Kings New York Sample Letter for Pension Plan Summary Plan Description provides a comprehensive summary of the pension plan offered by Kings New York. This plan is designed to provide financial security and stability to employees during their retirement years. It outlines the various features and benefits of the pension plan, ensuring that employees have a clear understanding of how the plan works and what they can expect. The Kings New York Sample Letter for Pension Plan Summary Plan Description covers several important aspects, including eligibility criteria, contribution details, vesting information, retirement options, and distribution rules. It specifies the conditions that must be met for an employee to be eligible for the pension plan, such as age and length of service requirements. The summary plan description also explains the contribution structure, whether it is based on a fixed percentage of the employee's salary or subject to specific limits. It clarifies how these contributions are invested to ensure growth and maximized returns over time. Another vital component covered is vesting, which refers to the employee's right to receive the employer's contributions. The summary plan description explains the vesting schedule, which may entail a certain number of years of service before an employee becomes fully vested. Retirement options are also discussed in detail within the Kings New York Sample Letter for Pension Plan Summary Plan Description. It outlines the different types of retirement benefits available, such as a monthly annuity or a lump-sum payment, allowing employees to select the option that best suits their needs. Lastly, the summary plan description addresses the rules and regulations regarding distributions. It specifies the conditions under which a participant can begin receiving pension benefits, such as reaching a certain age or retiring from the company. Additionally, it may mention any penalties or tax implications associated with early withdrawals or rollovers. Overall, Kings New York provides a comprehensive and transparent summary plan description to ensure that their employees have a clear understanding of the pension plan's intricacies. This document serves as a valuable resource for employees to make informed decisions about their retirement savings and secure their financial future effectively.

Kings New York Sample Letter for Pension Plan Summary Plan Description

Description

How to fill out Kings New York Sample Letter For Pension Plan Summary Plan Description?

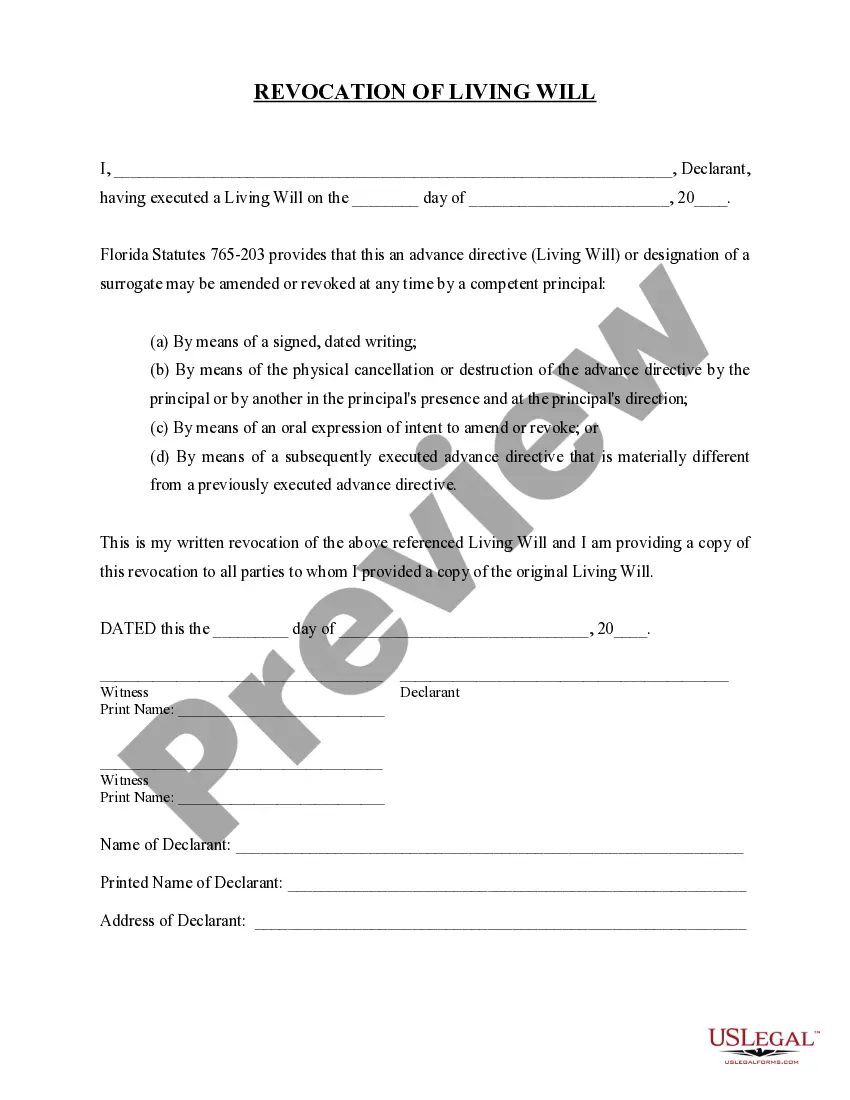

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including Kings Sample Letter for Pension Plan Summary Plan Description, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different types varying from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find information materials and guides on the website to make any tasks associated with document completion straightforward.

