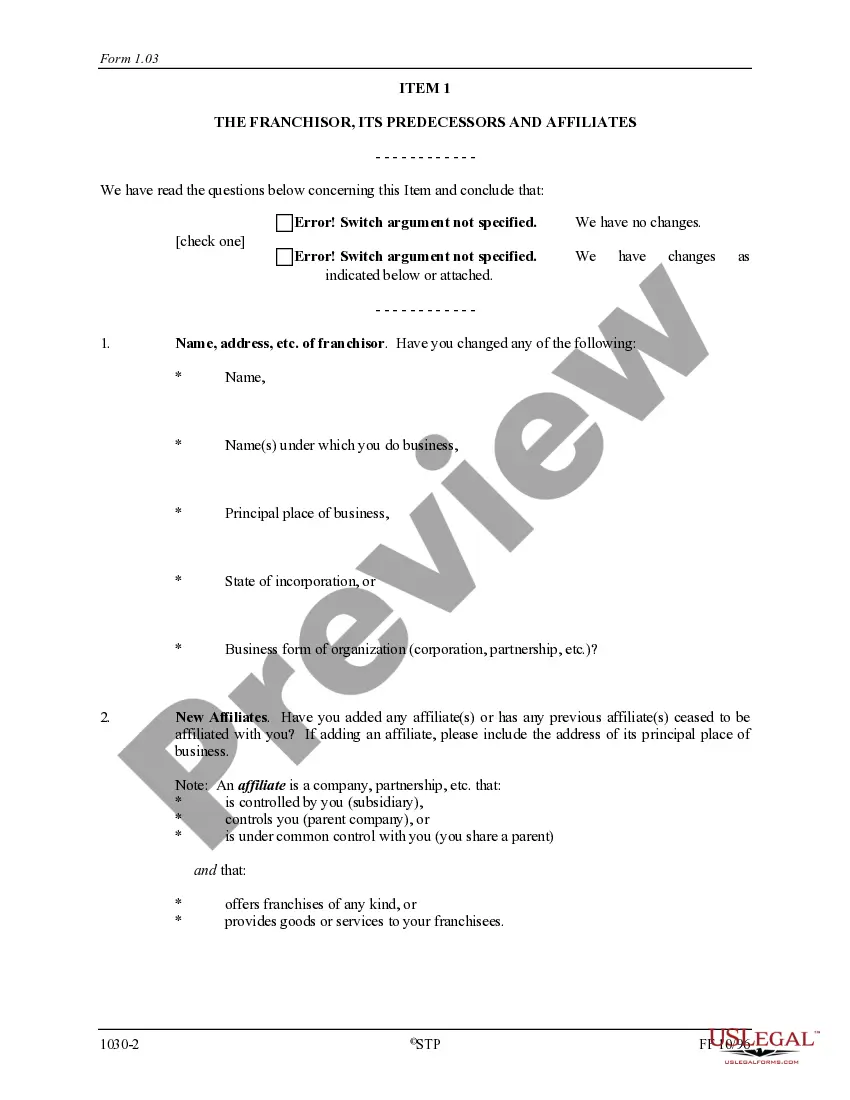

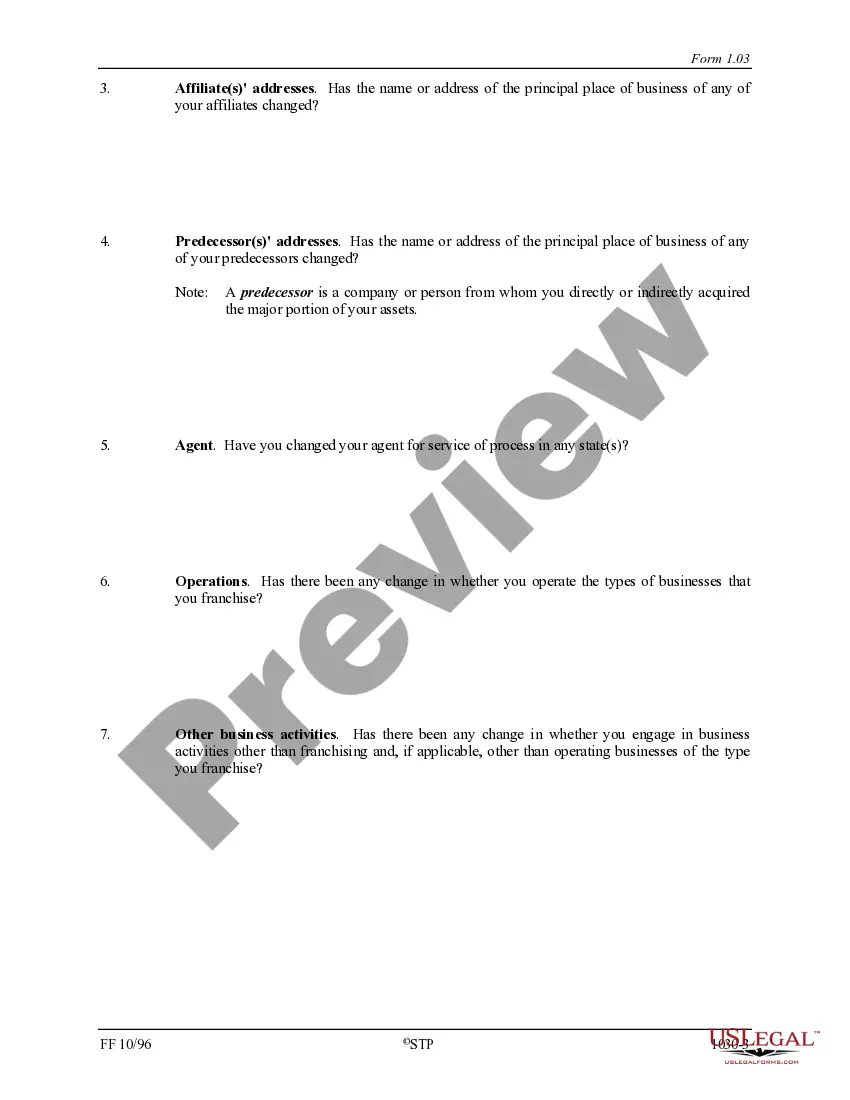

Oakland Michigan Franchise Registration Renewal Questionnaire

Description

How to fill out Franchise Registration Renewal Questionnaire?

How long does it usually take you to create a legal document.

As every state has its own laws and regulations for every life circumstance, locating an Oakland Franchise Registration Renewal Questionnaire that meets all local mandates can be exhausting, and hiring a professional lawyer can frequently be costly.

Numerous online services provide the most common state-specific documents for download, but utilizing the US Legal Forms library is the most advantageous.

Print the document or utilize any preferred online editor to fill it out digitally. No matter how frequently you need to utilize the downloaded template, you can find all the files you’ve ever saved in your profile by accessing the My documents tab. Give it a try!

- US Legal Forms is the most extensive online catalog of templates, organized by states and fields of use.

- In addition to the Oakland Franchise Registration Renewal Questionnaire, you can retrieve any specific document necessary to operate your business or personal affairs, adhering to your local regulations.

- Professionals validate all templates for their correctness, so you can ensure your documentation is prepared accurately.

- Using the service is quite simple.

- If you already possess an account on the platform and your subscription is active, you just need to Log In, select the needed form, and download it.

- You can access the file in your profile at any future time.

- If you are new to the site, there will be additional steps to follow before you can acquire your Oakland Franchise Registration Renewal Questionnaire.

- Review the content of the page you’re presently viewing.

- Examine the description of the template or Preview it (if available).

- Search for another document using the appropriate option in the header.

