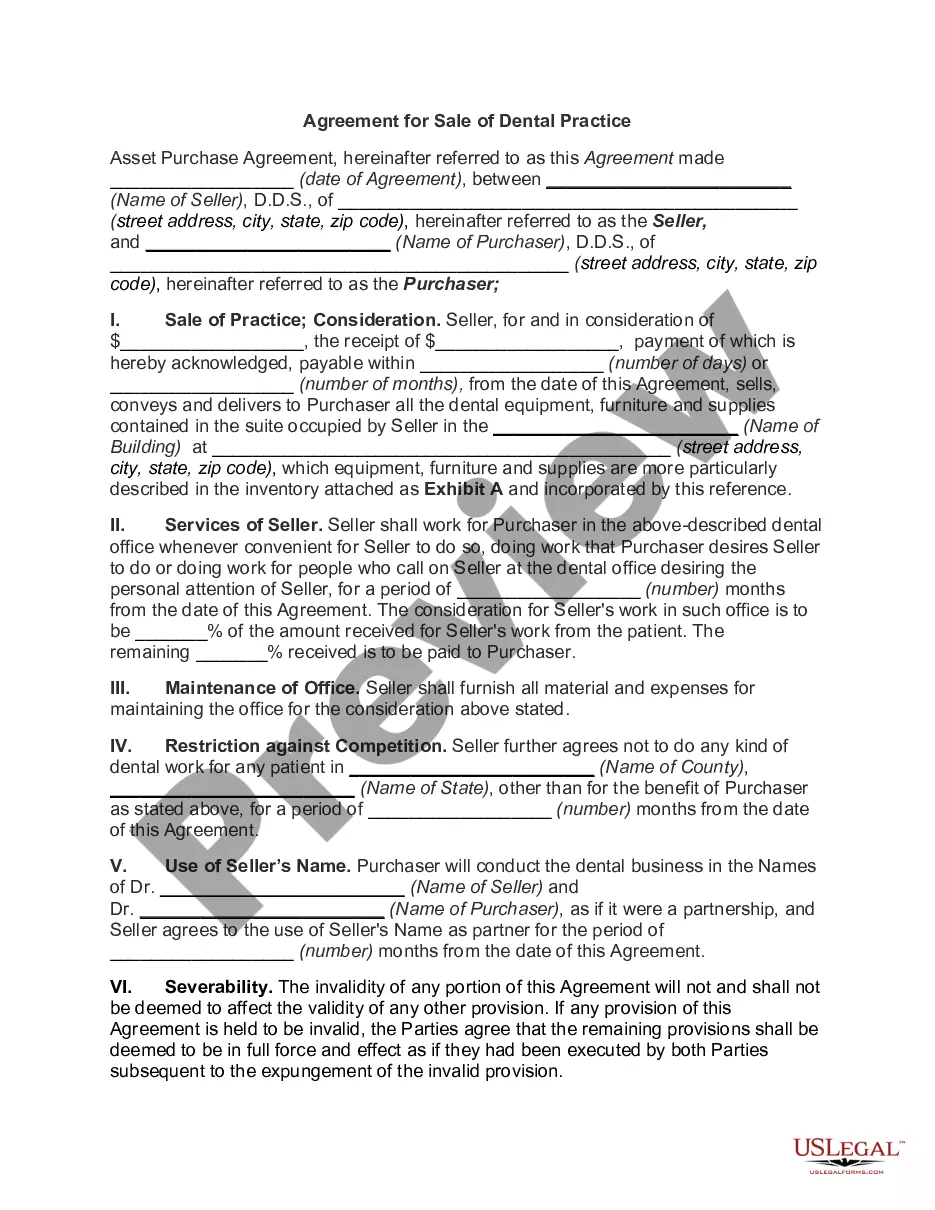

Are you looking to quickly create a legally-binding Salt Lake Sample Letter regarding Revolving Note and Loan Agreement or maybe any other document to handle your personal or business matters? You can select one of the two options: contact a legal advisor to write a valid paper for you or create it completely on your own. Luckily, there's another option - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-specific document templates, including Salt Lake Sample Letter regarding Revolving Note and Loan Agreement and form packages. We offer documents for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed document without extra troubles.

- First and foremost, double-check if the Salt Lake Sample Letter regarding Revolving Note and Loan Agreement is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the document isn’t what you were seeking by using the search bar in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Salt Lake Sample Letter regarding Revolving Note and Loan Agreement template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. In addition, the documents we provide are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!