Maricopa, Arizona Private Client General Asset Management Agreement is a legal contract established between a private client and a professional asset management firm based in Maricopa, Arizona. This agreement outlines the terms and conditions under which the asset management firm will provide comprehensive financial advisory and investment management services to its clients. This agreement encompasses various aspects related to the management of a client's assets, including investment strategies, risk tolerance assessment, portfolio construction, performance reporting, and ongoing client communication. The primary aim of this agreement is to protect the interests of the client and provide them with personalized and tailored investment solutions. Under the Maricopa, Arizona Private Client General Asset Management Agreement, there may be different types or variations to suit the specific needs and requirements of clients. These variations may include: 1. Standard Private Client General Asset Management Agreement: This is the most common type of agreement, catering to the usual requirements of private investors seeking professional asset management services in Maricopa, Arizona. 2. High Net Worth/Private Banking Asset Management Agreement: This type of agreement is designed for individuals with substantial investible assets, typically exceeding a certain threshold. The services provided under this agreement may be more comprehensive and may include additional offerings, such as estate planning, tax optimization, and philanthropic strategies. 3. Retirement Portfolio Asset Management Agreement: This specific agreement focuses on managing assets for clients who are primarily concerned with achieving long-term financial stability and growth to support their retirement goals. The investment strategies may prioritize capital preservation and income generation, while considering the client's retirement timeline, risk tolerance, and desired lifestyle during retirement. 4. Trust and Estate Asset Management Agreement: This type of agreement caters to clients who have established trusts or are dealing with family wealth preservation and inheritance planning. The asset management firm works closely with legal advisors to manage the assets within the trust, ensuring compliance with legal requirements and fulfilling the intended purposes of the trust. In conclusion, the Maricopa, Arizona Private Client General Asset Management Agreement is a comprehensive contract that specifies the terms and conditions for asset management services provided by a professional firm. The different types of agreements mentioned above ensure that clients receive customized solutions based on their unique financial circumstances, goals, and preferences.

