Philadelphia Pennsylvania Controlling Persons Questionnaire is a comprehensive survey designed to gather information about individuals who hold significant control over a company or organization in Philadelphia, Pennsylvania. This questionnaire plays a vital role in ensuring transparency and preventing illegal activities such as money laundering and fraudulent transactions. The Philadelphia Pennsylvania Controlling Persons Questionnaire features a detailed set of inquiries aimed at identifying individuals who exercise considerable influence or control over an entity. It requires respondents to provide personal and professional details, including their full name, date of birth, contact information, occupation, and residential address. Additionally, the questionnaire seeks information on a person's role within the company or organization, such as their job title, responsibilities, and decision-making authority. It seeks to establish if the individual holds positions of power, whether as a director, partner, beneficial owner, or any other controlling capacity. The questionnaire may also inquire about the nature and source of the person's wealth, seeking information on financial assets, investments, and income sources. This information is beneficial in evaluating the person's overall financial standing and uncovering any potential conflicts of interest. There can be variations or different types of Philadelphia Pennsylvania Controlling Persons Questionnaire, tailored to specific sectors or industries. For instance, there might be a separate questionnaire for financial institutions, real estate companies, or non-profit organizations, as each sector may have its unique set of regulations and compliance requirements. The purpose of the Philadelphia Pennsylvania Controlling Persons Questionnaire is to ensure compliance with local and federal laws and to prevent any illicit activities that may harm the financial system and the reputation of the city. By obtaining accurate and up-to-date information about controlling individuals, authorities can effectively monitor, trace, and investigate any suspicious or unlawful activities that involve Philadelphia-based entities. In conclusion, the Philadelphia Pennsylvania Controlling Persons Questionnaire is a crucial instrument for promoting accountability, transparency, and combating financial crimes within the city. Its comprehensive nature and specific inquiries help regulators and law enforcement agencies maintain integrity and security in the business environment.

Philadelphia Pennsylvania Controlling Persons Questionnaire

Description

How to fill out Philadelphia Pennsylvania Controlling Persons Questionnaire?

