Franklin Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization Keywords: Franklin Ohio, Notice, Special Stockholders' Meeting, Recapitalization Description: A Franklin Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization serves as a formal announcement informing the stockholders of a company based in Franklin, Ohio, about an upcoming meeting dedicated to discussing and voting on proposed recapitalization plans. Recapitalization generally refers to financial restructuring activities aimed at altering a company's capital structure. This notice signifies the significance of the proposed changes and provides stockholders with substantial information to understand the potential impacts on their investment. Different types of Franklin Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization may include: 1. Franklin Ohio Notice of Special Stockholders' Meeting to Consider Debt Recapitalization: This type of notice pertains to discussions regarding the restructuring of a company's debt obligations. It involves potential refinancing, debt restructuring, or modification of debt terms, contributing to a more favorable financial position for the company. 2. Franklin Ohio Notice of Special Stockholders' Meeting to Consider Equity Recapitalization: This notice revolves around discussions on the restructuring of a company's equity ownership. It entails exploring options like issuing new shares, repurchasing existing shares, or altering voting rights and ownership stakes, with the goal of optimizing the company's financial structure and shareholder value. 3. Franklin Ohio Notice of Special Stockholders' Meeting to Consider Operational Recapitalization: This notice relates to discussions on restructuring a company's operations to enhance operational efficiency, cost management, and profitability. It may involve initiatives like strategic partnerships, divestitures, mergers, acquisitions, or changes in business focus to revitalize the company's operations. The Franklin Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization is a fundamental part of corporate governance, ensuring transparency, and providing stockholders with a platform to voice their opinions and vote on important matters that may impact their investments. This notice outlines the purpose, date, time, and location of the meeting, empowering stockholders to make informed decisions and actively participate in shaping the company's future.

Franklin Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization

Description

How to fill out Franklin Ohio Notice Of Special Stockholders' Meeting To Consider Recapitalization?

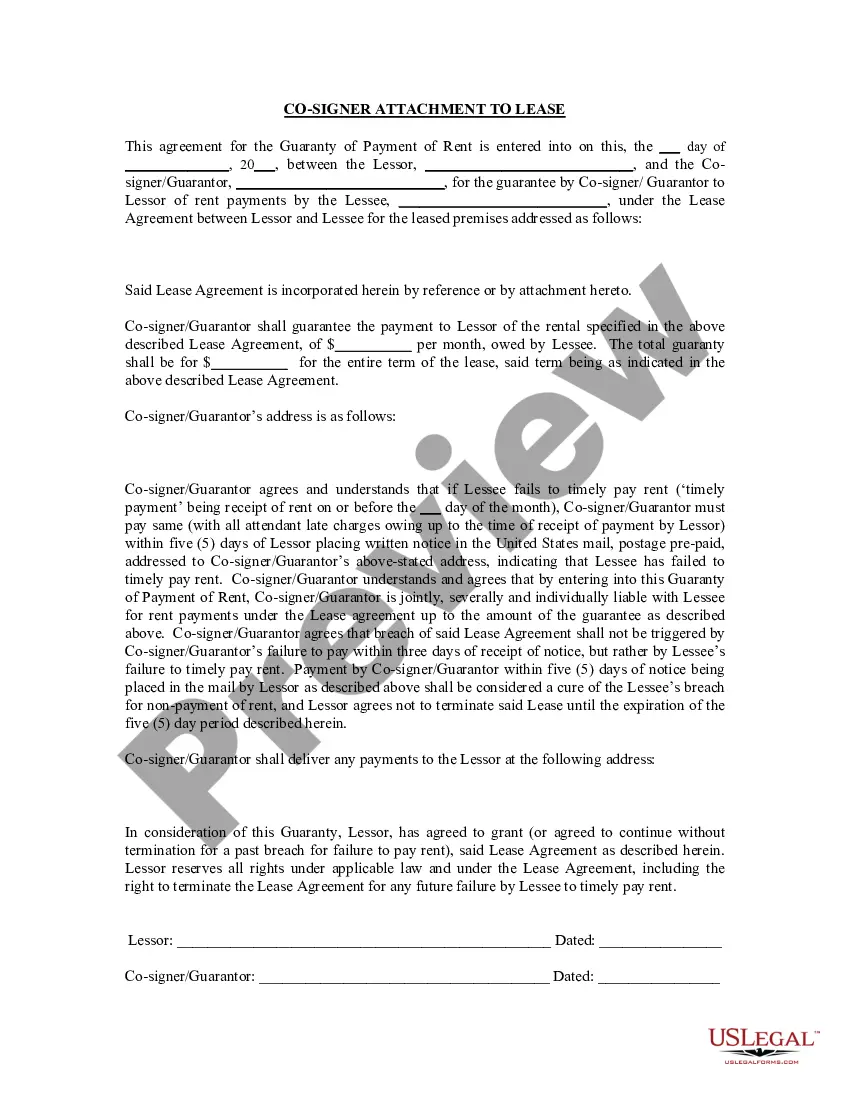

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, locating a Franklin Notice of Special Stockholders' Meeting to Consider Recapitalization meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Aside from the Franklin Notice of Special Stockholders' Meeting to Consider Recapitalization, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Franklin Notice of Special Stockholders' Meeting to Consider Recapitalization:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Franklin Notice of Special Stockholders' Meeting to Consider Recapitalization.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

The statutory right to call a meeting It reads: The holders of not less than 5 per cent of the issued shares of a corporation that carry the right to vote at a meeting sought to be held may requisition the directors to call a meeting of shareholders for the purposes stated in the requisition.

The directors must call the meeting within 21 days after the request is given to the company and the meeting is to be held not later than 2 months after the request is given to the company.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

The contact information for where to submit shareholder proposals is available on the company's proxy statement from its most recent annual gathering. This will include the submission deadline, which is generally six months prior to the actual meeting. The point of contact is more than likely the corporate counsel.

Special meetings of directors or members shall be held at any time deemed necessary or as provided in the bylaws: Provided, however, That at least one (1) week written notice shall be sent to all stockholders or members, unless a different period is provided in the bylaws, law or regulation.

SEC rules require submission of preliminary Proxy Materials to SEC at least 10 days prior to the mailing date if the company will seek stockholder action on specific matters.

Special stockholder meetings can be called by the board of directors or any person that is authorized in the certificate of incorporation or in the bylaws of the company.

Unless otherwise provided in the subsidiary holding company's charter, special meetings of the shareholders may be called by the board of directors or on the request of the holders of 10 percent or more of the shares entitled to vote at the meeting, or by such other persons as may be specified in the bylaws of the

Annual Meeting. The annual meeting of the shareholders of this corporation shall be held on the 30th day of June of each year or at such other time and place designated by the Board of Directors of the corporation. Business transacted at the annual meeting shall include the election of directors of the corporation.

The record date is the cut-off date used to determine which shareholders are entitled to a corporate dividend. To be eligible for the dividend, you must buy the stock at least two business days before the record date.