The Clark Nevada Agreement to Establish Committee to Wind Up Partnership is a legal document that outlines the process and responsibilities involved in terminating a partnership. This agreement is essential when partners decide to dissolve their partnership and proceed with the winding-up process. One type of Clark Nevada Agreement to Establish Committee to Wind Up Partnership is the voluntary dissolution. This occurs when partners mutually decide to end their partnership and settle any remaining obligations. Another type is involuntary dissolution, which can be initiated by a court order or the decision of one partner against the wishes of the others. The agreement outlines the key details of the wind-up process, including the formation of a committee responsible for overseeing and executing the necessary tasks. This committee is crucial in ensuring all partners' interests are protected and that the dissolution occurs according to legal requirements. The committee appointed under the Clark Nevada Agreement to Establish Committee to Wind Up Partnership is responsible for various tasks, including: 1. Identification and notification of creditors: The committee must identify all outstanding debts and obligations of the partnership and notify the creditors about the dissolution. 2. Asset liquidation and distribution: The committee oversees the sale and disposition of partnership assets, including inventory, property, and other holdings. The proceeds are then used to settle outstanding debts, with any remaining funds distributed amongst the partners based on their agreed-upon shares. 3. Closure of business operations: The committee ensures the proper closure of the partnership's day-to-day operations, including the termination of leases, contracts, and other agreements. 4. Tax and legal obligations: The committee handles the partnership's tax filings, ensuring compliance with all relevant laws and regulations. They are also responsible for fulfilling any legal requirements associated with the dissolution. 5. Documentation and record-keeping: The committee maintains accurate records of all transactions, including financial statements, contracts, and other relevant documents. This ensures transparency and can help resolve any potential disputes or legal issues that may arise during the wind-up process. Overall, the Clark Nevada Agreement to Establish Committee to Wind Up Partnership plays a vital role in providing a structured and organized approach to the dissolution of a partnership. It protects the rights and interests of all partners involved and ensures a smooth and legally compliant wind-up process.

Clark Nevada Agreement to Establish Committee to Wind Up Partnership

Description

How to fill out Clark Nevada Agreement To Establish Committee To Wind Up Partnership?

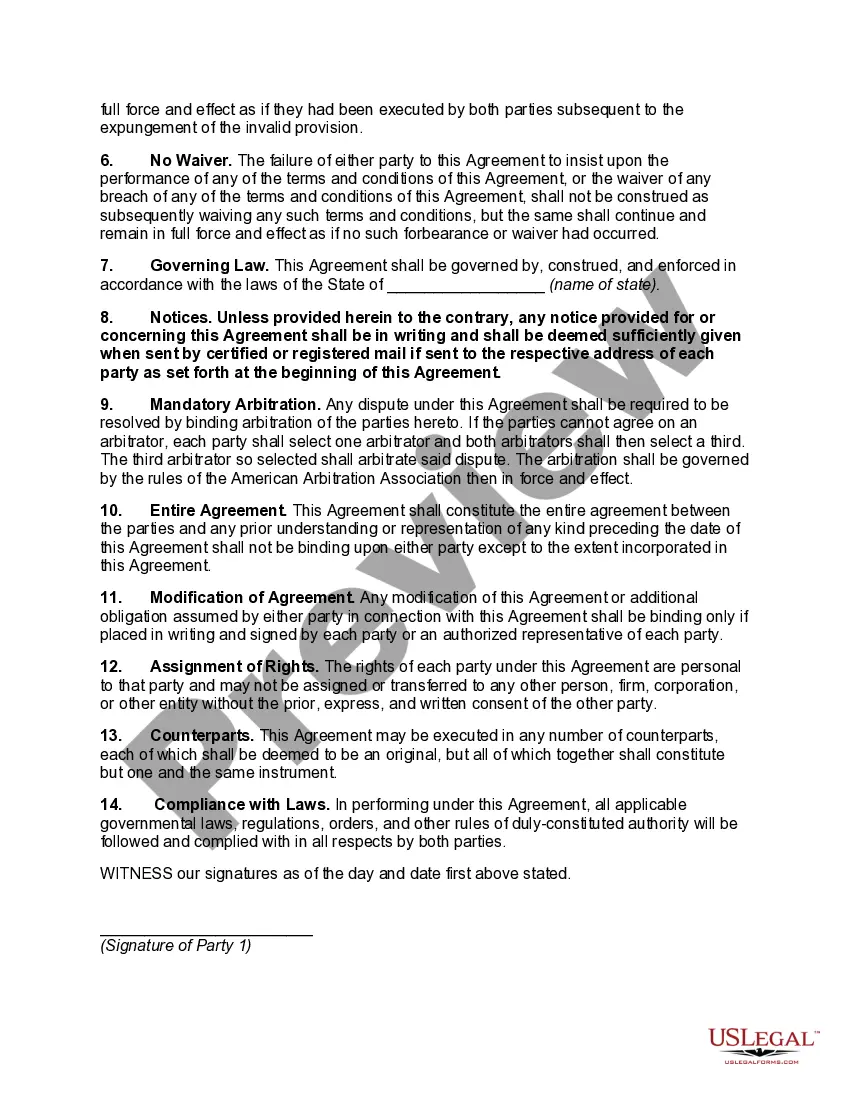

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Clark Agreement to Establish Committee to Wind Up Partnership, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Therefore, if you need the recent version of the Clark Agreement to Establish Committee to Wind Up Partnership, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Clark Agreement to Establish Committee to Wind Up Partnership:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Clark Agreement to Establish Committee to Wind Up Partnership and save it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

How to Write a Business Partnership Agreement name of the partnership. goals of the partnership. duration of the partnership. contribution amounts of each partner (cash, property, services, future contributions) ownership interests of each partner (assets) management roles and terms of authority of each partner.

A partnership can be dissolved when: An agreement between yourself and all other partners have been reached; One partner gives written notice to the other partners; The life of the partnership, according to the partnership agreement, has expired; Any partner dies or becomes bankrupt;

There are only two ways in which a partner can be removed from a partnership or an LLP. The first is through resignation and the second is through an involuntary departure, forced by the other partners in accordance with the terms of a partnership agreement.

If you don't have an operating agreement, and your partner won't come to terms, your only recourse is to file a lawsuit and ask the court to do what your operating agreement would have done: Kick her out and determine how much she's owed. However you look at it, isn't an attractive option.

Just keep in mind these five key steps when dissolving a partnership: Review your partnership agreement.Discuss with other partners.File dissolution papers.Notify others.Settle and close out all accounts.

The partners who have not wrongfully dissociated may participate in winding up the partnership business. On application of any partner, a court may for good cause judicially supervise the winding up. UPA, Section 37; RUPA, Section 803(a).

If you want to remove your name from a partnership, there are three options you may pursue: Dissolve your business. If there is no language in your operating agreement stating otherwise, this will be your only name-removal option.Change your business's name.Use a doing business as (DBA) name.

Any General Partner may be removed by the vote or written consent of Partners holding not less than 80% of the total number of votes eligible to be cast by all Partners.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves.