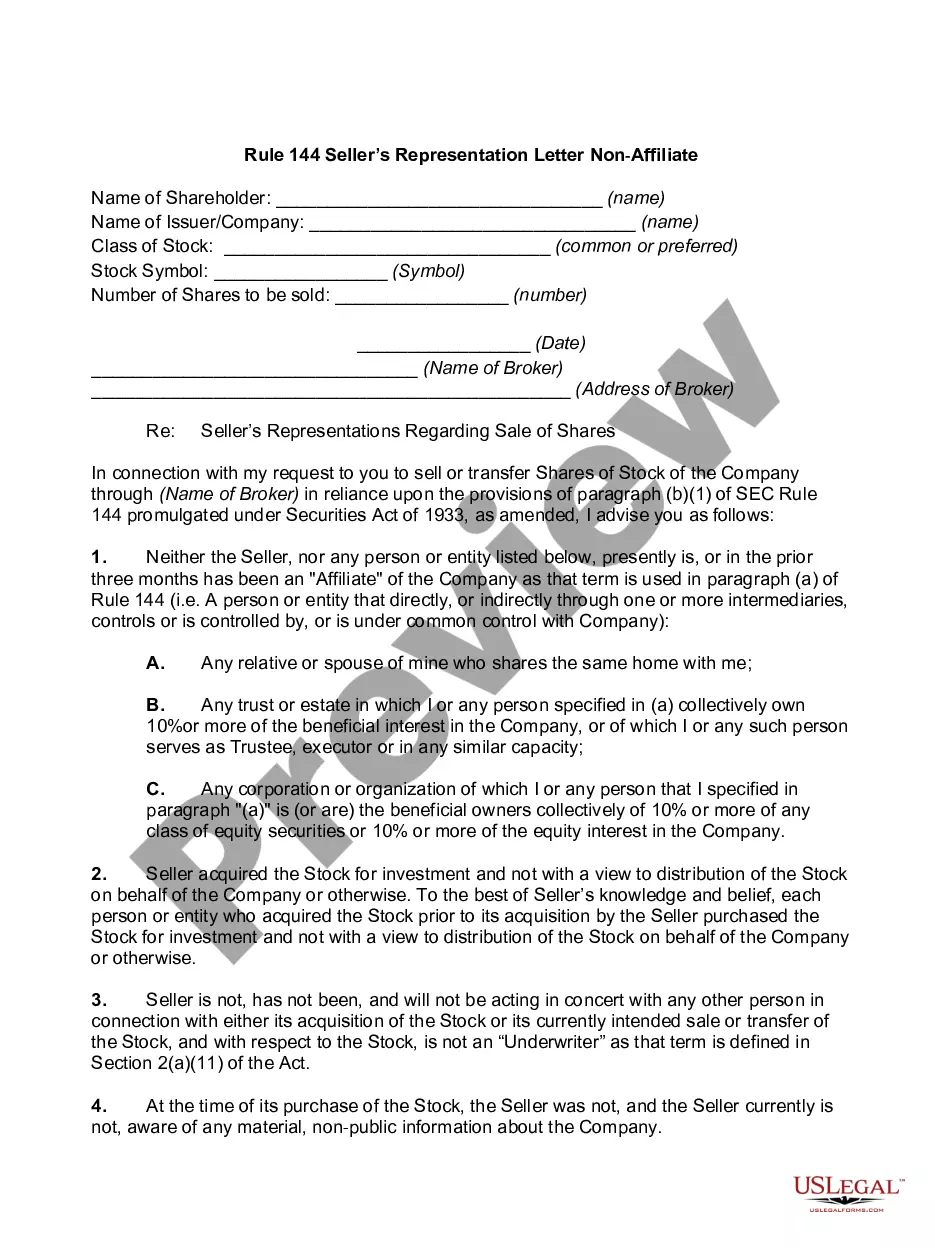

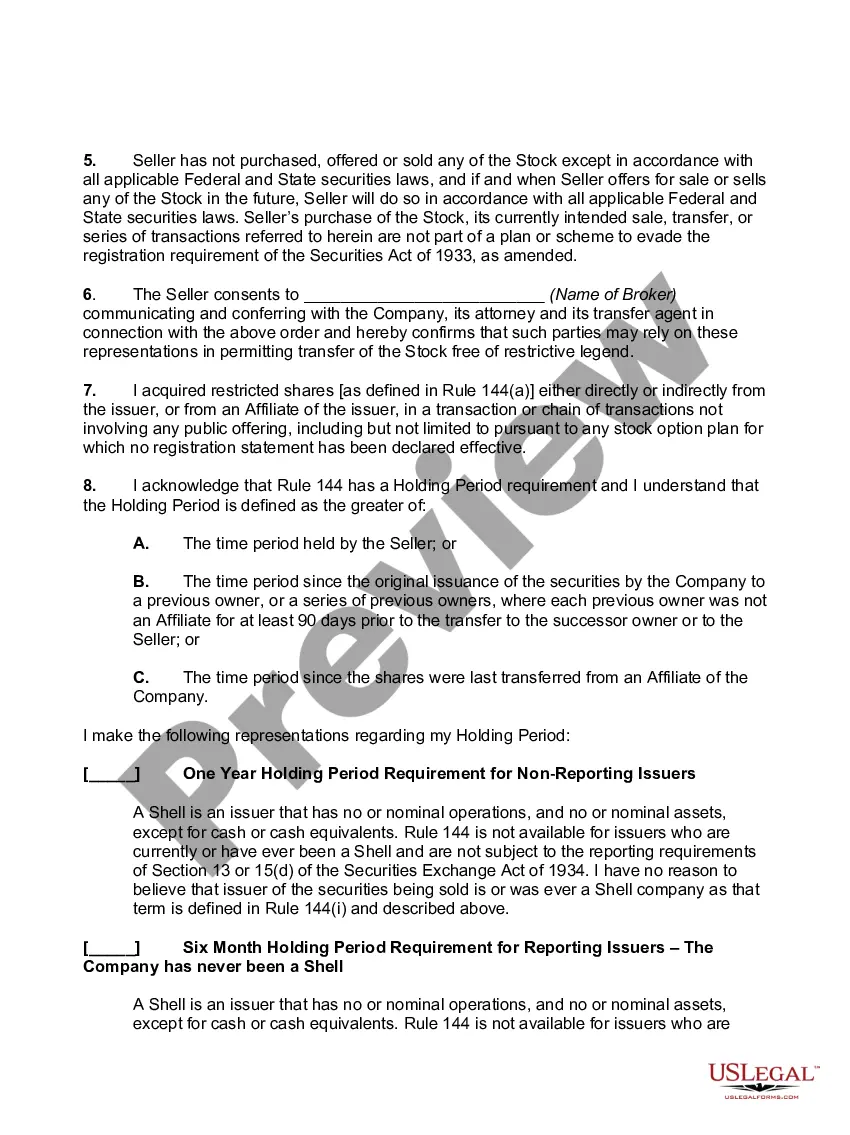

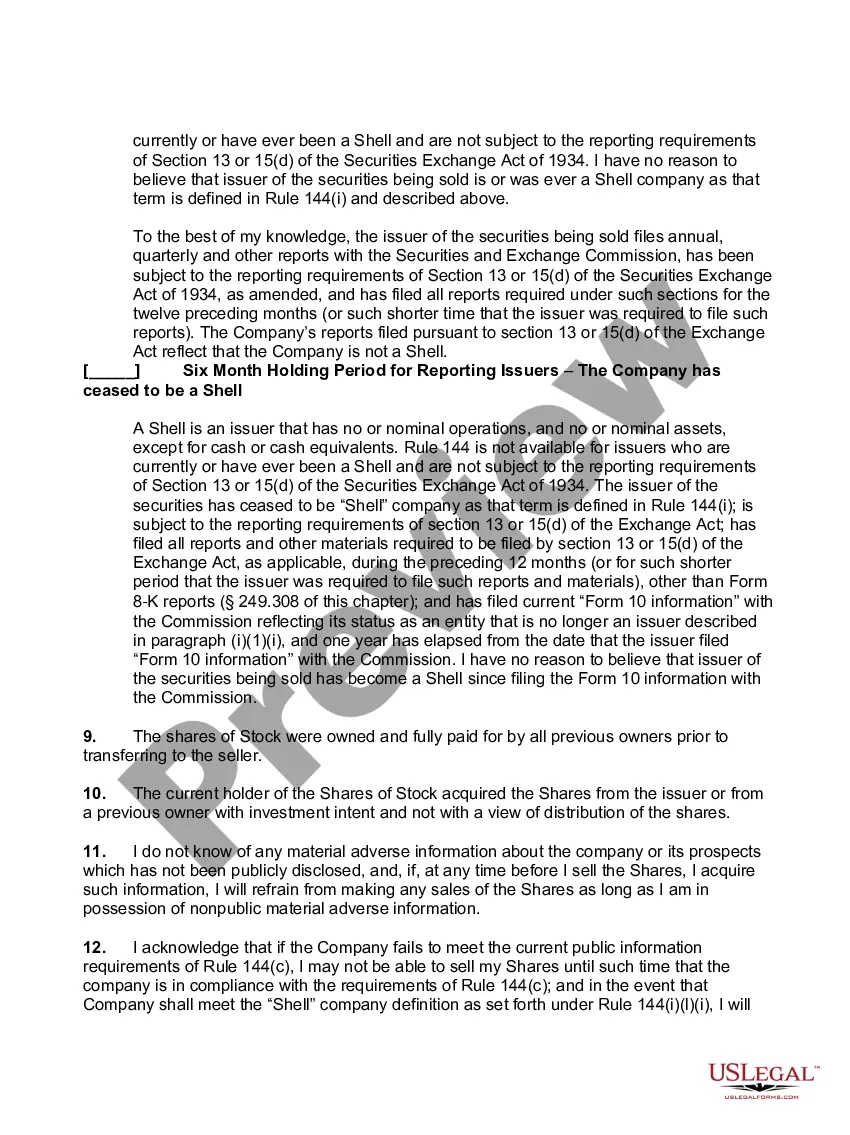

Chicago Illinois Rule 144 Sellers Representation Letter Non-Affiliate is a legal document used in securities transactions that involves the sale of certain securities by a non-affiliated individual or entity in Chicago, Illinois. This letter, often required by the Securities and Exchange Commission (SEC), serves as a representation by the seller, confirming their compliance with the relevant rules and regulations under Rule 144 of the SEC. Keywords: Chicago Illinois, Rule 144, Seller's Representation Letter, Non-Affiliate, securities transactions, sale of securities, legal document, Securities and Exchange Commission, SEC, compliance, rules and regulations. Different types of Chicago Illinois Rule 144 