Maricopa Arizona Private Client General Asset Management Agreement

Description

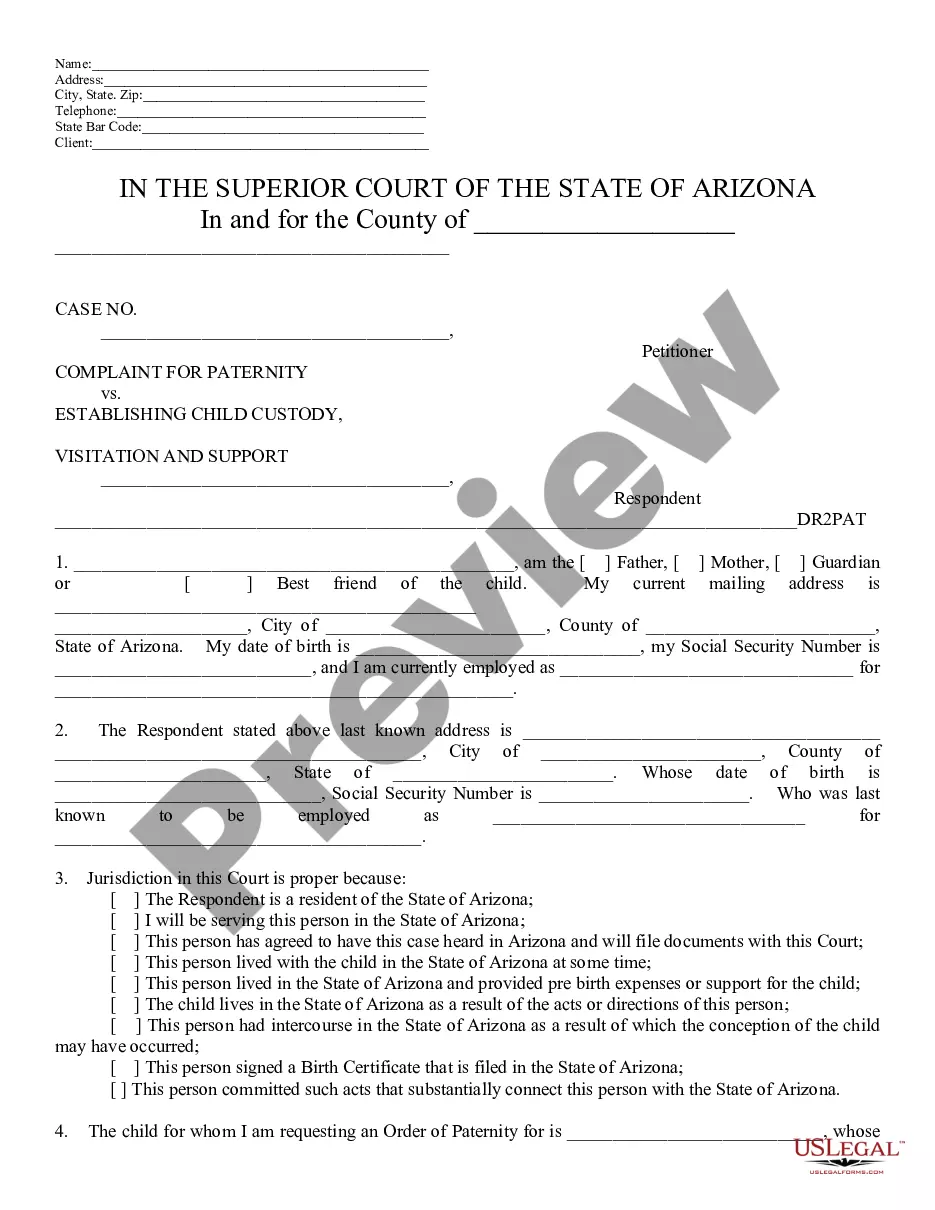

