Dallas Texas Investment Club Partnership Agreement is a legally binding contract that outlines the terms and conditions for the operation of an investment club in Dallas, Texas. This agreement serves as a roadmap for the club's activities, responsibilities, and decision-making processes. Keywords: Dallas Texas, investment club, partnership agreement, terms and conditions, operation, activities, responsibilities, decision-making processes. Types of Dallas Texas Investment Club Partnership Agreements: 1. Limited Partnership Agreement: This type of agreement establishes a partnership between general partners and limited partners. General partners have unlimited liability and are actively involved in the management of the club, while limited partners have limited liability and primarily contribute capital without participating in day-to-day operations. 2. General Partnership Agreement: This agreement creates a partnership where all partners have unlimited liability and equal responsibility for managing the investment club. All partners have the authority to make financial decisions and share profits, losses, and liabilities equally. 3. Limited Liability Partnership Agreement: This agreement combines the benefits of a partnership with limited liability protection. It allows partners to limit their personal liability for the club's debts and obligations. At least one partner must assume general partnership responsibilities and liability, while others can have limited liability status. 4. Joint Venture Agreement: This agreement is suitable when two or more parties collaborate on a specific investment venture or project. Each party shares the risks and rewards based on their contribution and has a clearly defined role and responsibility for the project. 5. Operating Agreement: While not specifically designated for investment clubs, an operating agreement is a key document that outlines the club's rules, management structure, voting procedures, profit distribution, admission and withdrawal procedures, and dispute resolution. In summary, the Dallas Texas Investment Club Partnership Agreement is a comprehensive contract that establishes the structure, responsibilities, and decision-making processes of an investment club in Dallas, Texas. Different types of agreements may be used based on the specific needs and preferences of the club, such as limited or general partnership agreements, limited liability partnerships, joint venture agreements, or an operating agreement.

Dallas Texas Investment Club Partnership Agreement

Description

How to fill out Dallas Texas Investment Club Partnership Agreement?

Whether you intend to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Dallas Investment Club Partnership Agreement is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to obtain the Dallas Investment Club Partnership Agreement. Adhere to the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

