The Suffolk New York Accredited Investor Representation Letter serves as a legal document that outlines the responsibilities and rights of accredited investors in Suffolk County, New York. It is crucial for investors seeking to take part in private placement transactions or investment opportunities that are restricted to accredited investors. This letter provides validation to the issuer of an investment opportunity that the investor meets the criteria set forth by the United States Securities and Exchange Commission (SEC) to be considered an accredited investor. It also ensures that the investor has a clear understanding of their obligations, risks, and potential benefits associated with their accredited investor status. Some relevant keywords associated with the Suffolk New York Accredited Investor Representation Letter include: 1. Accredited Investor: This term refers to an individual or entity that meets specific criteria set by the SEC, which qualifies them to invest in certain securities or investment opportunities that are not available to the public. 2. Private Placement: Private placement refers to the offering and sale of securities to a select group of investors rather than the public. It often involves the sale of securities that are not registered with the SEC, making them available only to accredited investors. 3. United States Securities and Exchange Commission (SEC): The SEC is a federal agency responsible for protecting investors, maintaining fair and efficient markets, and facilitating capital formation. The agency sets rules and regulations that govern investment activities, including defining the criteria for accredited investors. 4. Investment Opportunities: Investment opportunities encompass a wide range of assets or ventures in which individuals or entities can invest their money to potentially generate financial returns. Accredited investors often have access to exclusive investment opportunities that may offer higher return potential but also carry additional risks. There are not typically different types of Suffolk New York Accredited Investor Representation Letters. However, variations may exist based on specific circumstances, investments, or legal requirements. It is essential for accredited investors and financial professionals to carefully review and understand the terms and conditions outlined in the representation letter to ensure compliance and mitigate potential risks.

Suffolk New York Accredited Investor Representation Letter

Description

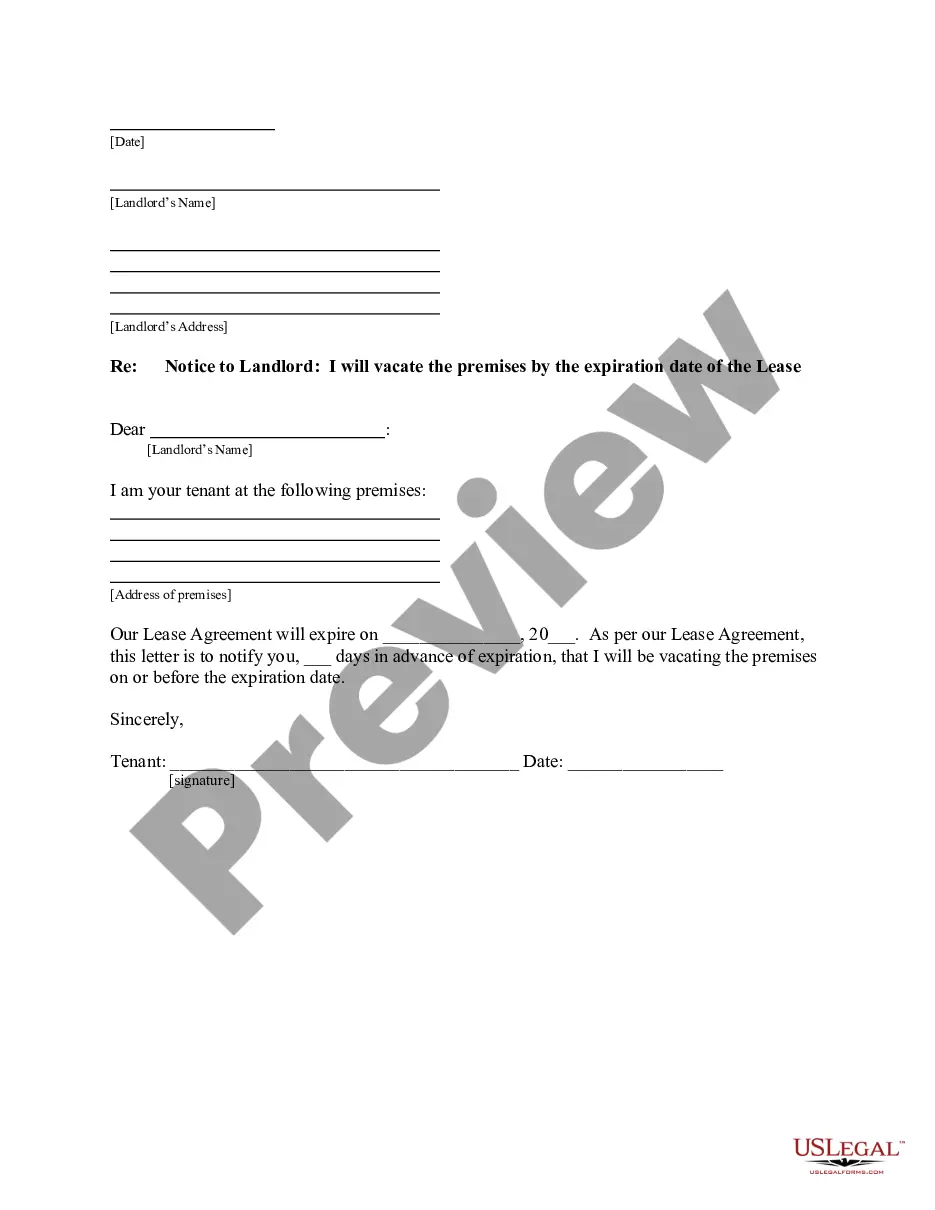

How to fill out Suffolk New York Accredited Investor Representation Letter?

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Suffolk Accredited Investor Representation Letter, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Therefore, if you need the recent version of the Suffolk Accredited Investor Representation Letter, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Suffolk Accredited Investor Representation Letter:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Suffolk Accredited Investor Representation Letter and save it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

This written confirmation of Investor's status as an accredited investor may be relied upon by any issuer and any of its partners, agents, affiliates, or participating platforms in connection with any transaction it may conduct pursuant to Rule 506 under the. Securities Act.

In lieu of providing income or net assets information, you may provide a professional letter from a licensed CPA, attorney, investment advisor or registered broker-dealer. The letter should state that the professional service provider has a reasonable belief that you are an Accredited Investor.

Investor Representation Letter means the investor letter provided to the Trustee and the Company in connection with the registration of transfer of any Physical Note, the form of which is set forth in Exhibit B attached hereto.

Note that individuals or couples meeting any one of these criteria are considered accredited investors: Income: Individuals with annual income of $200,000 or more (and couples making $300,000 or more) for at least two years in a row can be accredited investors.

In the U.S., an accredited investor is anyone who meets one of the below criteria: Individuals who have an income greater than $200,000 in each of the past two years or whose joint income with a spouse is greater than $300,000 for those years, and a reasonable expectation of the same income level in the current year.

This written confirmation of Investor's status as an accredited investor may be relied upon by any issuer and any of its partners, agents, affiliates, or participating platforms in connection with any transaction it may conduct pursuant to Rule 506 under the. Securities Act.

However, most investors won't have to frequently undergo intense scrutiny of their financial situations. Instead, they will undergo the verification process only once every five years. During the five-year period, investors may self-certify that they remain accredited.

You can use a third party letter to obtain an InvestReady certificate as long as the letter is no older than 90 days and it was written by a licensed attorney, CPA, investment advisor, or Broker Dealer.

Individuals who want to become accredited investors, must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an