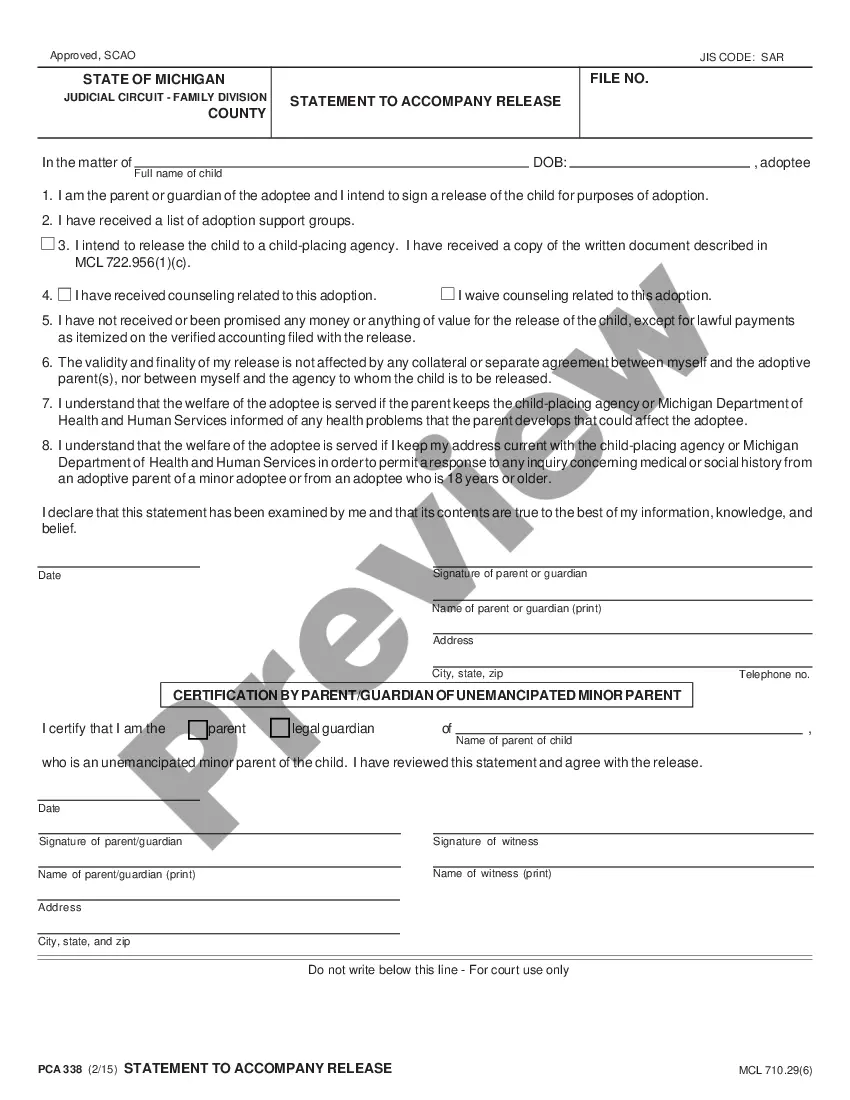

How to fill out Maricopa Arizona Private Client General Asset Management Agreement?