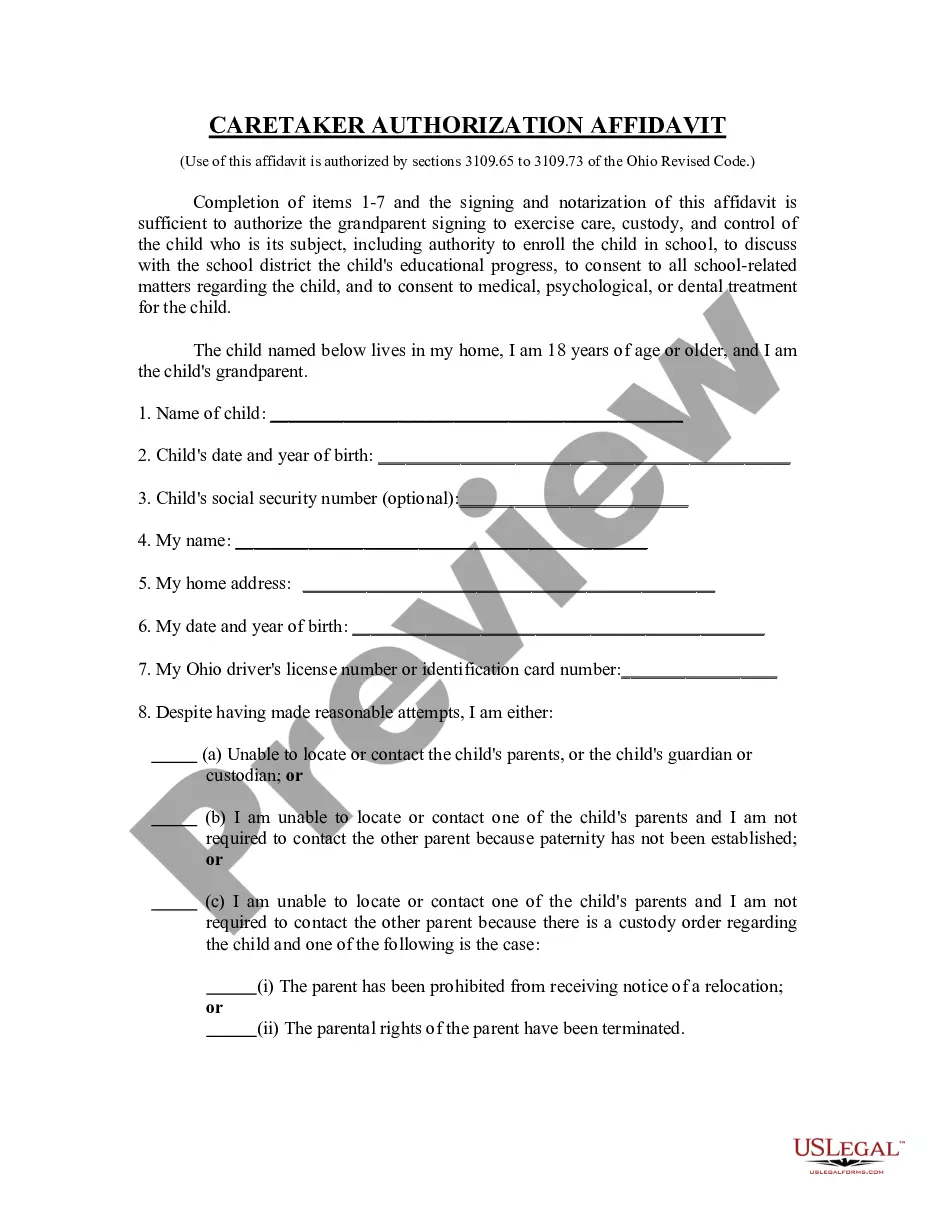

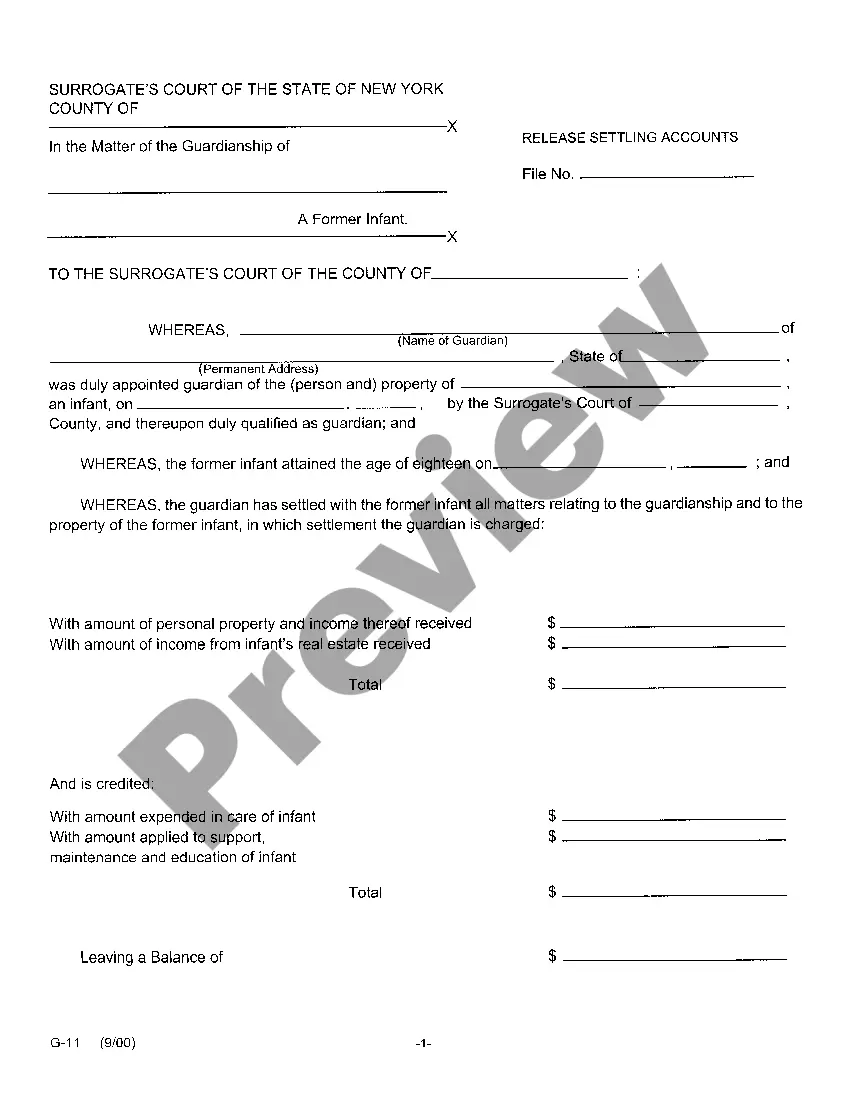

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life situation, finding a Philadelphia Controlling Persons Questionnaire meeting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. In addition to the Philadelphia Controlling Persons Questionnaire, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Experts check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can pick the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Philadelphia Controlling Persons Questionnaire:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Philadelphia Controlling Persons Questionnaire.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

File and pay online You can file NPT returns and make payments through the Philadelphia Tax Center. Starting with payments due in April 2018 for Tax Year 2017, taxpayers who owe $5,000 or more for the Net Profits Tax are required to pay those taxes electronically.

File and pay online You can file NPT returns and make payments through the Philadelphia Tax Center. Starting with payments due in April 2018 for Tax Year 2017, taxpayers who owe $5,000 or more for the Net Profits Tax are required to pay those taxes electronically.

You must pay the Earnings Tax if you are a: Philadelphia resident with taxable income who doesn't have the City Wage Tax withheld from your paycheck.

The tax applies to payments that a person receives from an employer in return for work or services. All Philadelphia residents owe the City Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

Who Must File. Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Every individual, partnership, association, limited liability company (LLC), and corporation engaged in a business, profession, or other activity for profit within the City of Philadelphia must fb01le a Business Income & Receipts Tax (BIRT) return.

