Fulton Georgia Private Client General Asset Management Agreement is a comprehensive financial contract between a private client and an asset management firm based in Fulton, Georgia. This agreement outlines the terms and conditions under which the asset management firm will provide various services to the client, tailored to their individual investment goals and objectives. The Fulton Georgia Private Client General Asset Management Agreement typically includes key provisions such as the scope of services to be provided, the duration of the agreement, the fees and compensation structure, and the responsibilities and obligations of both parties involved. Under this agreement, the asset management firm will offer personalized investment advice and portfolio management services, aimed at achieving the client's financial objectives. This may involve creating a diversified investment portfolio, selecting specific securities, periodic performance reporting, and regular communication to ensure that the client's investment goals are being met. It is important to note that there can be different types or variations of the Fulton Georgia Private Client General Asset Management Agreement, tailored to meet the unique requirements of different clients. Some of these variations may include: 1. Fixed-Term Agreement: This type of agreement specifies a predetermined term duration, typically ranging from one to five years or more. It ensures a structured relationship between the client and the asset management firm for a defined period. 2. Discretionary Investment Agreement: This agreement grants the asset management firm the authority to make investment decisions on behalf of the client without obtaining prior approval for each transaction. However, decisions are made in line with the client's investment objectives, risk tolerance, and overall investment policy guidelines. 3. Non-Discretionary Investment Agreement: In contrast to the discretionary agreement, this agreement requires the asset management firm to obtain explicit approval from the client for each investment decision made. The client retains more control and involvement in the investment process. 4. Specialized Investment Agreement: This type of agreement is tailored to meet specific requirements of clients, such as investing in specific industries or asset classes, or pursuing particular investment strategies like socially responsible investing or impact investing. These various types of Fulton Georgia Private Client General Asset Management Agreements offer flexibility and customization options to suit the client's preferences and needs while ensuring a professional and regulated framework for managing their assets. In summary, the Fulton Georgia Private Client General Asset Management Agreement is a vital document that governs the relationship between a private client and an asset management firm. It serves as a roadmap for the provision of investment advice, portfolio management services, and outlines the responsibilities and obligations of both parties.

Fulton Georgia Private Client General Asset Management Agreement

Description

How to fill out Fulton Georgia Private Client General Asset Management Agreement?

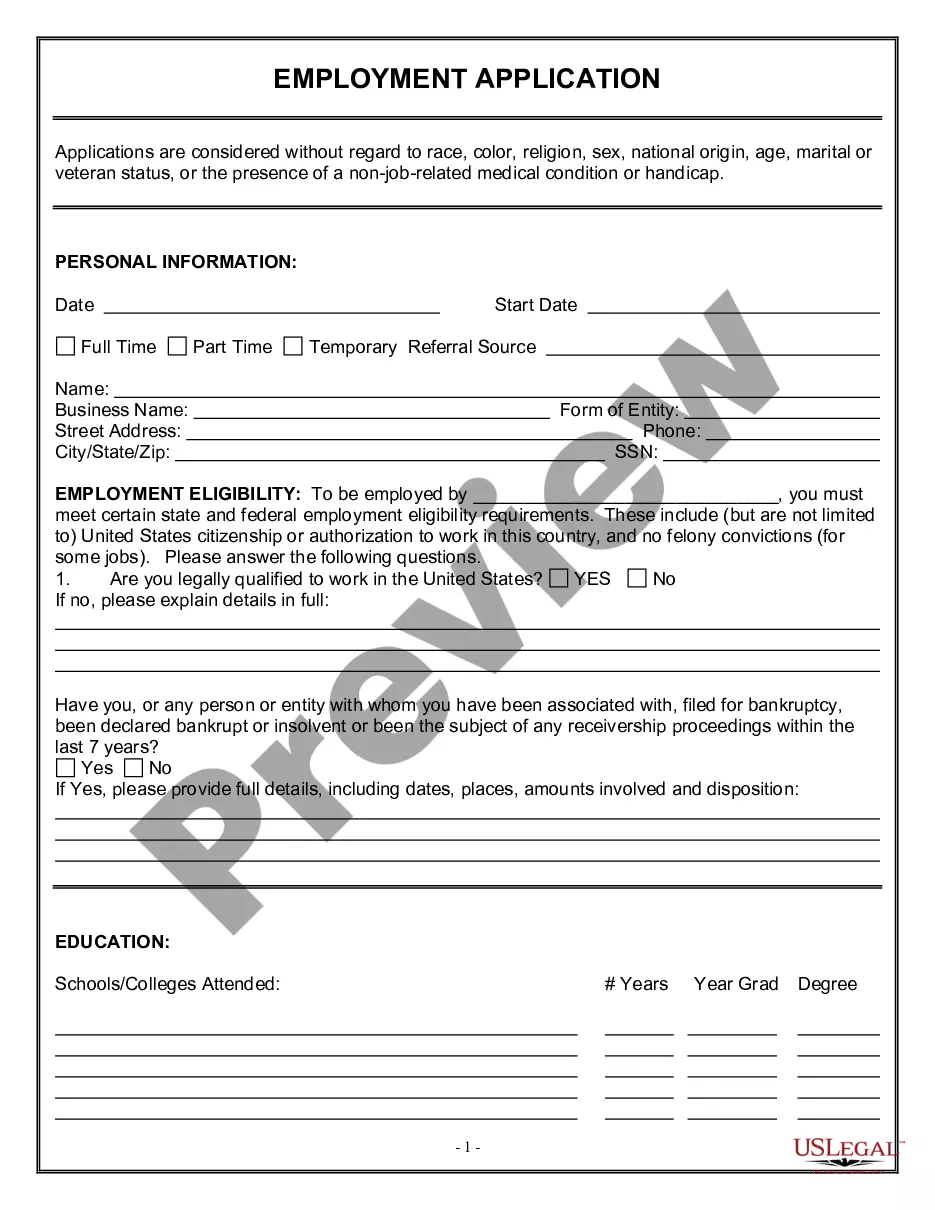

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from the ground up, including Fulton Private Client General Asset Management Agreement, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various categories varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find detailed resources and guides on the website to make any activities associated with document execution straightforward.

Here's how you can locate and download Fulton Private Client General Asset Management Agreement.

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the validity of some documents.

- Examine the related document templates or start the search over to locate the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment gateway, and buy Fulton Private Client General Asset Management Agreement.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Fulton Private Client General Asset Management Agreement, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional entirely. If you need to deal with an exceptionally difficult case, we advise using the services of an attorney to check your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Become one of them today and get your state-compliant documents with ease!