Sellers Representation Letter Non-Affiliate include: 1. Individual Non-Affiliate Seller's Representation Letter: This type of representation letter is used when an individual seller, who is not an affiliate of the issuer, is involved in the sale of securities in compliance with Rule 144. 2. Corporate Non-Affiliate Seller's Representation Letter: This type of representation letter is applicable when a non-affiliated corporate entity engages in the sale of securities in accordance with Rule 144. 3. Entity Non-Affiliate Seller's Representation Letter: This type of representation letter is used when a non-affiliated entity, such as a partnership or limited liability company, is involved in the sale of securities under Rule 144. These various types of Chicago Illinois Rule 144 Sellers Representation Letter Non-Affiliate ensure that sellers comply with the stringent regulations set by the SEC, protecting both the buyer and the seller in securities transactions.

Chicago Illinois Rule 144 Seller's Representation Letter Non-Affiliate

Description

How to fill out Chicago Illinois Rule 144 Seller's Representation Letter Non-Affiliate?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek professional help to draft some of them from the ground up, including Chicago Rule 144 Seller's Representation Letter Non-Affiliate, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different types varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find information materials and guides on the website to make any activities related to paperwork execution simple.

Here's how you can locate and download Chicago Rule 144 Seller's Representation Letter Non-Affiliate.