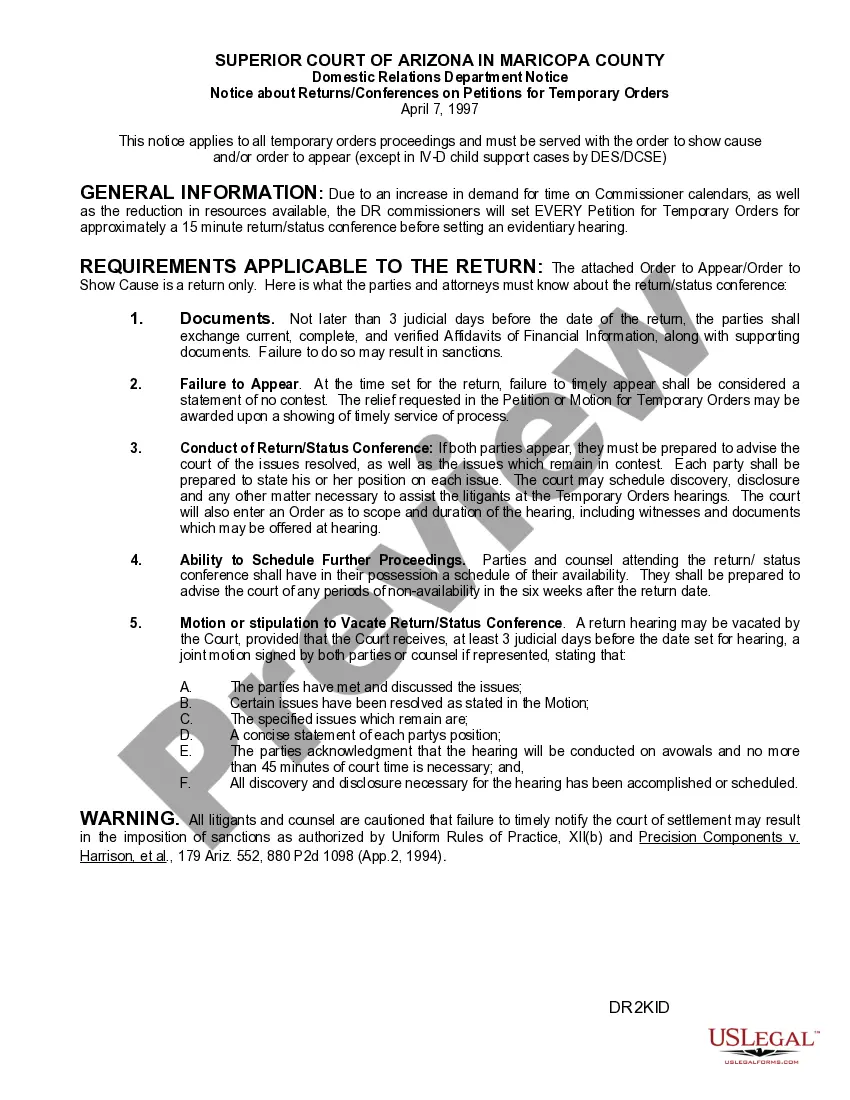

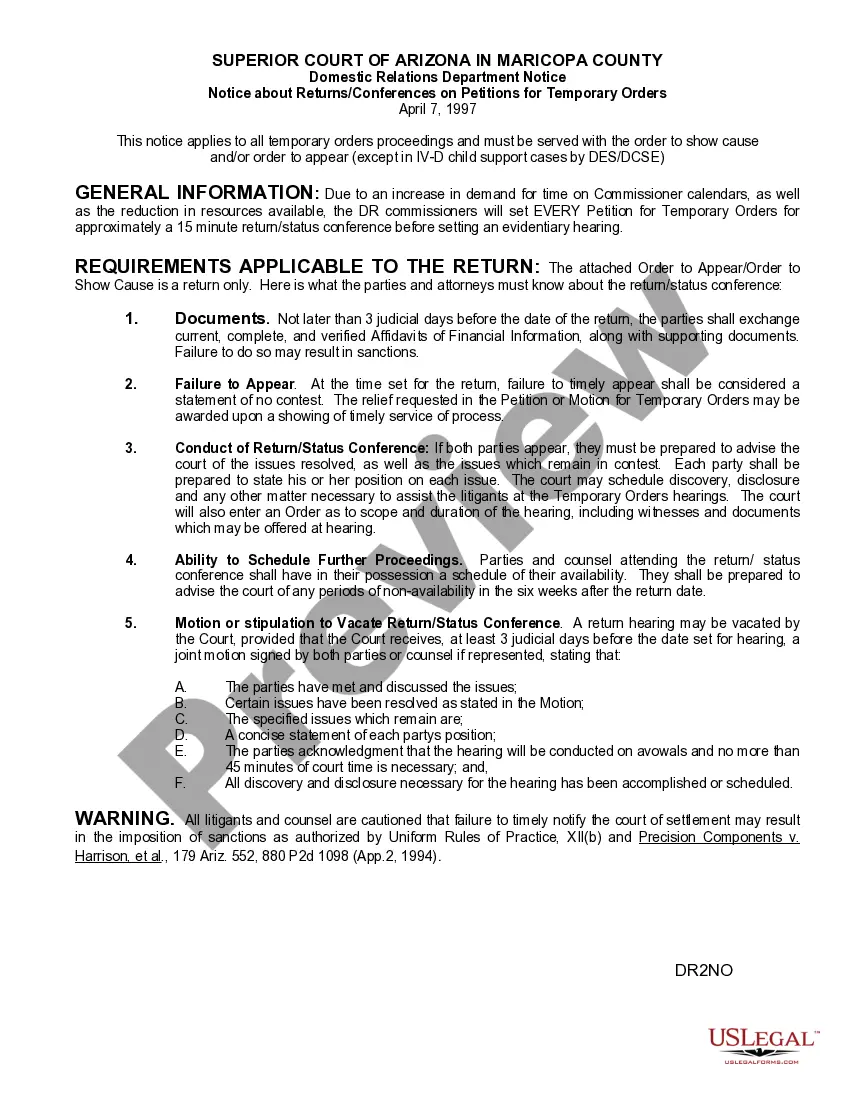

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Maricopa Private Client General Asset Management Agreement, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various categories ranging from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching process less challenging. You can also find detailed resources and guides on the website to make any activities associated with paperwork completion straightforward.

Here's how you can purchase and download Maricopa Private Client General Asset Management Agreement.