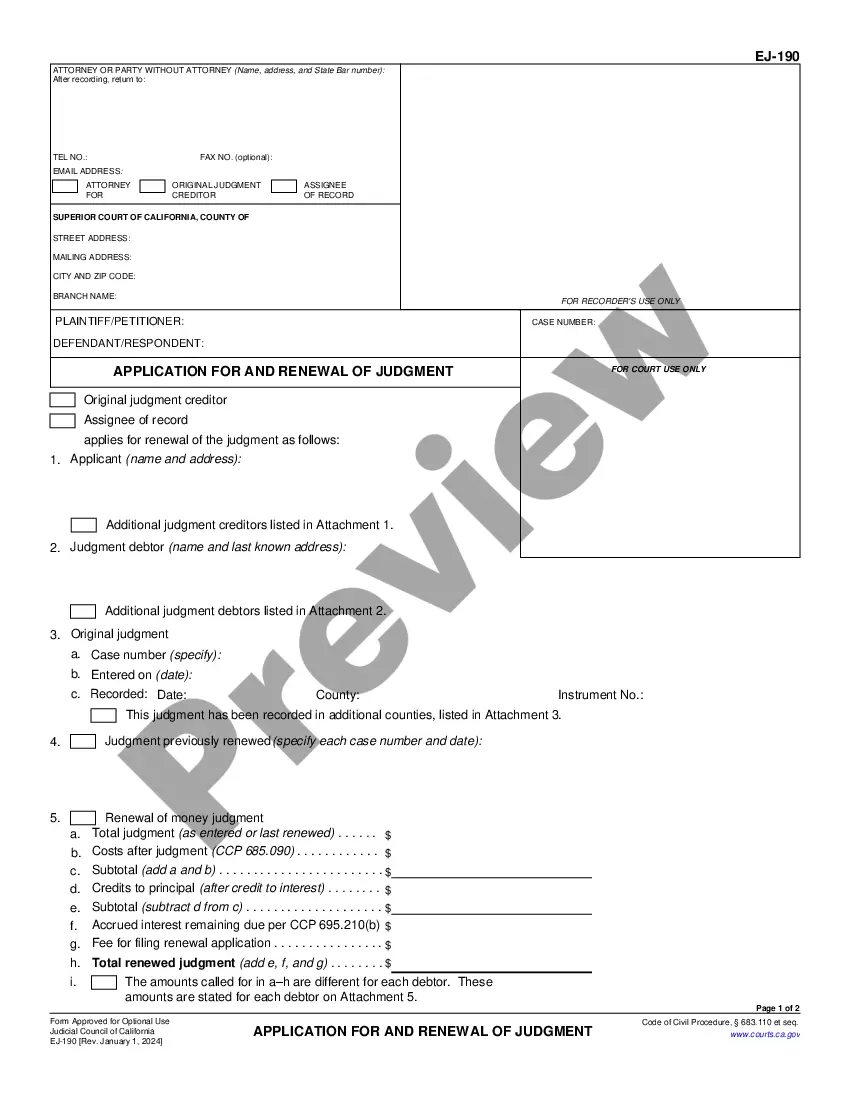

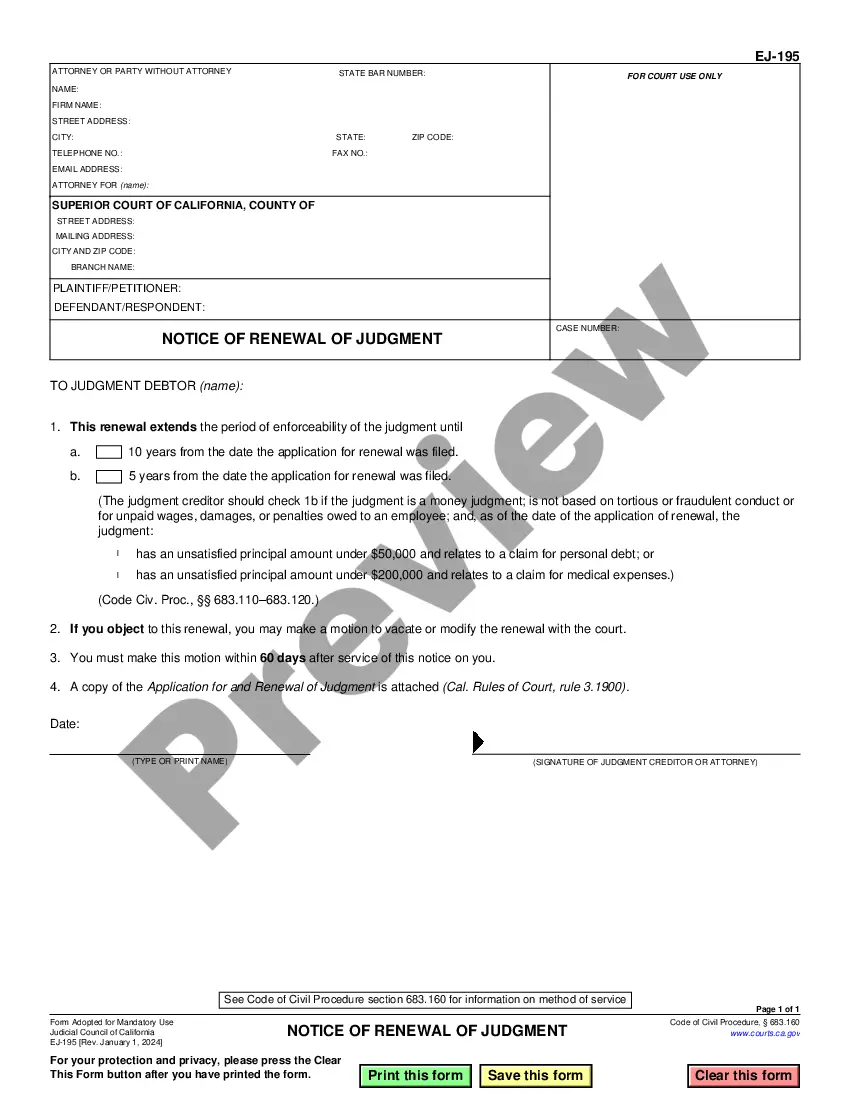

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file once you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Investment Club Partnership Agreement in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!