Title: San Diego, California Bond to Secure against Defects in Construction: Types and Detailed Description: When it comes to construction projects in San Diego, California, having a reliable bond to secure against defects is crucial. Such bonds are designed to protect both property owners and contractors, ensuring that any unforeseen defects in construction are addressed promptly and mitigated. This comprehensive description will cover various types of San Diego California bonds available to secure against defects in construction. 1. Performance Bond: A Performance Bond is a common type of surety bond that guarantees the contractor's performance according to the terms and conditions of the construction contract. In the case of defects, this bond offers financial coverage to the project owner, allowing them to rectify the issues without incurring additional costs. 2. Payment Bond: A Payment Bond ensures that subcontractors, suppliers, and laborers involved in the construction project are paid by the contractor. In case defects arise, this bond provides protection to those affected parties, guaranteeing that they are compensated. 3. Maintenance Bond: A Maintenance Bond, sometimes referred to as a Warranty Bond, provides coverage against defects that occur after the completion of a construction project. This bond ensures that the contractor is responsible for resolving any issues arising from faulty workmanship, materials, or design within a specified warranty period. 4. Subdivision Bond: For developers planning to create subdivisions or communities in San Diego, a Subdivision Bond is commonly required. This bond ensures that all public improvements, such as roads, infrastructure, and utilities, are constructed according to standards and free from defects. It provides protection to the city or county if the developer fails to fulfill their obligations. 5. Permit Bond: A Permit Bond is mandatory for contractors seeking building permits in San Diego, California. It guarantees that the construction project will adhere to all relevant building codes and regulations. This bond helps secure against any defects that may arise due to non-compliance with local guidelines. 6. Sub-Contractor Default Insurance: Although not a bond, Sub-Contractor Default Insurance is an alternative risk management tool utilized in San Diego construction projects. It provides financial security to the project owner in case a sub-contractor defaults on their obligations or if defects arise from their workmanship. In conclusion, San Diego, California offers various types of bonds to secure against defects in construction. Performance Bonds, Payment Bonds, Maintenance Bonds, Subdivision Bonds, Permit Bonds, and Sub-Contractor Default Insurance all play crucial roles in protecting stakeholders from potential financial impacts resulting from construction defects. These bonds offer assurance that any issues will be resolved promptly, maintaining the high standards of construction in San Diego.

