Title: Wake North Carolina Notice of Special Stockholders' Meeting to Consider Recapitalization: A Comprehensive Overview Keywords: Wake, North Carolina, notice, special stockholders' meeting, consider, recapitalization, types, detailed description Introduction: In Wake, North Carolina, a Notice of Special Stockholders' Meeting to Consider Recapitalization is an important event that takes place within the business community. This meeting serves as a platform for stockholders to discuss and evaluate potential changes and refinancing strategies for their company. This article provides a detailed description of what such a notice entails, the significance it holds, and various types of meetings related to recapitalization. 1. Definition of Wake North Carolina Notice of Special Stockholders' Meeting to Consider Recapitalization: The Wake North Carolina Notice of Special Stockholders' Meeting to Consider Recapitalization is a formal communication issued by a company based in Wake, North Carolina. It informs stockholders about a scheduled meeting where recapitalization strategies, such as debt-to-equity conversions, share repurchases, or alterations in financial structuring, will be discussed and evaluated for potential implementation. 2. Purpose and Importance: The purpose of this Notice is to notify stockholders of the upcoming meeting and provide them with necessary information regarding the recapitalization proposals. Stockholders are encouraged to attend the meeting and participate in discussions, voice their opinions, and cast their votes on the proposed recapitalization strategies. The decisions made during these meetings can have a substantial impact on the future of the company, its financial structure, and overall value. 3. Content of the Notice: The Notice includes all essential details regarding the Special Stockholders' Meeting, such as the date, time, and location of the meeting. It outlines the agenda, highlighting the specific topics to be discussed, the proposed recapitalization measures, and any voting procedures required. Additionally, the notice may include relevant financial statements, reports, and disclosure documents to provide stockholders with comprehensive information before the meeting. Types of Wake North Carolina Notice of Special Stockholders' Meeting to Consider Recapitalization: 1. Debt-to-Equity Conversion Meeting: This type of meeting focuses on discussing the conversion of company debts into equity. It is aimed at reducing the debt burden while increasing the equity ownership of existing stockholders. 2. Share Repurchase Meeting: A Share Repurchase Meeting seeks stockholders' input on the company's plan to repurchase its own shares from the market. Share repurchases may be employed to enhance shareholder value or thwart potential threats of external takeovers. 3. Financial Restructuring Meeting: This type of meeting revolves around adjusting the financial structure of the company, typically involving changes to debt obligations, interest rates, or payment terms. The goal is to optimize the capital structure, providing stability and improved financial performance. Conclusion: The Wake North Carolina Notice of Special Stockholders' Meeting to Consider Recapitalization is a crucial event that allows stockholders to participate in important decisions involving the financial restructuring of their company. Through these meetings, stockholders play an active role in shaping the future direction and success of the business. By providing comprehensive information and facilitating discussions, these meetings help foster informed decision-making, ensuring the interests of stockholders are represented effectively.

Wake North Carolina Notice of Special Stockholders' Meeting to Consider Recapitalization

Description

How to fill out Wake North Carolina Notice Of Special Stockholders' Meeting To Consider Recapitalization?

Whether you plan to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occasion. All files are collected by state and area of use, so picking a copy like Wake Notice of Special Stockholders' Meeting to Consider Recapitalization is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Wake Notice of Special Stockholders' Meeting to Consider Recapitalization. Adhere to the guidelines below:

- Make sure the sample fulfills your individual needs and state law regulations.

