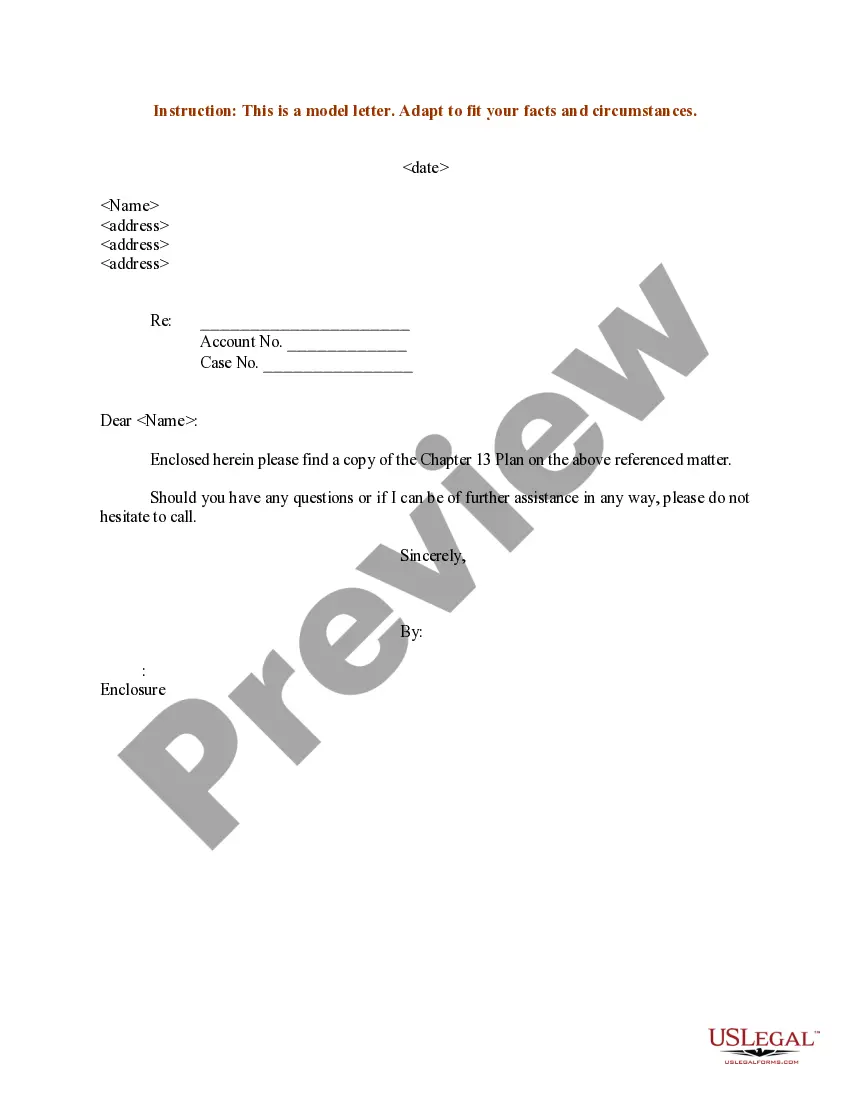

Subject: Detailed Description of Franklin Ohio Sample Letter Regarding Chapter 13 Plan Dear [Recipient's Name], I am writing to provide you with a detailed description of the Franklin Ohio Sample Letter regarding Chapter 13 Plan. Chapter 13 bankruptcy is a form of debt relief that allows individuals with a regular income to reorganize their debts and develop a plan to repay their creditors over a period of three to five years. In Franklin Ohio, when individuals file for Chapter 13 bankruptcy, they must submit a Chapter 13 Plan outlining how they intend to repay their debts. This plan is a critical document that guides the debtor, creditors, and the court throughout the bankruptcy process. The purpose of the Sample Letter is to offer guidance to debtors on how to create an effective Chapter 13 Plan that complies with the requirements and expectations of the bankruptcy court. Key elements that should be addressed in the Franklin Ohio Sample Letter regarding Chapter 13 Plan include: 1. Detailed Financial Information: Debtors should provide an accurate and comprehensive overview of their income, expenses, and assets. This includes monthly income from all sources, detailed breakdowns of expenses, and a list of assets and their respective values. 2. Repayment Schedule: Debtors should outline their proposed repayment schedule, showing how much they will pay to the trustee each month and for how long. The plan should demonstrate the debtor's ability to meet these payments based on their income and expenses, while ensuring adequate funds are allocated towards essential living expenses. 3. Priority and Secured Debts: The debtor must specify how they intend to address priority and secured debts, such as taxes or mortgages. These debts may need to be paid in full or according to specific terms outlined in the plan. 4. Treatment of Unsecured Debts: The Sample Letter should provide options for unsecured debts, such as credit cards or medical bills. Debtors can propose to repay a portion of these debts or propose a plan where they will pay the trustee a set amount each month, which will be distributed among the creditors based on priority and the terms of the plan. 5. Length of the Plan: The Sample Letter should suggest a plan duration of either three or five years, depending on the debtor's income and the nature of their financial situation. The letter should explain the advantages and disadvantages of each duration to help debtors make an informed decision. Different types of Franklin Ohio Sample Letters regarding Chapter 13 Plan may include: 1. Standard Chapter 13 Plan Sample Letter: A comprehensive letter that follows the standard requirements for creating a plan and addresses the aforementioned key elements. 2. Modified Chapter 13 Plan Sample Letter: This type of letter may be used when there are specific circumstances or deviations from the standard plan layout, such as when a debtor has irregular income or special circumstances affecting their repayment ability. 3. Amended Chapter 13 Plan Sample Letter: If there are any changes or amendments needed to an existing Chapter 13 Plan, debtors can use this letter format to inform the court and creditors about the proposed modifications. In conclusion, the Franklin Ohio Sample Letter regarding Chapter 13 Plan serves as a helpful guide for debtors navigating the Chapter 13 bankruptcy process. It provides debtors with a blueprint for creating an effective repayment plan that satisfies both their financial capabilities and the legal requirements. By following this suggested structure, debtors can increase their chances of obtaining court approval and achieving a successful debt repayment outcome. Should you require any further information or assistance regarding Chapter 13 bankruptcy or the sample letter, please do not hesitate to reach out. Sincerely, [Your Name]

Franklin Ohio Sample Letter regarding Chapter 13 Plan

Description

How to fill out Franklin Ohio Sample Letter Regarding Chapter 13 Plan?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Franklin Sample Letter regarding Chapter 13 Plan, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Franklin Sample Letter regarding Chapter 13 Plan from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Franklin Sample Letter regarding Chapter 13 Plan:

- Take a look at the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!