The Harris Texas Accredited Investor Representation Letter is a crucial document that serves as proof of an individual's status as an accredited investor in Texas. This letter is commonly required by various financial institutions, investment firms, and private securities companies to ensure compliance with state and federal securities regulations. An accredited investor is an individual or entity that meets specific criteria set by the U.S. Securities and Exchange Commission (SEC), allowing them to invest in certain private investments, such as hedge funds, venture capital funds, or private equity offerings. The purpose of the accreditation is to ensure that only individuals with sufficient financial knowledge and resources can participate in higher-risk investment opportunities. The Harris Texas Accredited Investor Representation Letter typically includes the following essential details: 1. Personal Information: The letter begins by stating the individual investor's full legal name, address, contact details, and relevant identification information (such as social security number or taxpayer identification number). 2. Statement of Accreditation: This section explicitly confirms that the investor meets the necessary accreditation requirements set forth by SEC regulations. These qualifications primarily involve possessing a high net worth or a significant income, among other criteria defined by the SEC. 3. Elaboration of Accreditation Criteria: The letter provides a detailed explanation of the specific qualification(s) met by the investor. It states the required financial thresholds, such as their net worth or annual income, which make them eligible for accreditation. This information may vary depending on the type of accredited investor status claimed. It is important to note that there may be different types of Harris Texas Accredited Investor Representation Letters based on the specific accreditation criteria met by the investor. These different types may include: 1. High Net Worth Individuals: This category typically comprises individuals with a net worth exceeding $1 million, excluding the value of their primary residence. The letter would comment on the investor's financial status, verifying their eligibility based on this criterion. 2. Annual Income: Another type of accreditation is based on an individual's annual income. To qualify, an investor must have earned an annual income surpassing $200,000 in each of the past two years (or $300,000 if jointly filing with a spouse). The representation letter would focus on confirming the investor's income, substantiating their eligibility. 3. Entities: Accreditation is also granted to certain entities, such as corporations, trusts, or partnerships, based on specific financial criteria. These entities must meet certain thresholds regarding their assets, investment portfolios, or professional knowledge to qualify. In conclusion, the Harris Texas Accredited Investor Representation Letter is a critical document that verifies an individual's accredited investor status. It serves as a testament to the investor's financial capabilities and qualifications to participate in high-risk investments. By providing relevant personal details, explicit confirmation of accreditation, and elaboration on the criteria met, this letter ensures compliance with regulatory requirements and facilitates investment opportunities.

Harris Texas Accredited Investor Representation Letter

Description

How to fill out Harris Texas Accredited Investor Representation Letter?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Harris Accredited Investor Representation Letter, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various categories ranging from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information resources and guides on the website to make any tasks related to paperwork completion simple.

Here's how to find and download Harris Accredited Investor Representation Letter.

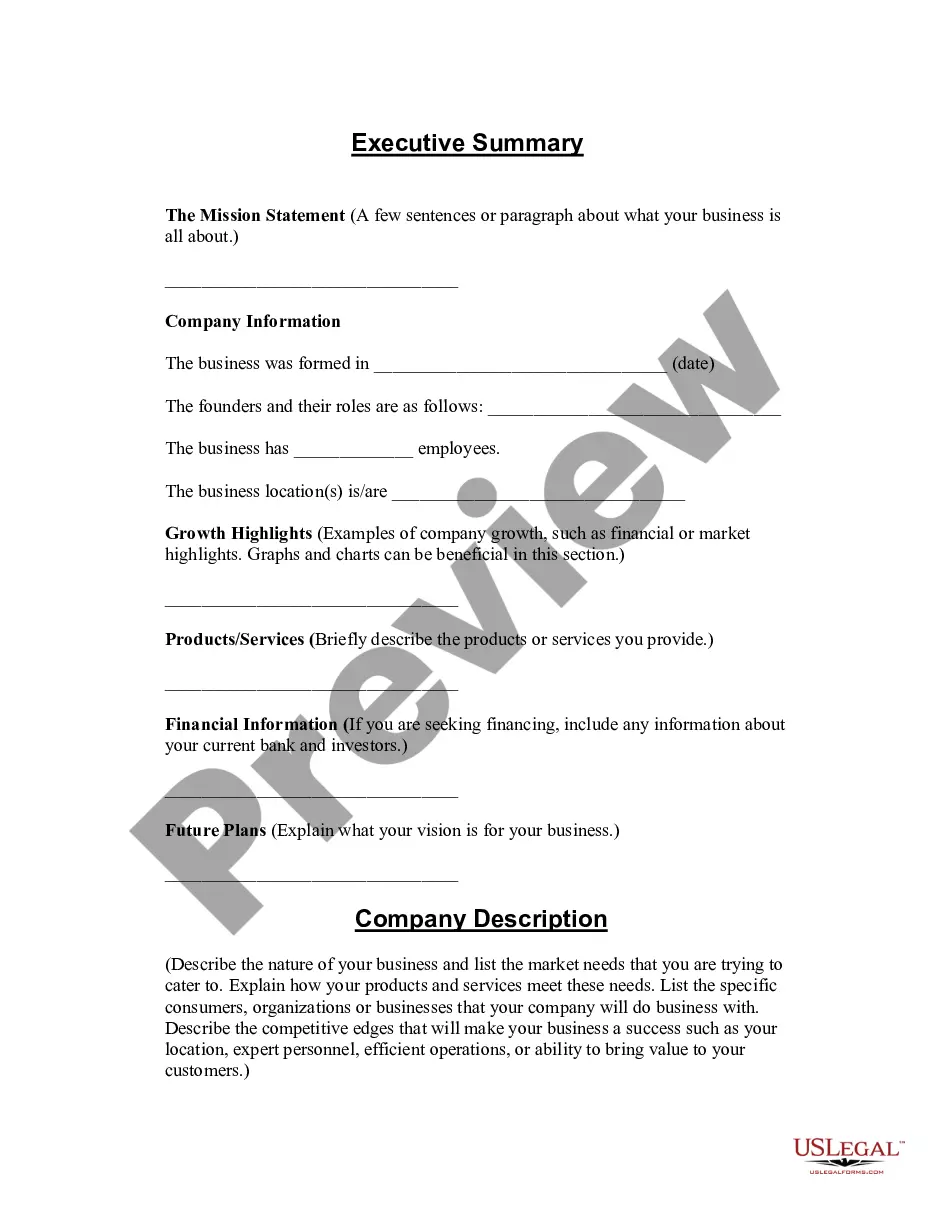

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can affect the validity of some documents.

- Examine the similar document templates or start the search over to locate the correct file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment method, and purchase Harris Accredited Investor Representation Letter.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Harris Accredited Investor Representation Letter, log in to your account, and download it. Of course, our website can’t replace a lawyer completely. If you have to cope with an extremely challenging case, we advise getting a lawyer to review your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-compliant documents effortlessly!