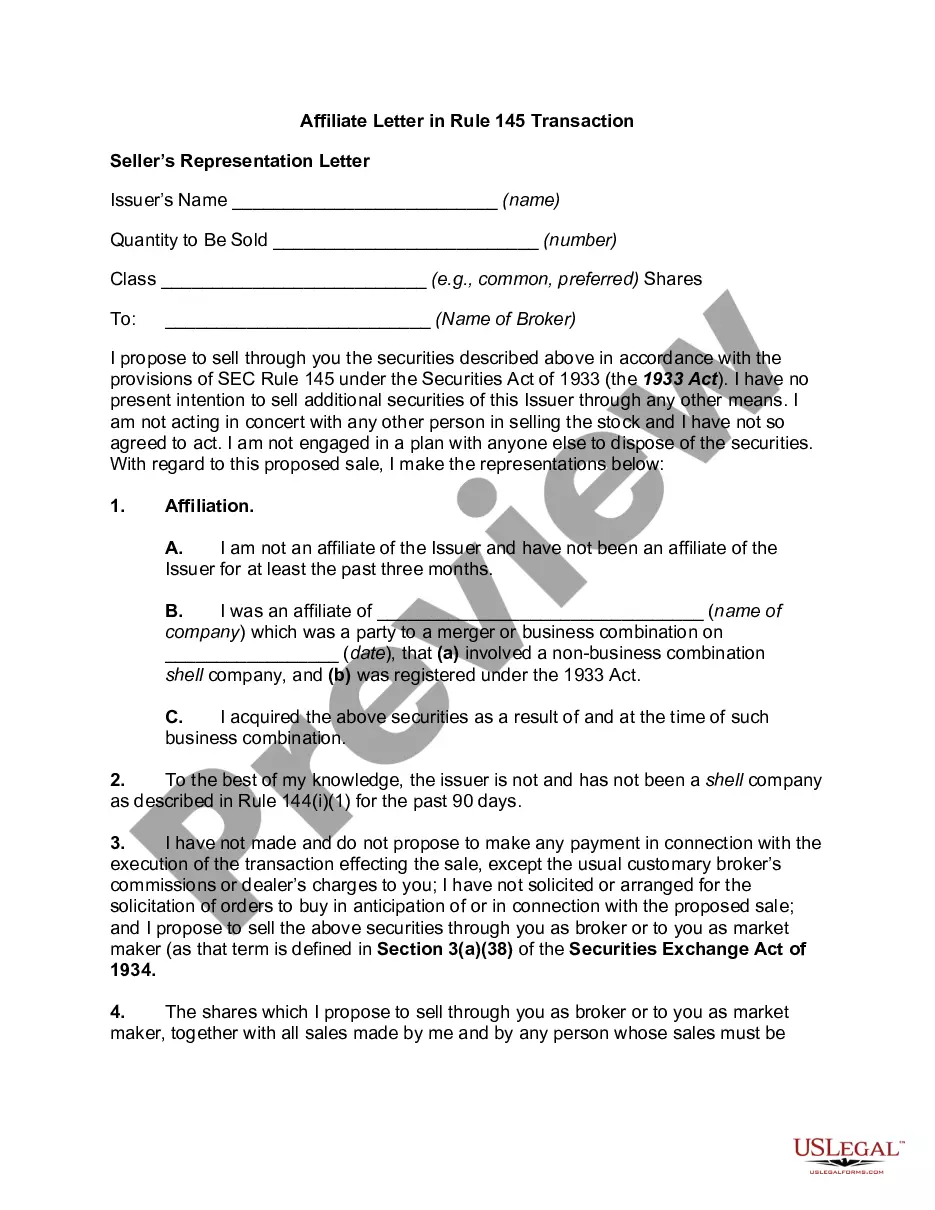

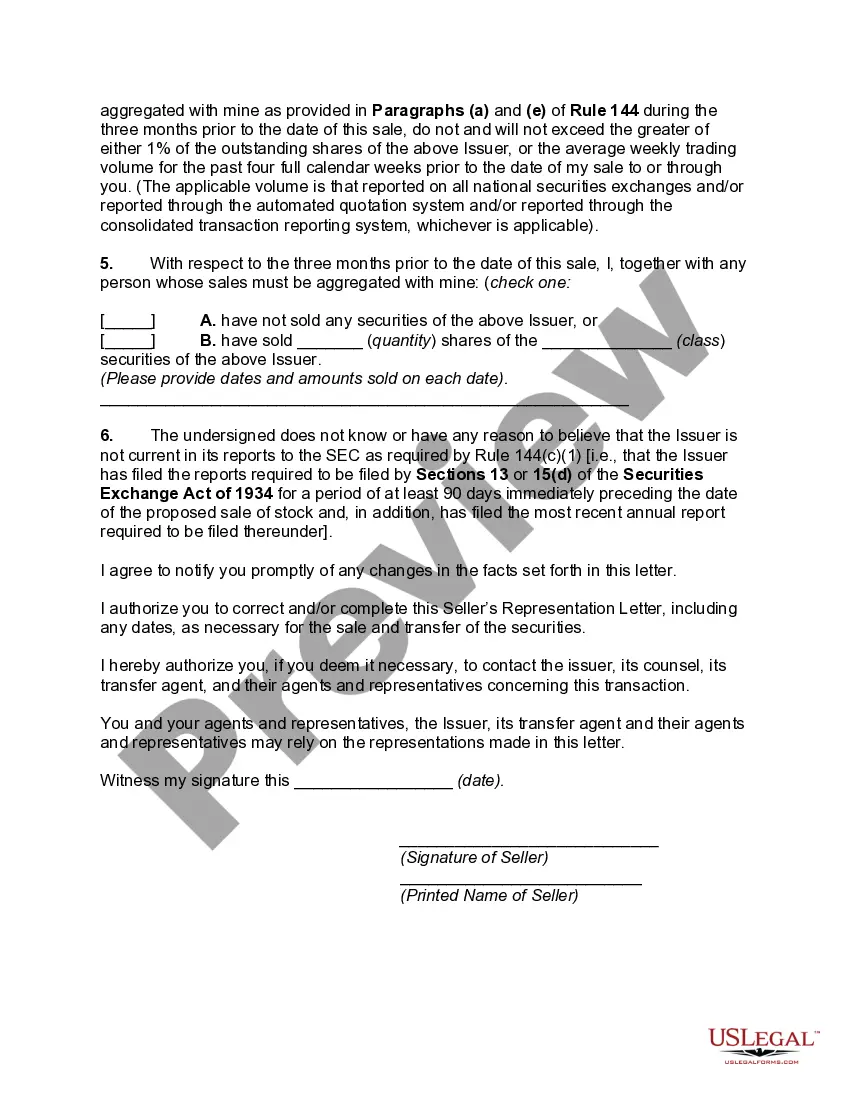

Orange, California is a vibrant city located in Orange County, California. It is known for its picturesque landscapes, thriving community, and a wide range of activities and attractions. Orange is home to several historical landmarks, including California State University, Fullerton, which contributes to the city's educational and cultural diversity. An "Orange California Affiliate Letter in Rule 145 Transaction" refers to a specific type of transaction that is governed by Rule 145 of the Securities Act of 1933. Rule 145 is designed to regulate certain business combination transactions, particularly when a company is issuing securities to its affiliates in exchange for their stock or assets. In such a transaction, an Orange California affiliate letter plays a crucial role. There are different types of Orange California affiliate letters that can be used in a Rule 145 transaction. Here are some examples: 1. Orange California Affiliate Supporting Letter: This type of affiliate letter is provided by an affiliate of the company involved in the Rule 145 transaction. It generally contains detailed information about the affiliate's relationship with the company, including their ownership stake, role, and any relevant financial information. This letter aims to demonstrate that the affiliate has a genuine interest in the transaction and is acting in accordance with the requirements of Rule 145. 2. Orange California Affiliate Consent Letter: In this type of affiliate letter, the affiliate provides their consent to the proposed Rule 145 transaction. The letter may also outline any conditions or restrictions that the affiliate wishes to include in the transaction to protect their interests. This letter signifies the affiliate's agreement to be bound by the terms of the transaction and indicates their understanding of the potential impact and risks involved. 