All Philadelphia residents owe the City Wage Tax, regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

ACH Debits and Credits are accepted for payment of Net Profits Tax. For more information or to enroll in this program go to in the "Electronic Filing" section under "Electronic Payments", or contact the Electronic Government Unit at 215-686-6582, 6628 or 6459 or e-mail to egovservices@phila.gov.

The application for the Commercial Activity License (CAL) and Business Tax Account number (BIRT) is a combination application. You can apply online or in person in the basement of the Municipal Services building. If you apply online, it will take time for the city to process your application.

To file and pay the Earnings Tax by mail: Mail the application form to: Philadelphia Dept. of Revenue. 1401 John F. Kennedy Blvd.File returns and send quarterly payments to: Philadelphia Dept. of Revenue. P.O. Box 1648.File and pay the annual reconciliation by mailing it to: Philadelphia Dept. of Revenue. P.O. Box 1648.

Interesting Questions

More info

When we contacted the city for a comment, the city said there wasn't a problem. “There is no law prohibiting Open Carry of a concealed handgun in Philadelphia for those who meet the definition of a license holder.” But then they said they would be willing to discuss it if we stopped publishing, so We were also told that some individuals could still carry out. The Philadelphia PD has responded to our request for comment on open carry. This is from the department's media relations: “We want to express our position on this matter as it relates to the current legislative session. There is no issue with citizens openly carrying in the City of Philadelphia regardless of license or permit status since it is a common-sense law to follow. “As you may know, there are some individuals who have taken advantage of the current law which allows them to carry a concealed firearm without a license.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.