Here's how to locate and download Kings Sample Letter for Pension Plan Summary Plan Description.

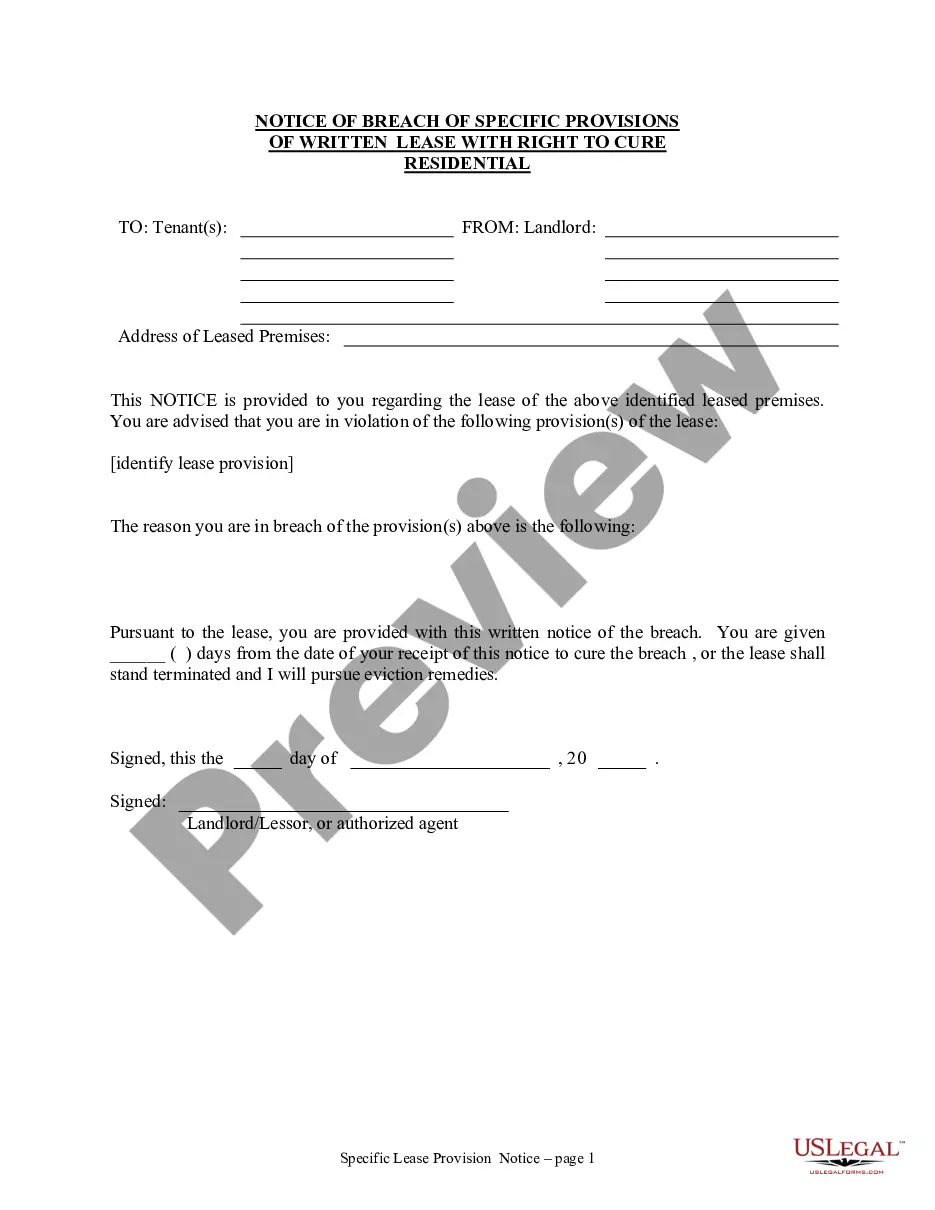

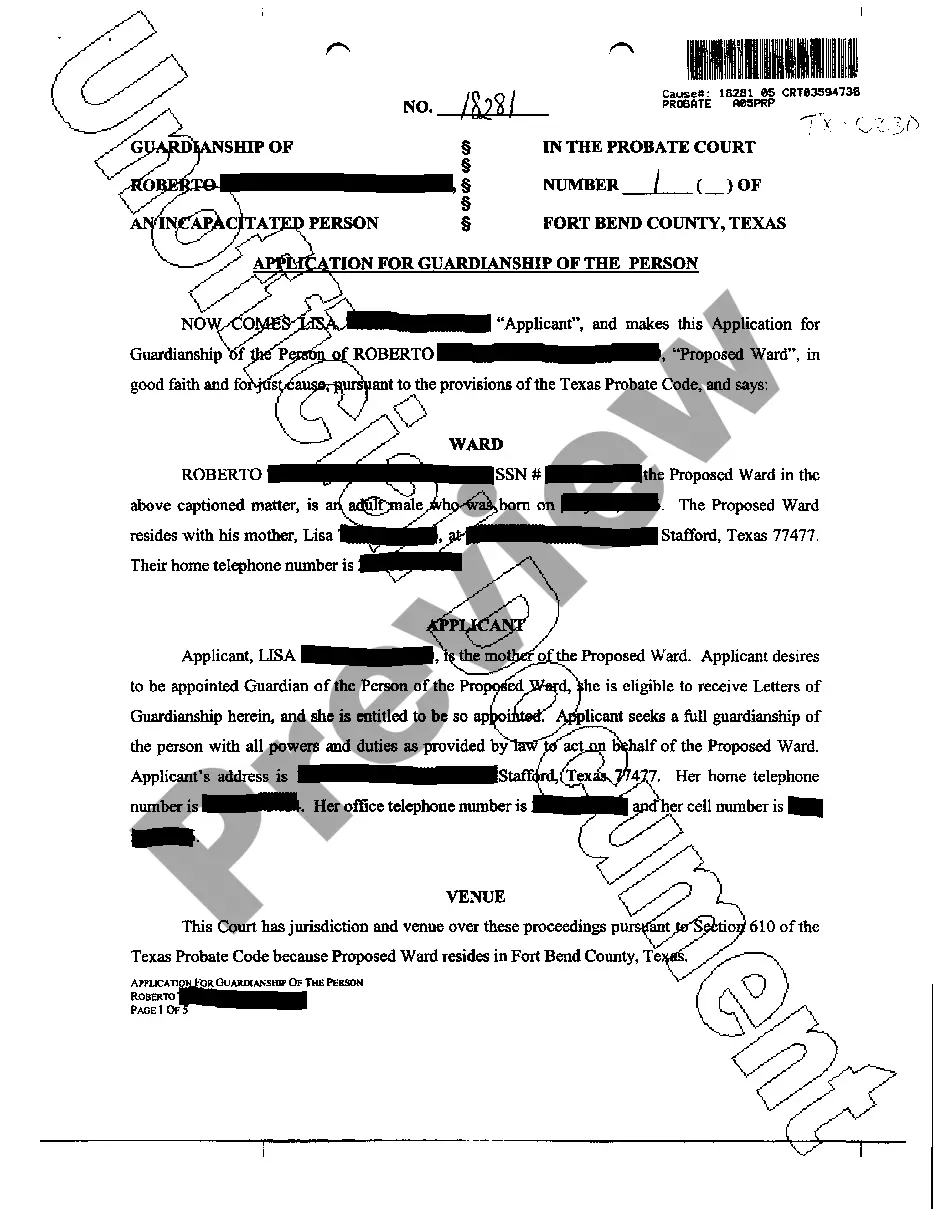

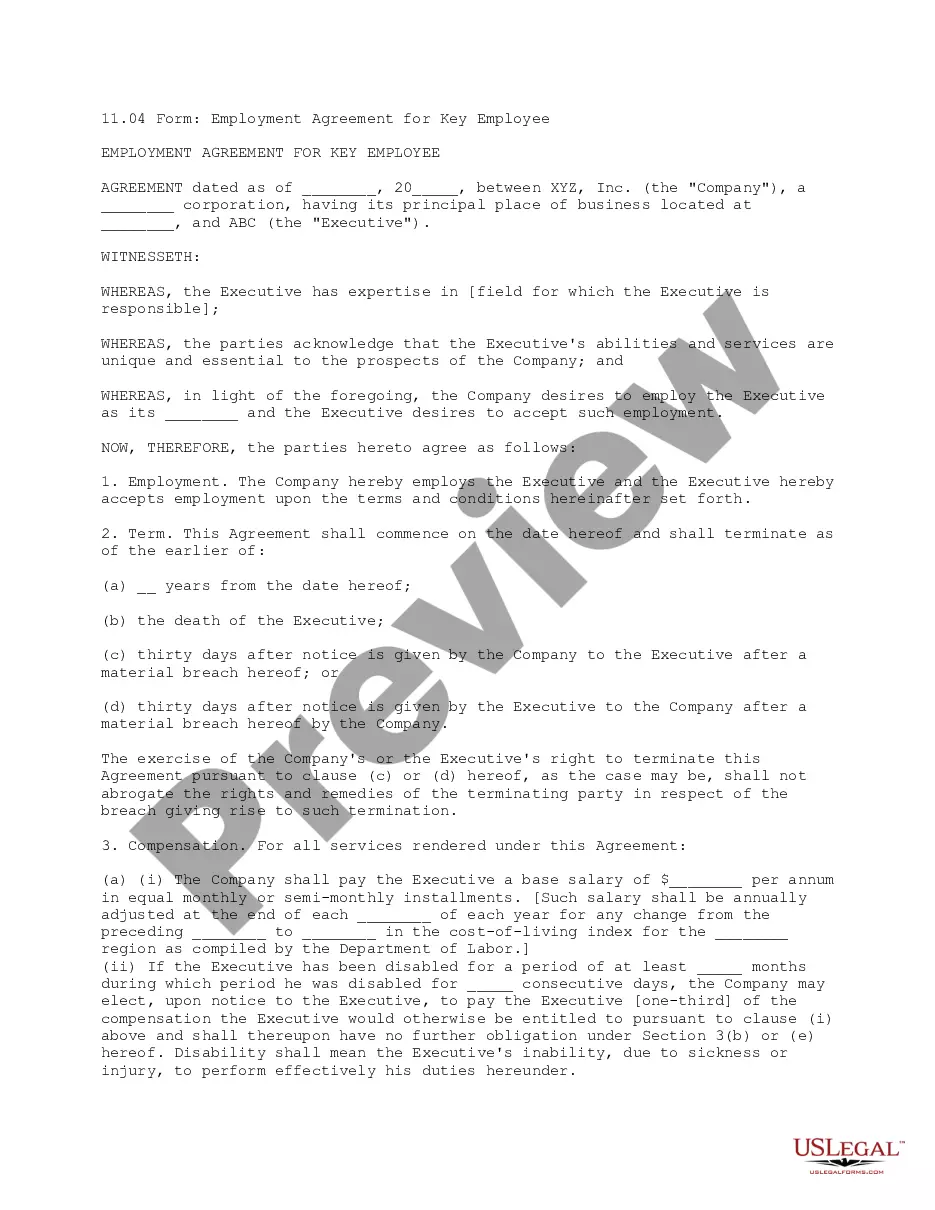

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can affect the validity of some documents.

- Examine the related document templates or start the search over to find the correct file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and purchase Kings Sample Letter for Pension Plan Summary Plan Description.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Kings Sample Letter for Pension Plan Summary Plan Description, log in to your account, and download it. Needless to say, our website can’t take the place of a lawyer completely. If you have to cope with an extremely difficult case, we advise getting an attorney to examine your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork effortlessly!

Form popularity

FAQ

Get in touch with your pension provider, ensure they have your current address and then request a statement. You should be able to find their contact details on any paperwork you do have.