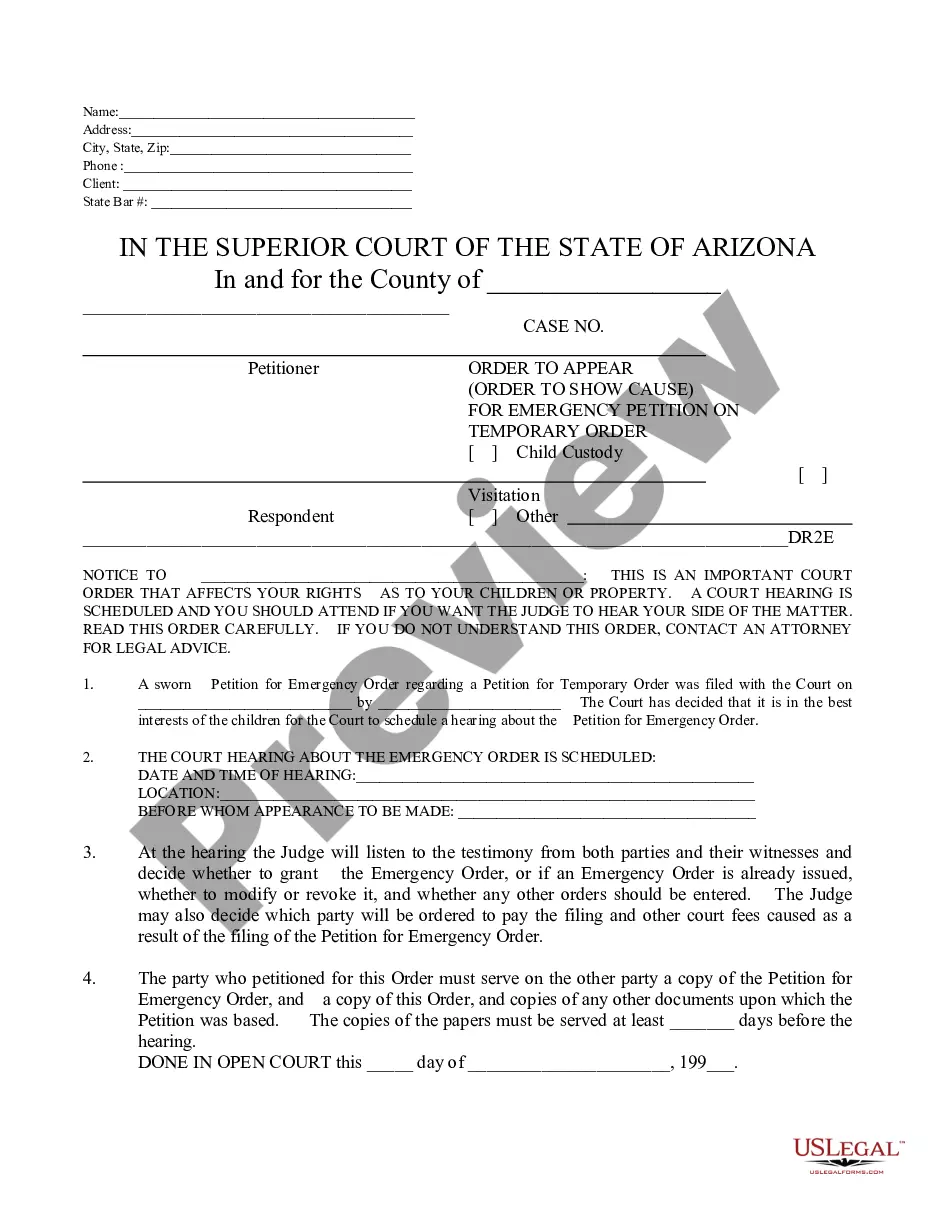

- Go over the document's preview and outline (if provided) to get a general information on what you’ll get after getting the document.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can impact the legality of some documents.

- Check the similar forms or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment method, and purchase Maricopa Private Client General Asset Management Agreement.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Maricopa Private Client General Asset Management Agreement, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer completely. If you have to deal with an extremely complicated situation, we recommend using the services of a lawyer to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Become one of them today and purchase your state-specific documents with ease!

Form popularity

FAQ

High medium density residential (R1-6): the principal land uses of this district are single-family dwellings. No residence in this district shall have livable floor area of less than one thousand two hundred square feet.

Approximately 90% of the unincorporated areas of the County are zoned RU (Rural). These districts allow residential uses on large acreage, as well as some other uses typically found in rural areas.

However, certain changes, such as new constructions or additions, parcel splits or consolidations, or changes to a property's use trigger a reassessment of the LPV.

What the heck is RU-4? RU-4 is a magical designation in Cochise county that will guarantee that our land will never be divided into anything less than 4 acres AND it allows us to opt-out of some building permits and inspections. It will also let us build in unconventional ways like straw bale and earthbag housing.

This district is intended to promote and preserve a low-density residential character and maintain open space and natural features. The principal land use is single-family dwellings and uses incidental or accessory thereto. Lot size of at least 43,560 sq. ft is required in this district.

(R1-6) SINGLE-FAMILY RESIDENTIAL ZONING DISTRICT ? SIX THOUSAND SIX HUNDRED (6,600) SQUARE FEET PER DWELLING UNIT.

In addition to the regular location standards, detached accessory buildings are permitted to be constructed/placed at a minimum 3 foot setback in any location other than the required front yard. Accessory buildings cannot occupy more than 30 percent of the required rear yard or side yard.

GR-1 RURAL RESIDENTIAL ZONE.

A. Purpose. A basic purpose of these regulations is to foster the creation of living areas which can assist the establishment of stable, functional neighborhoods.