- Tap Buy Now once you’re confident in the chosen file.

- Choose the subscription plan that best suits your needs.

- Register for an account on the platform or Log In to continue to payment methods.

- Pay through PayPal or with your credit card.

- Alter the file format if needed.

- Click Download to save the Oakland Franchise Registration Renewal Questionnaire.

Form popularity

FAQ

You can register for a California sales tax permit online at the California Department of Tax and Fee Administration (CDTFA) by clicking Register then Register a New Business Activity. Alternatively, you may register in person at one of their field offices.

You have to renew the license and pay a fee every year. If you organize your business as an LLC or a corporation, you'll also have to pay the fees associated with filing to the Secretary of State.

State of California entities A seller's permit is different from a business license. All California-based businesses need a local business license. But not all businesses need a seller's permit. In California, a business license (or equivalent) is obtained at the city or county level.

Apply for a New Business Tax Certificate online or at the Business Tax Office. There is a non-refundable business registration fee of $90.50 plus $8.50 in special fees for $99.00 total.

In Oakland's current business tax structure, tax rates vary from 60 cents to $13.95 per $1,000 in gross receipts. Retail, restaurants and other businesses pay $1.20 per $1,000 in gross receipts, and business and personal services firms and contractors pay $1.80 per $1,000 in gross receipts.

HdL offers taxpayer-friendly processes for collecting and monitoring sales tax, identifying errors in reporting and allocations, analyzing trends, and accurately forecasting revenues.

Call (510) 238-3704 Monday, Tuesday, Thursday, Friday from AM to PM Wednesdays AM to PM (excluding holidays) Email: BtWebSupport@oaklandca.gov. To pay business taxes: Walk-in services available Monday and Wednesday 10am-2pm.