San Diego California Bond to Secure against Defects in Construction

Description

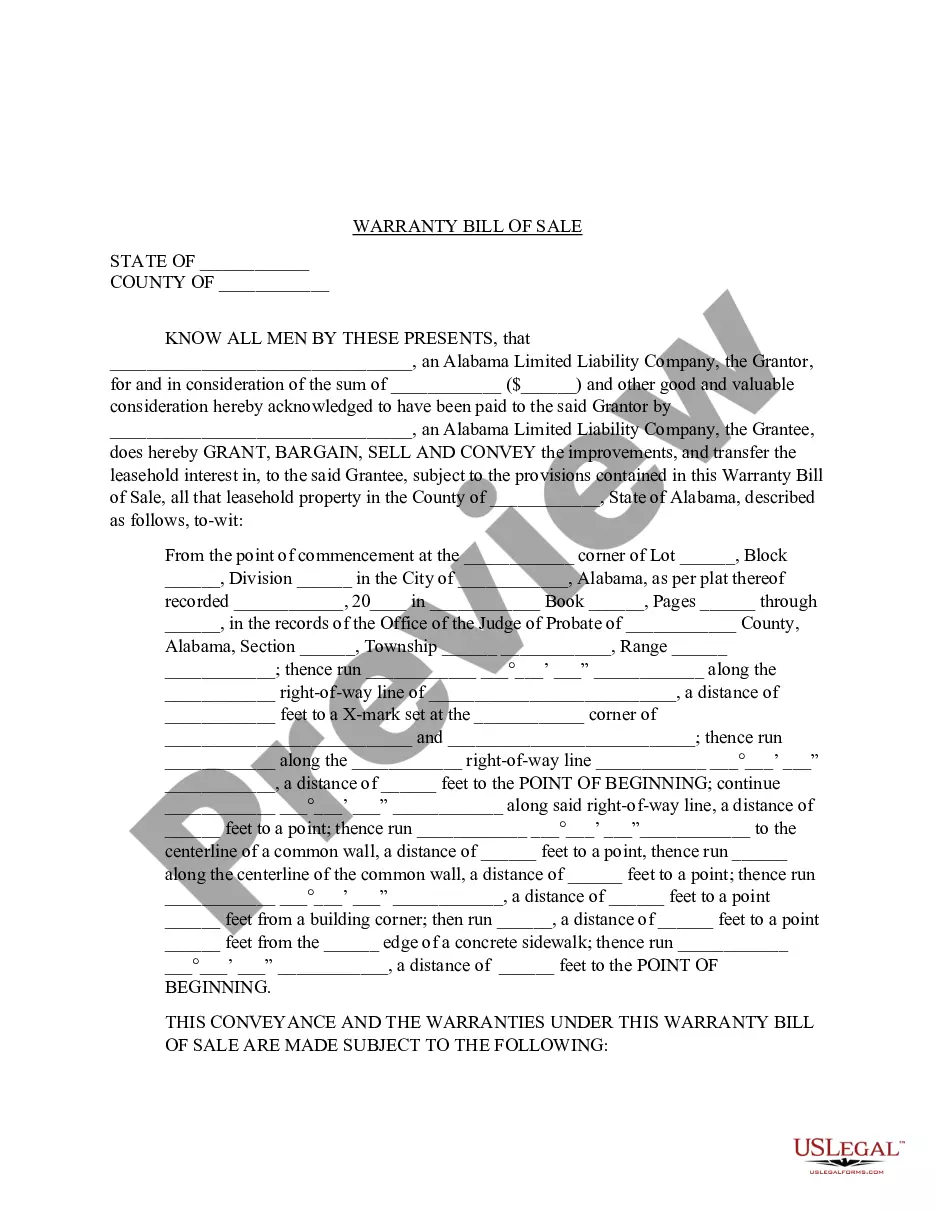

How to fill out San Diego California Bond To Secure Against Defects In Construction?

If you need to get a reliable legal paperwork provider to obtain the San Diego Bond to Secure against Defects in Construction, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of learning materials, and dedicated support team make it simple to find and execute various papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to search or browse San Diego Bond to Secure against Defects in Construction, either by a keyword or by the state/county the document is intended for. After locating required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the San Diego Bond to Secure against Defects in Construction template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes this experience less expensive and more reasonably priced. Create your first company, organize your advance care planning, create a real estate agreement, or execute the San Diego Bond to Secure against Defects in Construction - all from the convenience of your home.

Join US Legal Forms now!

Form popularity

FAQ

The 3 most common types of construction bonds are Bid Bonds, Performance Bonds, and Payment Bonds. Other construction bonds that are often required include Maintenance Bonds, Supply Bonds, Subdivision Bonds, and Site Improvement Bonds.

A performance bond is a type of contract construction bond that guarantees a contractor will complete a project according to the terms outlined in a contract by the project owner, also called the obligee. The obligee can be a city, state, or local government, as well as the federal government or a private developer.

A construction bond is a type of surety bond used by investors in construction projects. The bond protects against disruptions or financial loss due to a contractor's failure to complete a project or failure to meet project specifications.

When a performance bond is called and the claim has been deemed valid, a surety company will sometimes find a new contractor to complete the project. When this happens, a new contract is drafted with different terms and prices.

It can be simply described as the guarantee given by the surety firm to compensate the first party if a second party does not fulfill the obligations. If the necessary obligations are not fulfilled, a claim can be made on the bond.

A surety bond is a three-party agreement between a surety, a contractor, and an owner. The surety, (typically an insurance company) promises to satisfy the contractor's obligations if the contractor fails to perform in accordance with the construction contract.

The 3 most common types of construction bonds are Bid Bonds, Performance Bonds, and Payment Bonds. Other construction bonds that are often required include Maintenance Bonds, Supply Bonds, Subdivision Bonds, and Site Improvement Bonds.

A California contractor bond covers any damages caused by the principal. For example, if you don't complete a construction project per the terms of your contract, then the client can place a claim on your bond to cover the damages. Unlike insurance, you'll need to fully repay any claims paid out by the surety.

3 Types of Construction Bonds Bid Bonds. In the construction industry, contractors bid for construction contracts.Performance Bonds. These type of construction bonds guarantee that the contractor will complete the project according to the terms of the construction contract.Payment Bonds.