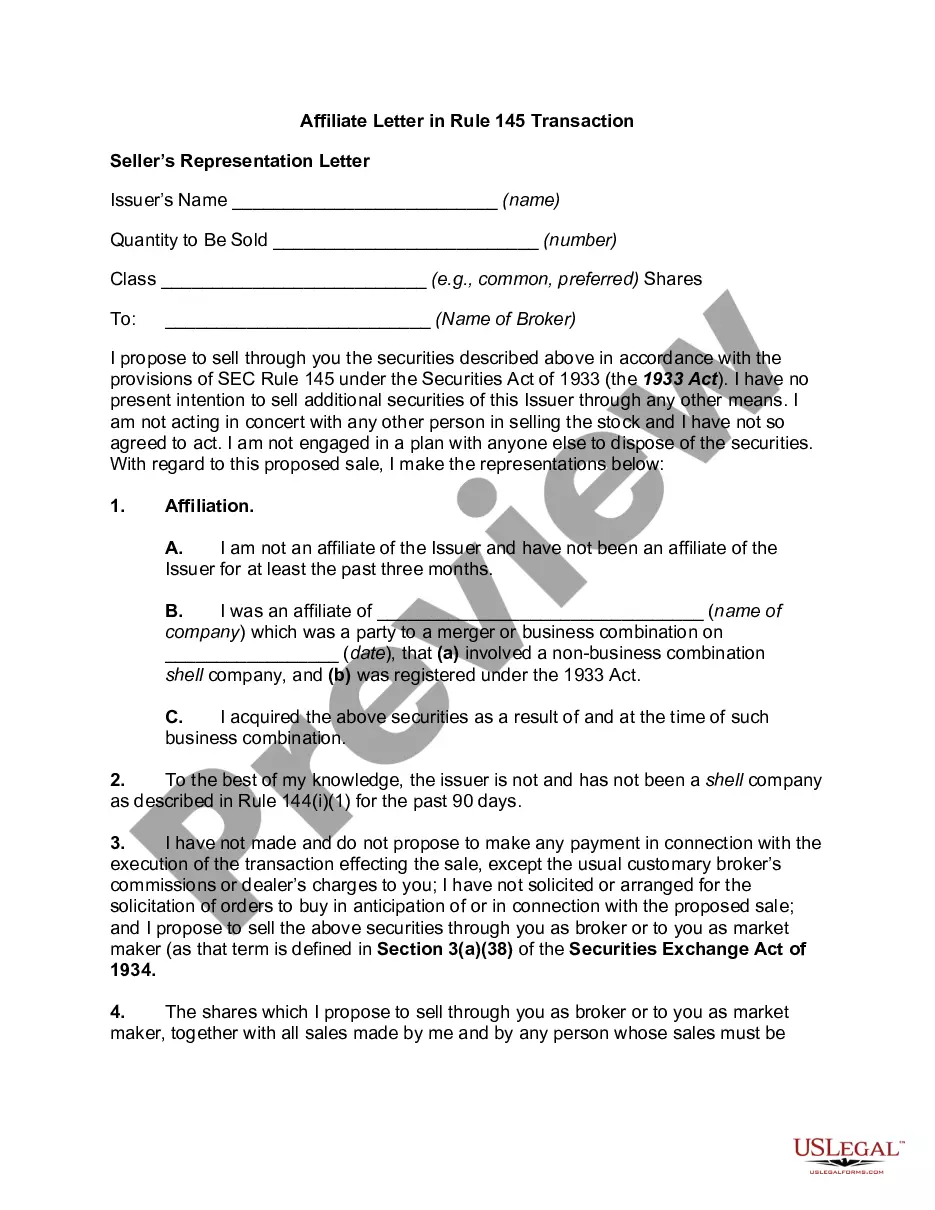

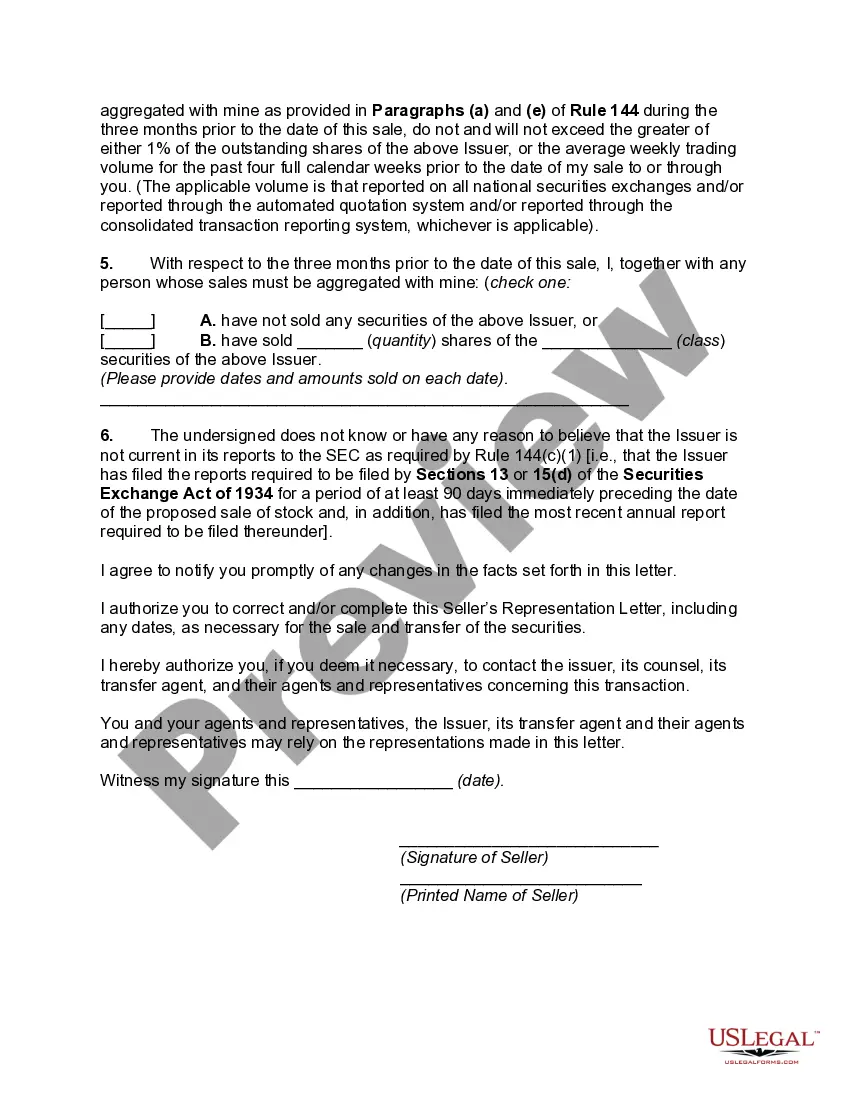

San Antonio Texas Affiliate Letter in Rule 145 Transaction: A Comprehensive Overview In Rule 145 transactions, an affiliate letter is often required by the Securities and Exchange Commission (SEC) to ensure compliance with federal securities laws. Affiliate letters are particularly important in cases when a party involved in the transaction is an affiliate of the issuer. This article focuses on San Antonio, Texas, and explores the concept of the San Antonio Texas Affiliate Letter in Rule 145 Transaction, shedding light on its significance and any possible variations. San Antonio, Texas serves as a prominent hub for various industries, ranging from tourism and healthcare to military and shipping. As a result, it experiences a substantial amount of corporate activity, including mergers, acquisitions, and other business reorganizations. When such transactions fall under Rule 145 of the Securities Act of 1933, an affiliate letter is often required as a means to ensure proper disclosure and adherence to regulatory requirements. Affiliate letters play a crucial role in Rule 145 transactions, as they provide assurance that the affiliate party will comply with certain limitations and restrictions on the resale of securities received in the transaction. By obtaining an affiliate letter, the issuer aims to address any concerns relating to potential insider trading or market manipulation. This letter serves as a formal agreement between the issuer and the affiliate, outlining the terms and conditions under which the affiliate may sell or transfer the securities they receive in the transaction. While the San Antonio Texas Affiliate Letter in Rule 145 Transaction does not have specific variations compared to other locations, it can be tailored to address the particular requirements and circumstances of the transaction. Factors such as the nature of the business, the relationship between the affiliate and the issuer, and the size and scope of the transaction can all influence the content and provisions within the affiliate letter. Therefore, it is crucial to consult legal counsel familiar with securities laws to ensure that the San Antonio Affiliate Letter aligns with the unique