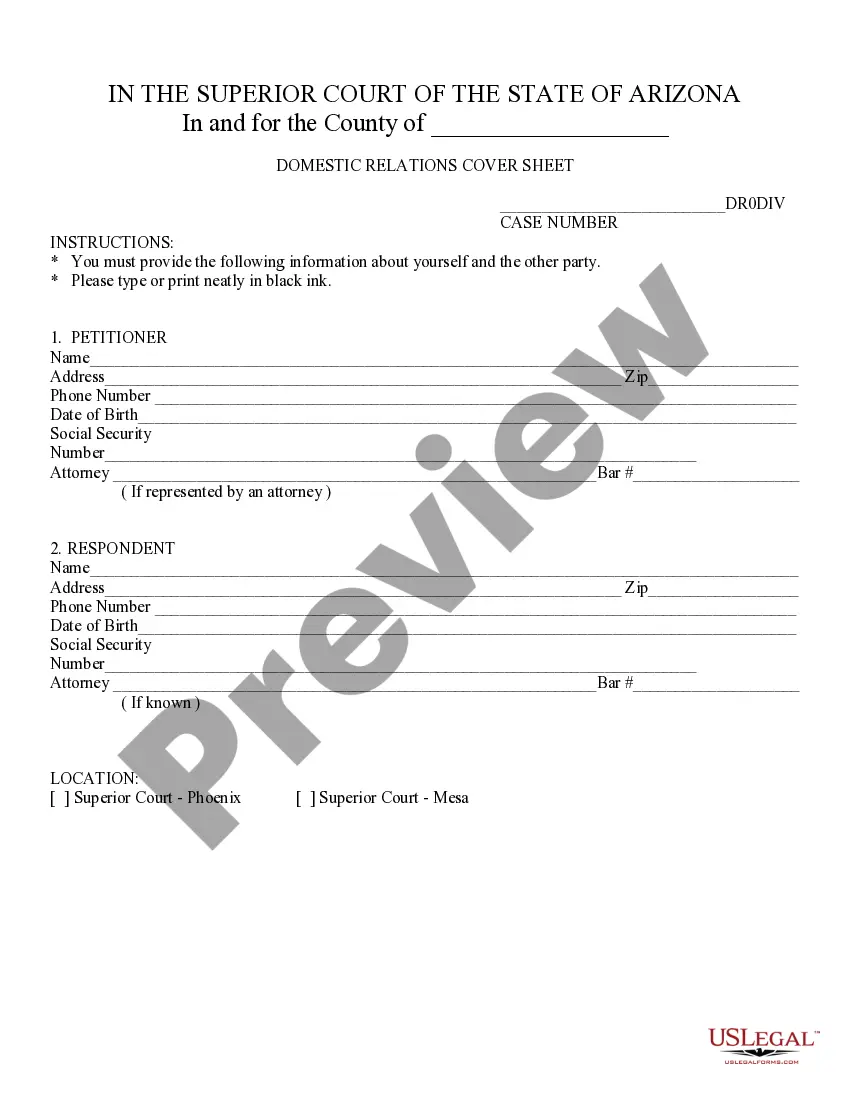

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the right one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Wake Notice of Special Stockholders' Meeting to Consider Recapitalization in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

Even though the corporation is legally required to notify shareholders of the annual meeting, stockholders may opt out of receiving notification of the meeting by signing a waiver of notice form. Essentially, shareholders are telling the corporation that they no longer wish to be notified of future annual meetings.

In addition to specifying the date, time, and location of the meeting, special meeting notices should make note of all agenda items. Unless the bylaws indicate something different, board members should only be discussing the business that was stated in the notice for the special meeting.

Special meetings of directors or members shall be held at any time deemed necessary or as provided in the bylaws: Provided, however, That at least one (1) week written notice shall be sent to all stockholders or members, unless a different period is provided in the bylaws, law or regulation.

Notice to Shareholders Most states require notice of any shareholder meeting be mailed to all shareholders at least 10 days prior to the meeting. The notice should contain the date, time and location of the meeting as well as an agenda or explanation of the topics to be discussed.

Shareholder meetings are a regulatory requirement which means most public and private companies must hold them. Notification of the meeting's date and time is often accompanied by the meeting's agenda.

Here are five steps to write a notice of meeting letter: Create a header. Start by creating a header for the notice of meeting letter.Write meeting information. Below the header, write a brief paragraph that includes the meeting's information.List the agenda.Conclude the letter.Revise the letter.

The notice for the postponement of the annual stockholders' meeting should be sent at least 2 weeks prior to the date of the postponed meeting unless a different period is required under the bylaws, laws or regulations. The notice should also include the reason for the postponement.

Question: What documents are required to be sent to members along with the notice of the annual general meeting? Copy of annual accounts of the company. Director's report on the company's position for the given year. Report by the Auditor of the annual accounts.

Although attending a shareholders' meeting or board of directors' meeting is technically not required, the group must have a quorum present in order to make any decisions or vote. A "quorum" is the minimum number of voting members that must be present to conduct business.