The Hennepin Minnesota Affiliate Letter in Rule 145 Transaction is a legal document that plays a crucial role in certain financial transactions. It is associated with rule 145 of the Securities Act of 1933, which addresses the registration requirements for the issuance of securities in certain business combinations or reclassification of securities. In a Rule 145 Transaction, where a company intends to offer securities in exchange for the securities of another company, an affiliate letter becomes essential. This letter is required from any person or entity that is considered an affiliate of the company offering the securities. An affiliate, in this context, refers to any person or entity that controls, is controlled by, or is under common control with the company. The purpose of the Hennepin Minnesota Affiliate Letter is to provide disclosure and assurances regarding the affiliate's interest and involvement in the transaction. This letter typically contains detailed information about the affiliate's relationship with the company, including their position, ownership or control of securities, and any potential conflicts of interest. Different types of Hennepin Minnesota Affiliate Letter in Rule 145 Transactions may include: 1. Affiliate Letter from Officers: This type of affiliate letter is issued by the officers of the company. It provides information about their role in the transaction, their ownership of securities, and any potential benefits or compensation they may receive from the transaction. 2. Affiliate Letter from Directors: Directors of the company may also be required to provide an affiliate letter. This letter outlines their position, ownership interests, and any potential conflicts of interest that could arise from the transaction. 3. Affiliate Letter from Major Shareholders: If significant shareholders of the company are considered affiliates, they may be required to submit an affiliate letter. This letter details their ownership interests, any agreements related to the transaction, and their intentions regarding the exchange of securities. 4. Affiliate Letter from Controlling Entities: In cases where a controlling entity exists, such as a parent company or a majority shareholder, an affiliate letter may be necessary to disclose their influence over the decision-making process and their interest in the success of the transaction. It is important to note that the Hennepin Minnesota Affiliate Letter in Rule 145 Transaction serves as a legal requirement to ensure transparency and protect the interests of shareholders and potential investors. Companies and affiliates involved in such transactions must carefully prepare and provide accurate and comprehensive information in these letters, as failure to do so can result in legal consequences.

Hennepin Minnesota Affiliate Letter in Rule 145 Transaction

Description

How to fill out Hennepin Minnesota Affiliate Letter In Rule 145 Transaction?

Drafting documents for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft Hennepin Affiliate Letter in Rule 145 Transaction without professional help.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Hennepin Affiliate Letter in Rule 145 Transaction on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Hennepin Affiliate Letter in Rule 145 Transaction:

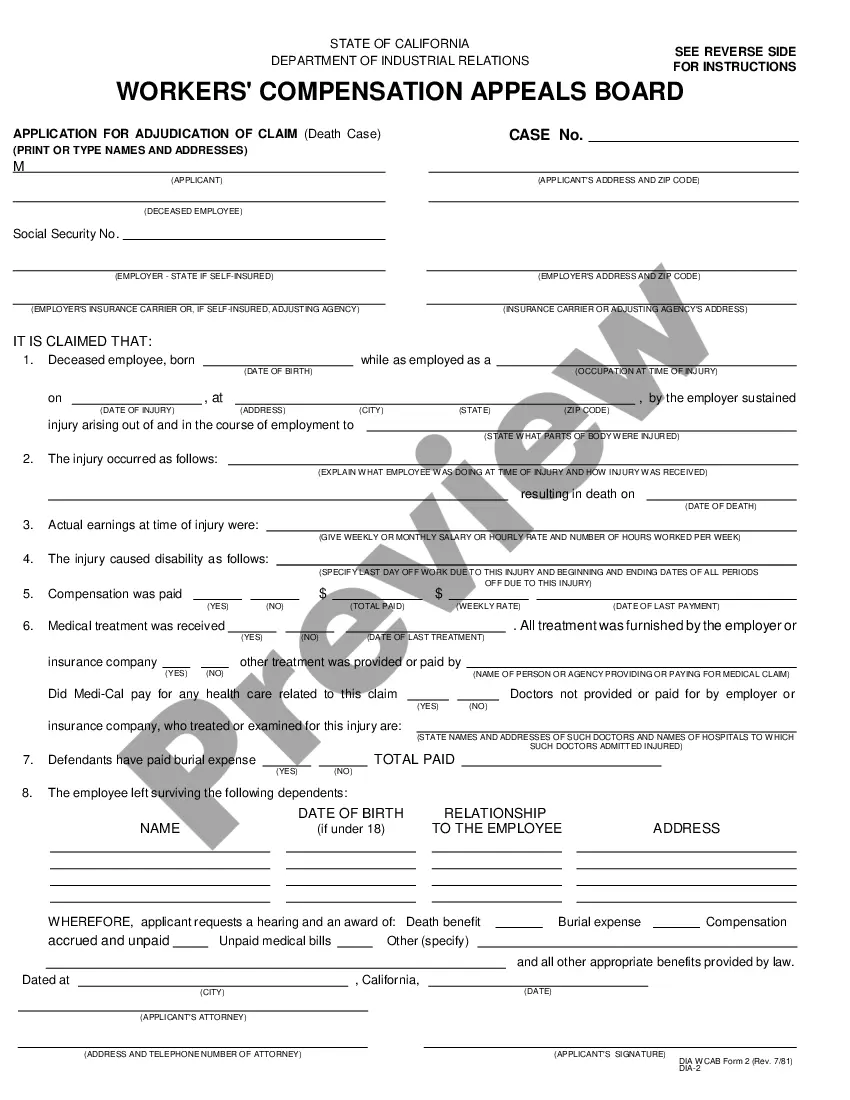

- Examine the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any situation with just a few clicks!