circumstances of the Rule 145 transaction. When drafting a San Antonio Texas Affiliate Letter in Rule 145 Transaction, several essential elements should be included. These may consist of a representation from the affiliate that they are an affiliate of the issuer, a commitment to comply with applicable securities laws, and an agreement to comply with certain resale restrictions. Additionally, the affiliate letter should acknowledge that the securities received in the transaction may require registration or that an exemption under the securities laws should be available for any resale. In summary, San Antonio, Texas is no different from any other location when it comes to Affiliate Letters in Rule 145 Transactions. It is crucial for parties involved in such transactions to understand the significance of affiliate letters in ensuring compliance with securities laws and providing transparency to investors. While the San Antonio Texas Affiliate Letter in Rule 145 Transaction does not have distinct variations, it should be tailored to meet the specific circumstances of the transaction, guided by legal expertise.

San Antonio Texas Affiliate Letter in Rule 145 Transaction

Description

How to fill out San Antonio Texas Affiliate Letter In Rule 145 Transaction?

If you need to find a trustworthy legal form provider to find the San Antonio Affiliate Letter in Rule 145 Transaction, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of supporting materials, and dedicated support make it simple to get and execute various documents.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply select to look for or browse San Antonio Affiliate Letter in Rule 145 Transaction, either by a keyword or by the state/county the form is created for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the San Antonio Affiliate Letter in Rule 145 Transaction template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be immediately available for download once the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less pricey and more reasonably priced. Set up your first business, arrange your advance care planning, create a real estate contract, or execute the San Antonio Affiliate Letter in Rule 145 Transaction - all from the convenience of your home.

Sign up for US Legal Forms now!