Kings New York Investment Letter — Intrastate Offering is a subscription-based financial newsletter that provides valuable insights and analysis for investors interested in the New York market. This offering specifically targets individuals within the state of New York who can benefit from local investment opportunities. The Kings New York Investment Letter offers a range of valuable information to its subscribers, helping them navigate the complexities of the New York investment landscape. Subscribers gain access to in-depth research, expert opinions, market trends, and investment recommendations. The letter focuses on providing timely and accurate information, enabling investors to make informed decisions based on the latest developments in the local market. Some major types of Kings New York Investment Letter — Intrastate Offering include: 1. New York Real Estate Investments: This offering focuses solely on investment opportunities within the New York real estate market. It provides detailed analysis of different property types, such as residential, commercial, and industrial, highlighting potential investment hotspots, emerging trends, and expert opinions for subscribers. 2. New York Stock Market Investments: This offering is dedicated to helping subscribers navigate the volatile New York stock market. It provides analysis and recommendations on New York-based companies listed on major exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. The publication covers a wide range of industries including finance, technology, healthcare, and more. 3. New York Startup Investments: This offering caters to investors interested in supporting and funding innovative startups in the New York area. It provides information on emerging startups, venture capital opportunities, and the latest trends in the local startup ecosystem. Subscribers gain valuable insights to identify potential high-growth companies before they become widely known. 4. New York Economic Analysis: This offering offers a broader perspective by focusing on macroeconomic analysis of the state of New York. It covers diverse topics such as local GDP growth, employment rates, market regulations, and government policies, to help subscribers understand the overall economic climate. This information is valuable for making informed investment decisions across various sectors. Overall, Kings New York Investment Letter — Intrastate Offering is a comprehensive resource for individuals interested in unlocking the potential of the New York investment market. With its range of offerings, subscribers gain access to unique insights and recommendations tailored to their specific investment preferences, whether it be real estate, stocks, startups, or macroeconomic analysis.

Kings New York Investment Letter - Intrastate Offering

Description

How to fill out Kings New York Investment Letter - Intrastate Offering?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Kings Investment Letter - Intrastate Offering, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Kings Investment Letter - Intrastate Offering from the My Forms tab.

For new users, it's necessary to make several more steps to get the Kings Investment Letter - Intrastate Offering:

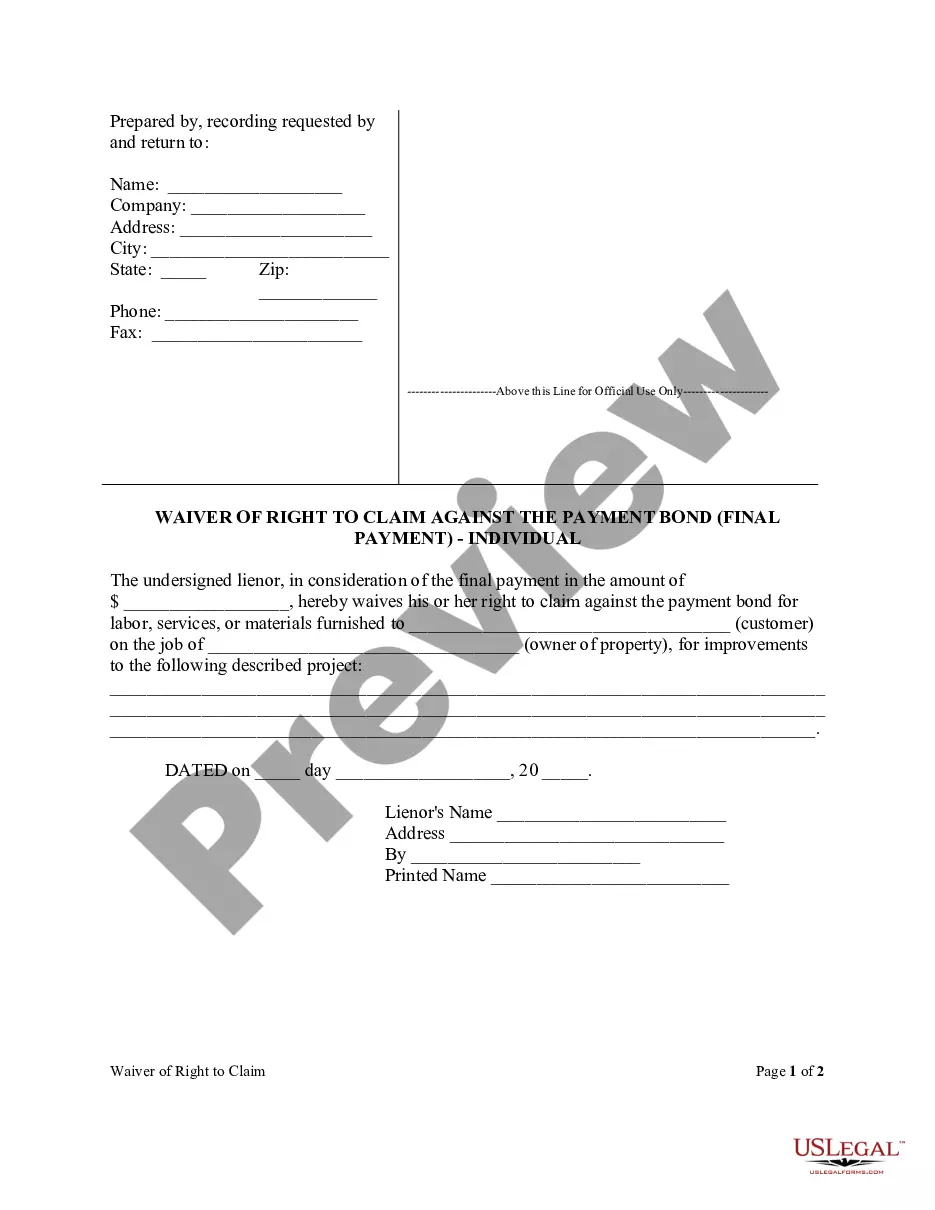

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!