3. Orange California Affiliate Disclosure Letter: This letter focuses on disclosing any material information that the affiliate may have regarding the Rule 145 transaction and the company involved. It is essential to provide complete and accurate information to enable potential investors or stockholders to make informed decisions. The disclosure letter may include information about the affiliate's financial situation, potential conflicts of interest, or any other relevant details. In conclusion, an Orange California Affiliate Letter in Rule 145 Transaction is a document used in specific business combination transactions within the city of Orange, California, governed by Rule 145 of the Securities Act of 1933. Different types of affiliate letters, including supporting letters, consent letters, and disclosure letters, play key roles in ensuring transparency and compliance in these transactions.

Orange California Affiliate Letter in Rule 145 Transaction

Description

How to fill out Orange California Affiliate Letter In Rule 145 Transaction?

Dealing with legal forms is a must in today's world. However, you don't always need to seek professional help to create some of them from the ground up, including Orange Affiliate Letter in Rule 145 Transaction, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various types ranging from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find information resources and guides on the website to make any activities related to paperwork execution straightforward.

Here's how to locate and download Orange Affiliate Letter in Rule 145 Transaction.

- Go over the document's preview and description (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the legality of some documents.

- Examine the similar document templates or start the search over to find the correct file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment method, and purchase Orange Affiliate Letter in Rule 145 Transaction.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Orange Affiliate Letter in Rule 145 Transaction, log in to your account, and download it. Needless to say, our platform can’t take the place of a legal professional completely. If you have to deal with an exceptionally complicated case, we advise using the services of a lawyer to check your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and get your state-compliant paperwork effortlessly!