A San Bernardino California Security Agreement regarding Member Interests in a Limited Liability Company is a legal document that outlines the terms and conditions relating to the collateral used to secure the repayment of a loan or debt by a member of an LLC located in San Bernardino, California. This contract is crucial for protecting the interests of both the lender and the member of the LLC involved in the borrowing arrangement. By using relevant keywords, let's dive into a detailed description of this agreement and its different types. 1. Purpose: The purpose of a San Bernardino California Security Agreement regarding Member Interests in a Limited Liability Company is to establish a legal framework for securing a loan or debt by creating a security interest in the member's interests and assets in the LLC. The agreement ensures that if the member defaults on the loan, the lender has the right to seize and sell the collateral to recover the outstanding debt. 2. Essential Elements: The agreement typically includes the following essential elements: — Identification of the member(s) granting the security interest — Description of the collateral securing the loan (member's interests, assets, distributions, voting rights, etc.) — Obligations and responsibilities of both the lender and the member — The amount of the loan and repayment terms — Events of default and remedies available to the lender — Governing law and dispute resolution mechanisms 3. Different types of Security Agreements regarding Member Interests: a) Personal Property Security Agreement: This type of agreement involves securing personal property or assets owned by the member, such as equipment, inventory, accounts receivable, or intellectual property. It provides a comprehensive understanding of the collateral and the obligations associated with it. b) Real Property Security Agreement: This agreement is used when the LLC member wishes to pledge their interests in real estate or real property as collateral. It outlines the specific details of the property, including its location, legal description, and any liens or encumbrances. c) Cross-Collateralization Agreement: In certain cases, a member may use multiple assets and interests within the LLC as collateral against a single loan. A cross-collateralization agreement ensures that the lender has a security interest in each of the specified assets, reducing the risk associated with the loan. d) Subordination Agreement: Sometimes, a member may have multiple loans or debts secured against their interests in the LLC. In such cases, a subordination agreement is used to establish the priority of these security interests and determine which debt takes precedence in case of default or bankruptcy. In conclusion, a San Bernardino California Security Agreement regarding Member Interests in a Limited Liability Company is a vital document that safeguards the lender's rights and the member's obligations in a borrowing arrangement. Depending on the nature of the collateral or the specific requirements of the situation, various types of security agreements can be employed to secure these interests effectively.

San Bernardino California Security Agreement regarding Member Interests in Limited Liability Company

Description

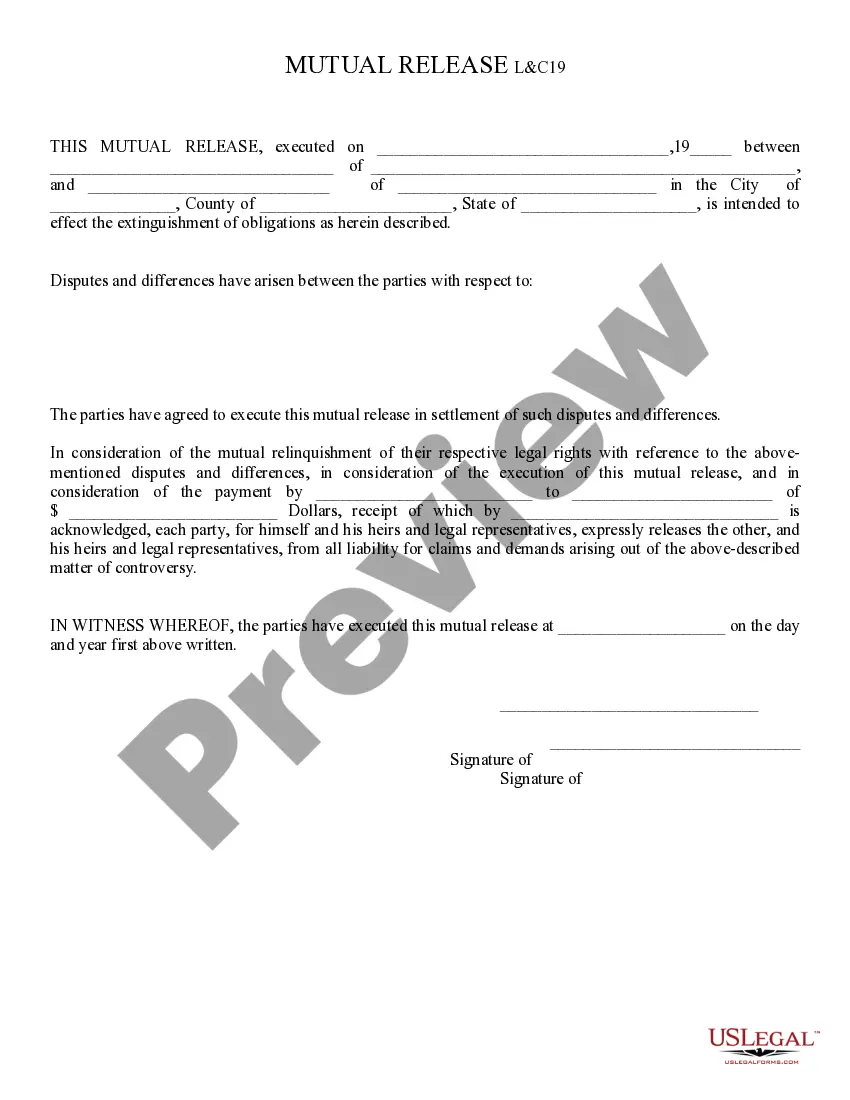

How to fill out San Bernardino California Security Agreement Regarding Member Interests In Limited Liability Company?

Drafting papers for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate San Bernardino Security Agreement regarding Member Interests in Limited Liability Company without professional help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid San Bernardino Security Agreement regarding Member Interests in Limited Liability Company by yourself, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the San Bernardino Security Agreement regarding Member Interests in Limited Liability Company:

- Examine the page you've opened and check if it has the document you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that fits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any situation with just a few clicks!