A Dallas Texas Subcontractor's Performance Bond is a form of surety bond that is typically required in construction projects in Dallas, Texas. It acts as a guarantee that subcontractors will perform their contractual obligations in accordance with the terms and conditions agreed upon in their construction contract. The main purpose of the Dallas Texas Subcontractor's Performance Bond is to protect the project owner, also known as the obliged, from financial losses in case the subcontractor fails to meet their responsibilities. If a subcontractor defaults on their obligations, such as failing to complete the assigned work or delivering subpar results, the bond provides the obliged with financial compensation to cover the costs of hiring another subcontractor to complete the work or rectify any deficiencies. Different types of Dallas Texas Subcontractor's Performance Bonds may exist, depending on specific project requirements or contractual agreements. Some common variations include: 1. Bid Bond: This type of bond ensures that subcontractors who submit bids for a project will enter into a contract if they are awarded the job. It guarantees that the subcontractor will provide the necessary performance bond if selected. 2. Payment Bond: This bond guarantees that the subcontractor will pay all suppliers, laborers, and subcontractors involved in the project. It protects the project owner from potential claims or liens against the construction project resulting from non-payment. 3. Maintenance Bond: In some cases, a subcontractor may be required to provide a maintenance bond, which guarantees their work for a specific period after project completion. This bond provides coverage in case any defects or issues arise and need to be resolved during the maintenance period. It is important to note that the specific requirements for a Dallas Texas Subcontractor's Performance Bond can vary depending on the project's scope, size, and complexity. Contractors and subcontractors should consult with legal or bonding professionals to understand their specific obligations and requirements regarding these bonds.