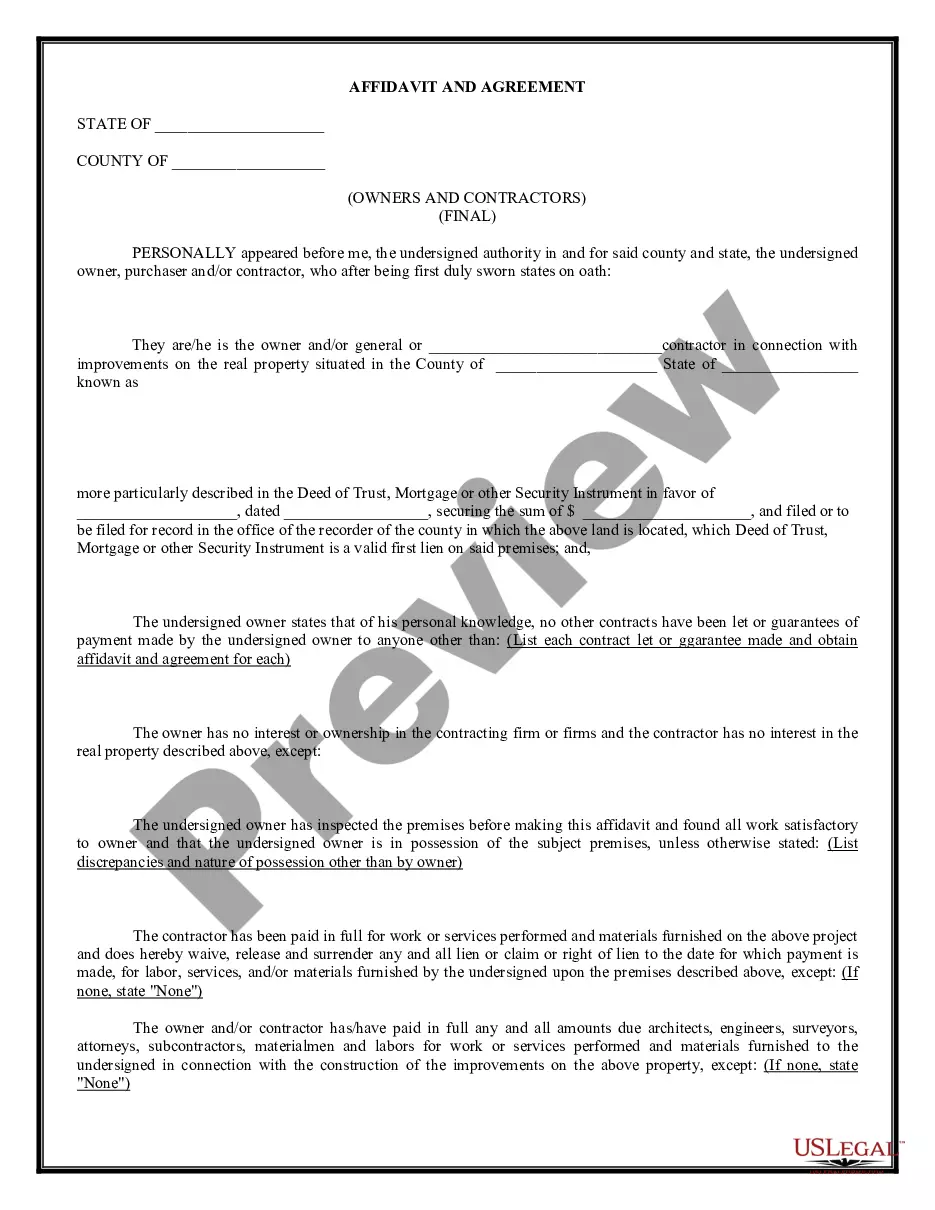

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some documents.

- Examine the similar forms or start the search over to find the right file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and buy Chicago Rule 144 Seller's Representation Letter Non-Affiliate.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Chicago Rule 144 Seller's Representation Letter Non-Affiliate, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer completely. If you have to cope with an exceptionally difficult situation, we advise using the services of an attorney to check your form before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and get your state-specific documents with ease!