If you belong to one, your pension provider will usually send you an annual benefit statement. If you don't receive a statement, you can ask for one. The statement shows how much pension you might get. It might assume that you take your tax-free cash lump sum.

A pension is a retirement fund for an employee paid into by the employer, employee, or both, with the employer usually covering the largest percentage of contributions. When the employee retires, she's paid in an annuity calculated by the terms of the pension.

What are the two required financial statements of a defined contribution retirement plan? A statement of net assets available for benefits of the plan and a statement of changes in net assets available for benefits.

A summary plan description (SPD) is a document an employer gives to their employees who are participating in retirement or health benefits plans covered under the U.S. Department of Labor's Employee Retirement Income Security Act of 1974 (ERISA).

Your Annual Member Statement shows an accounting of your retirement-related work history as reported by your employer. Statements are typically available in late August. You should keep your statement with your personal records for future financial planning purposes.

This Statement requires the notes to the financial statements of defined contribution plans to include a brief plan description, a summary of significant accounting policies (including the fair value of plan assets, unless reported at fair value), and information about contributions and investment concentrations.

Understanding workplace retirement plans A defined contribution plan is a common workplace retirement plan in which an employee contributes money and the employer typically makes a matching contribution. Two popular types of these plans are 401(k) and 403(b) plans.

If you're in a final salary or career average pension then your provider doesn't have to automatically send you an annual statement, although many schemes do. Instead, you have the right to ask for a statement, and you must receive it within two months of your request.

A pension statement is an annual summary sent to you by your pension provider. It shows you how much money or benefits you have in your pension and, if your money is invested, how your investments are performing.