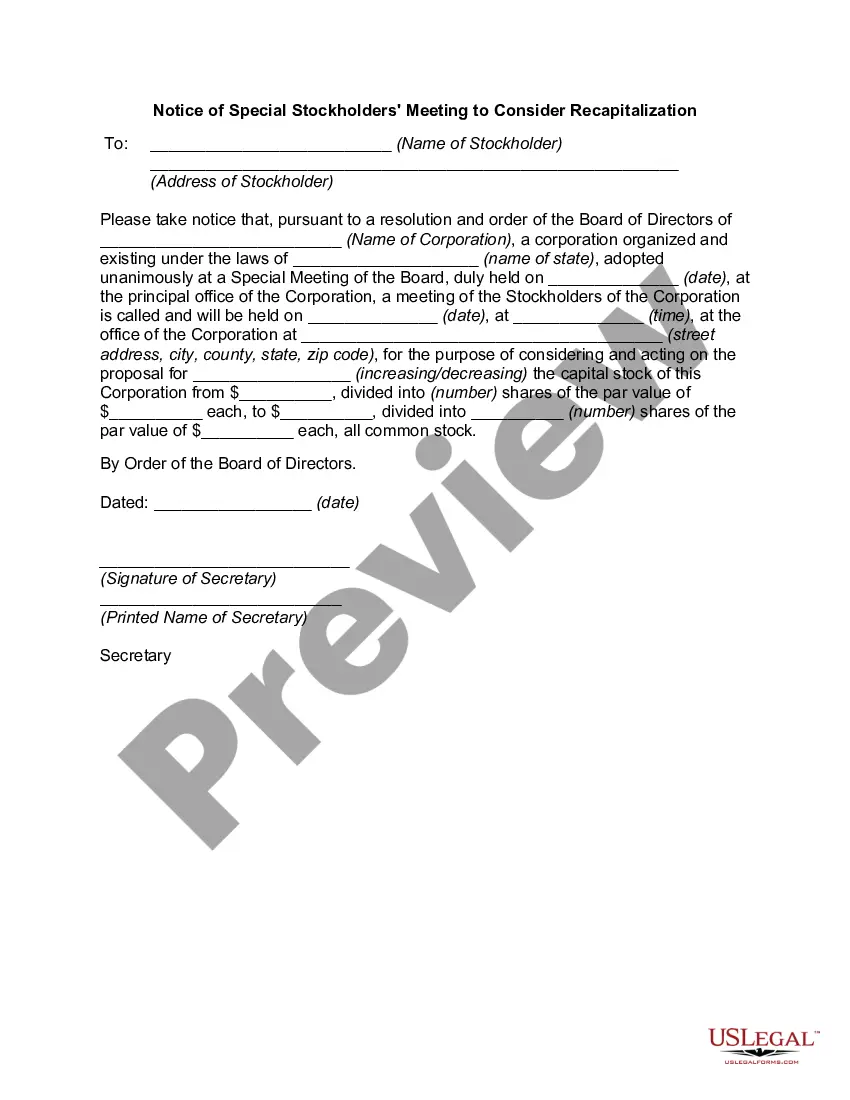

Philadelphia, Pennsylvania Notice of Special Stockholders' Meeting to Consider Recapitalization In Philadelphia, Pennsylvania, a Notice of Special Stockholders' Meeting has been issued to discuss the crucial topic of Recapitalization. This meeting aims to gather all stockholders under one roof to deliberate and make informed decisions regarding the recapitalization of the company or organization. Recapitalization refers to the process of restructuring a company's capital structure, typically involving changes to the debt-equity ratio. It may include actions such as issuing new shares, repurchasing existing shares, or modifying the terms of outstanding debt. The goal is to optimize the company's financial structure while enhancing shareholder value and ensuring sustainable growth. There can be various types of Philadelphia, Pennsylvania Notices of Special Stockholders' Meeting to Consider Recapitalization based on the specific circumstances and objectives of the organization. Some notable types include: 1. Equity Recapitalization Meeting: This focuses on altering the equity portion of the company's capital structure. It might involve issuing additional shares or repurchasing existing shares to adjust the ownership stakes and potential voting rights of stockholders. 2. Debt Recapitalization Meeting: This primarily concerns restructuring the debt aspect of the company's capital structure. The discussion revolves around modifying the terms of existing debt instruments, refinancing debt to achieve better interest rates, or negotiating debt repayment schedules. 3. M&A Recapitalization Meeting: In the case of a merger or acquisition, this type of meeting examines how recapitalization can facilitate the integration of two entities. Discussions may cover aspects like share swaps, capital injections, or conversion of debt into equity to align the capital structure with the new business arrangement. 4. Strategic Recapitalization Meeting: Here, the focus is on aligning the company's capital structure with its long-term strategic goals. This may involve the issuance of new shares to fund expansion plans, repurchasing shares to mitigate ownership dilution, or adjusting the company's financing mix to adapt to changing market conditions. Regardless of the specific type, Philadelphia, Pennsylvania Notices of Special Stockholders' Meeting to Consider Recapitalization serve as critical platforms for stockholders to voice their concerns, seek clarifications, and actively participate in shaping the future of the organization. These meetings are pivotal for ensuring transparency, accountability, and collective decision-making. It is essential for all stockholders to carefully review the notice, conduct due diligence, and come prepared to contribute constructively to the conversation surrounding recapitalization.

Philadelphia Pennsylvania Notice of Special Stockholders' Meeting to Consider Recapitalization

Description

How to fill out Philadelphia Pennsylvania Notice Of Special Stockholders' Meeting To Consider Recapitalization?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Philadelphia Notice of Special Stockholders' Meeting to Consider Recapitalization.

Locating forms on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Philadelphia Notice of Special Stockholders' Meeting to Consider Recapitalization will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Philadelphia Notice of Special Stockholders' Meeting to Consider Recapitalization:

- Ensure you have opened the correct page with your local form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Philadelphia Notice of Special Stockholders' Meeting to Consider Recapitalization on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!