A Wake North Carolina Bond to Secure against Defects in Construction is a type of surety bond required by jurisdictions in Wake County, North Carolina, to safeguard against construction defects. This bond serves as financial protection for property owners, ensuring that any defective work, materials, or construction issues will be rectified by the contractor or developer. The purpose of a Wake North Carolina Bond to Secure against Defects in Construction is to provide assurance to the owner that their project will be completed with utmost quality and adherence to building regulations. These bonds play a crucial role in maintaining standards and protecting the interests of property owners. There are primarily two types of Wake North Carolina Bonds to Secure against Defects in Construction: 1. Performance Bond: This bond guarantees that the contractor will complete the construction project according to the specifications outlined in the contract. In case of any incomplete or faulty work, the bond will cover the costs associated with hiring a new contractor or correcting the defects. 2. Payment Bond: This bond ensures that all subcontractors, laborers, and suppliers involved in the construction project will be paid in a timely manner. If the contractor fails to fulfill their payment obligations, the bond will cover the outstanding payments to protect the rights of those involved. Investing in a Wake North Carolina Bond to Secure against Defects in Construction provides several benefits for property owners. Firstly, it offers financial security, as any defects or incomplete work can be rectified without the owner incurring additional expenses. Additionally, it promotes a sense of trust between the owner and contractor, fostering a cooperative relationship throughout the construction process. In summary, a Wake North Carolina Bond to Secure against Defects in Construction is a necessary safeguard for property owners in Wake County. By requiring contractors to obtain these bonds, the local jurisdiction is working towards ensuring that construction projects are completed to the highest standards, thereby protecting the value and integrity of properties within the community.

Wake North Carolina Bond to Secure against Defects in Construction

Description

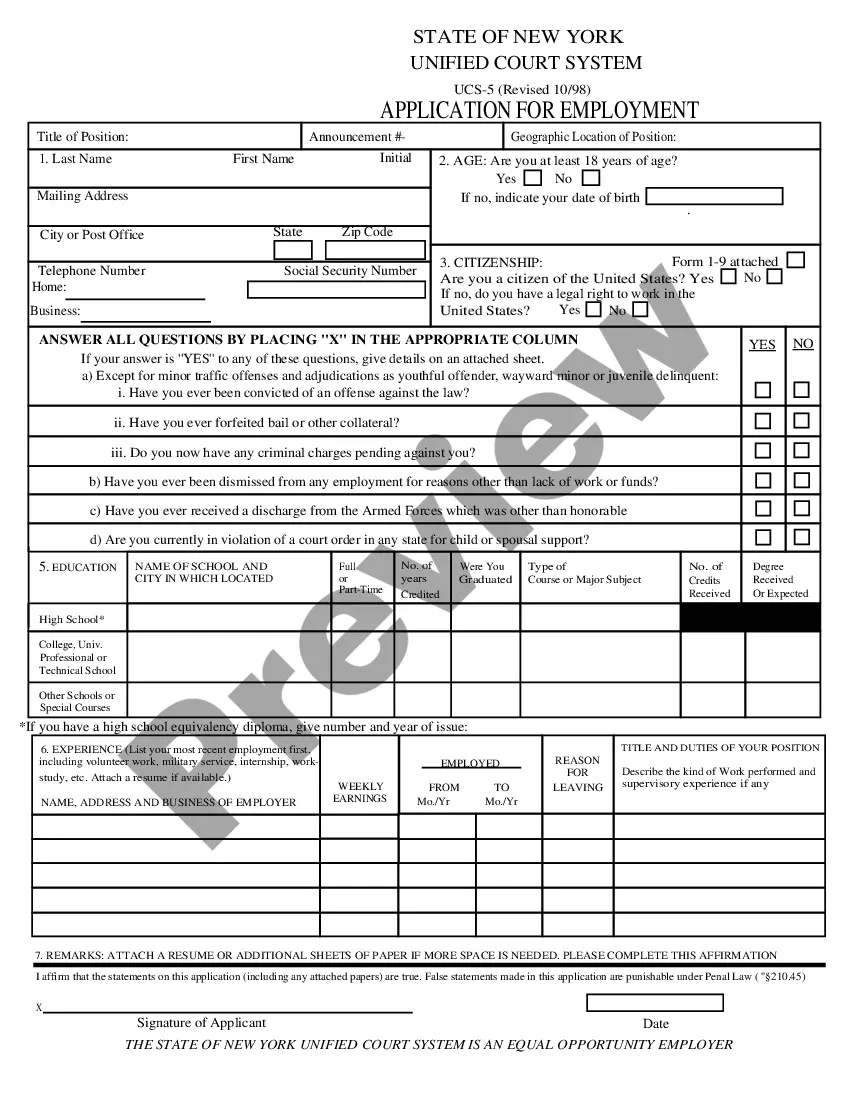

How to fill out Wake North Carolina Bond To Secure Against Defects In Construction?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Wake Bond to Secure against Defects in Construction, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Wake Bond to Secure against Defects in Construction from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Wake Bond to Secure against Defects in Construction:

- Take a look at the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Surety bonds play a vital role in the construction industry. They guarantee that contractors perform on jobs in compliance with contractual conditions and legal requirements. They protect project owners, other contractors and the public by playing the role of a financial security mechanism.

The three main types of construction bonds are bid, performance, and payment.

Construction bonds, also known as contract bonds, are a type of surety bond that guarantees the payment, performance, or bid of a project. It ensures that the contract will be completed to the standards specified in the initial agreement when the bid is won.

4 Easy Steps in Securing a Surety Bond Step 1: Verify Forms and Amounts. Many bonds go by the name surety bond, so you must specify which bonds and amounts you need.Step 2: Get a Quote.Step 3: Apply for a Bond.Step 4: Verify Information.

The process varies by state, but in general you must file your bond either with your state's commissioning official, or the county clerk in the county in which your principal place of business is located or in which you reside.

3 Types of Construction Bonds Bid Bonds. In the construction industry, contractors bid for construction contracts.Performance Bonds. These type of construction bonds guarantee that the contractor will complete the project according to the terms of the construction contract.Payment Bonds.

Understanding 4 Types of Surety Bonds Surety Bond Basics. A surety bond is an agreement among three parties, who are identified by the following terms:Contract Surety Bonds.Judicial Surety Bonds.Probate Court Surety Bonds.Commercial Surety Bonds.Obtaining a Surety Bond.

The three main types of construction bonds are bid, performance, and payment.

The major types of surety bonds are contractor license bonds, bid bonds, performance or contract bonds, and payment bonds. These bonds provide protection for the project owner and for taxpayers or investors in private projects. Usually, a project requires a trio of bid, performance, and payment bonds.