Franklin Ohio Investment Club Partnership Agreement is a legal document that outlines the terms and conditions of a partnership formed by individuals in Franklin, Ohio, for the purpose of investing in various financial opportunities. This agreement sets forth the roles, responsibilities, and expectations of the partners involved in the investment club. The Franklin Ohio Investment Club Partnership Agreement typically includes key provisions such as the name and purpose of the investment club, the duration of the partnership, the capital contributions by each partner, profit and loss distribution ratios, voting rights, decision-making processes, meeting schedules, and dispute resolution mechanisms. Additionally, the agreement may specify the types of investments the club will focus on, such as stocks, bonds, real estate, mutual funds, or other asset classes. It may also outline investment strategies, risk management approaches, and any limitations or restrictions placed on the investment activities. Different types of Franklin Ohio Investment Club Partnership Agreements may include: 1. General Partnership Agreement: This is the most common type of partnership agreement where all partners share equal responsibilities, liabilities, and profits. 2. Limited Partnership Agreement: This agreement involves general partners who have unlimited liability and manage the investment club, while limited partners contribute capital but have limited liability and limited involvement in club management. 3. Limited Liability Partnership Agreement: This type of agreement offers limited liability to all partners, protecting their personal assets from business debts or liabilities incurred by the investment club. 4. Joint Venture Agreement: This agreement is formed for a specific investment opportunity or project, with partners pooling resources and expertise to achieve a common goal. It may have a fixed duration or terminate upon the completion of the venture. 5. Silent Partnership Agreement: In this agreement, one or more partners contribute capital to the investment club but remain silent or inactive in its management and decision-making processes. It is important for individuals considering joining a Franklin Ohio Investment Club Partnership to seek legal advice and carefully review the terms of the agreement to understand their rights, obligations, and potential risks associated with participating in the investment club.

Franklin Ohio Investment Club Partnership Agreement

Description

How to fill out Franklin Ohio Investment Club Partnership Agreement?