Dallas Texas Subcontractor's Performance Bond

Description

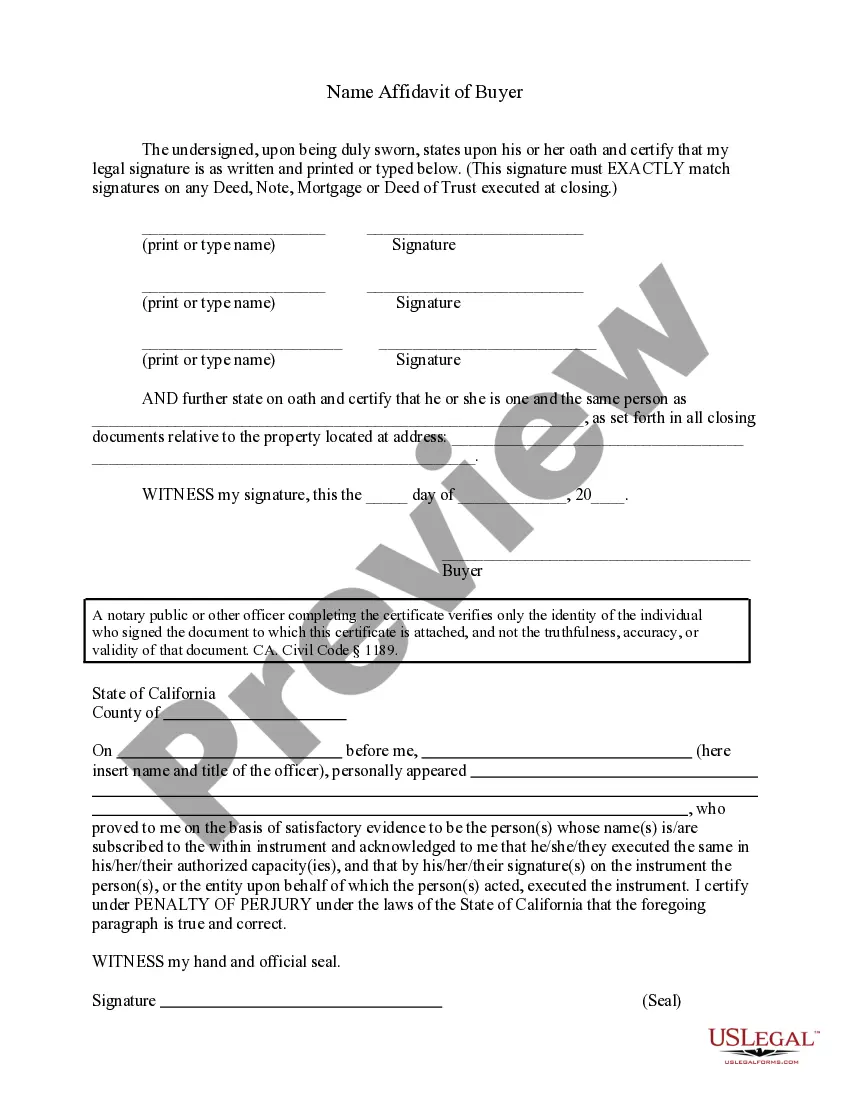

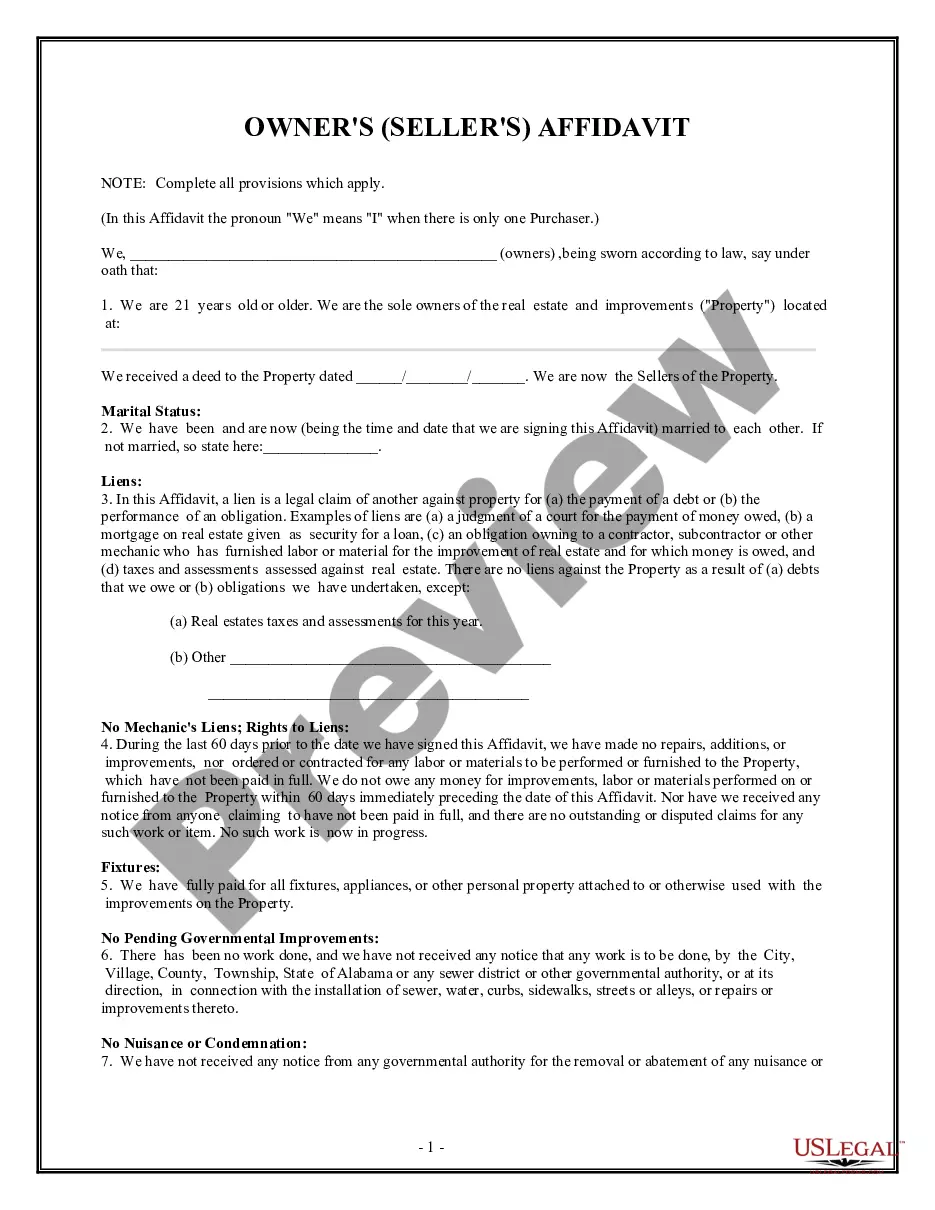

How to fill out Dallas Texas Subcontractor's Performance Bond?

Creating forms, like Dallas Subcontractor's Performance Bond, to manage your legal matters is a difficult and time-consumming task. Many situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for various scenarios and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Dallas Subcontractor's Performance Bond template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before getting Dallas Subcontractor's Performance Bond:

- Ensure that your template is specific to your state/county since the regulations for writing legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a brief intro. If the Dallas Subcontractor's Performance Bond isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin using our website and get the form.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s an easy task to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!