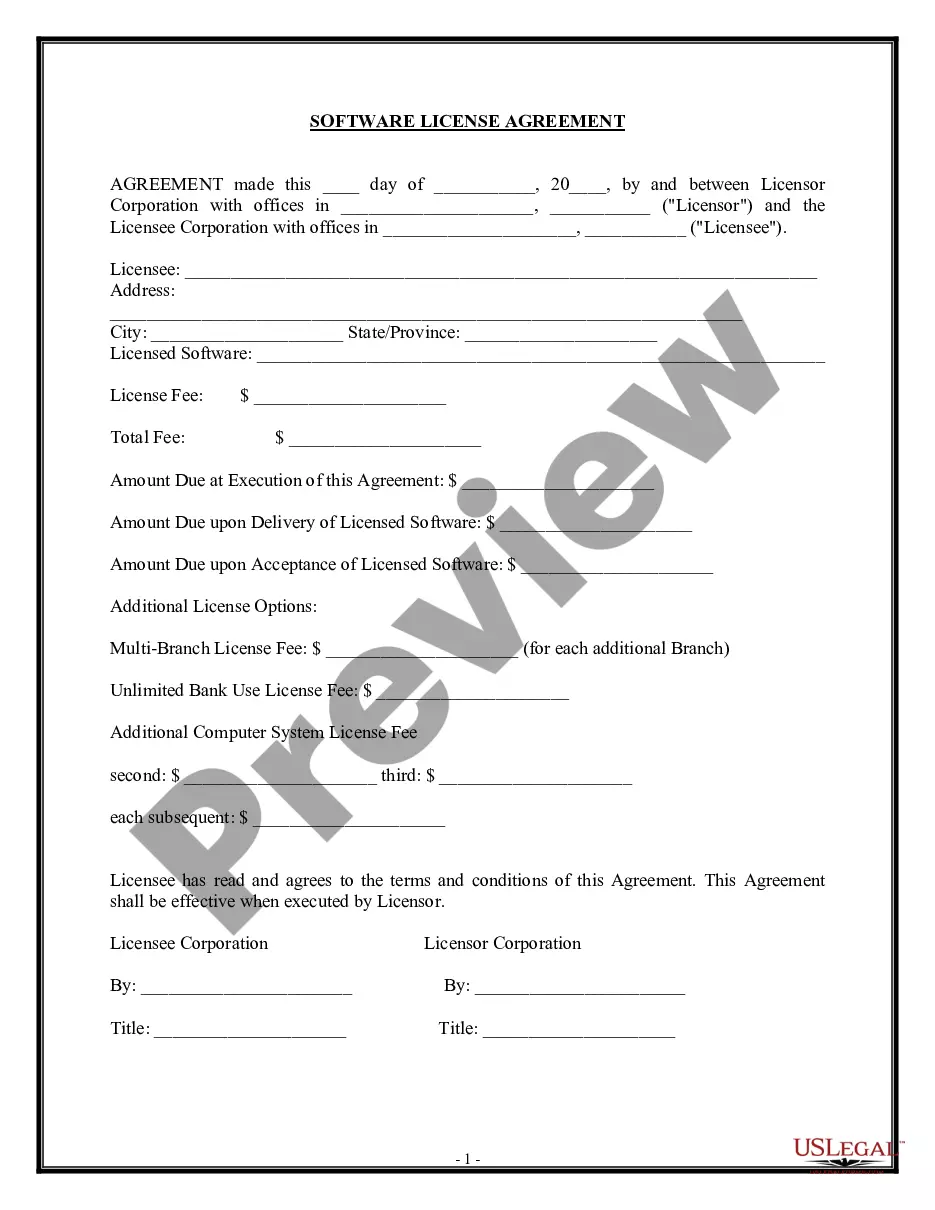

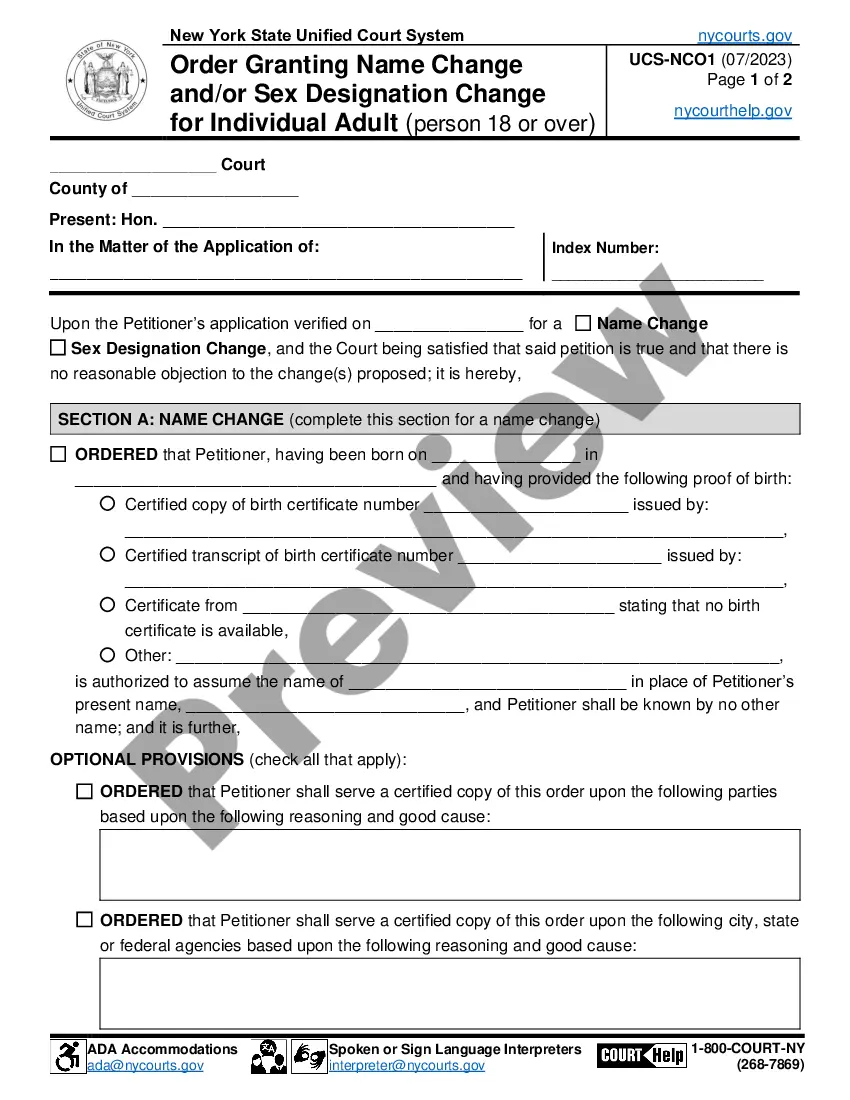

How much time does it usually take you to draw up a legal document? Considering that every state has its laws and regulations for every life situation, locating a Franklin Investment Club Partnership Agreement suiting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Aside from the Franklin Investment Club Partnership Agreement, here you can get any specific document to run your business or personal affairs, complying with your county requirements. Professionals check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can retain the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Franklin Investment Club Partnership Agreement:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Franklin Investment Club Partnership Agreement.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!